Mortgage holders can all but lock in a rate cut in less than two weeks after the central bank’s preferred measure of inflation fell to its lowest level in three-and-a-half years.

Trimmed mean inflation – which omits volatile items to measure underlying growth in prices – was 0.6 per cent in the June quarter, the Australian Bureau of Statistics reported on Wednesday.

The result was in line with economists’ expectations and brought the annual figure down to 2.7 per cent from 2.9 in March.

The last time the trimmed mean was that low was in December 2021.

After the Reserve Bank of Australia shocked the market by holding the cash interest rate steady at 3.85 per cent in its July meeting, the board should have “all the comfort it needs” to cut rates in August, said KPMG chief economist Brendan Rynne.

“Since the RBA’s last board meeting, it seems the arguments for lowering the cash rate have now materialised more than the arguments put forward to maintain the more restrictive monetary policy settings,” he said.

“Consumer and business confidence has continued to remain in the doldrums, with households and investors looking for continued rate relief before they open their wallets further.”

After the RBA’s last meeting, Governor Michele Bullock said the board was waiting for June quarter figures to confirm whether or not inflation was still on track to sustainably reach 2.5 per cent.

Although the result was slightly above the central bank’s 2.6 per cent forecast from May, it reflects ongoing progress toward the midpoint of the RBA’s two to three per cent target band.

A recent uptick in unemployment and weaker-than-expected household spending further supported the case for a cut.

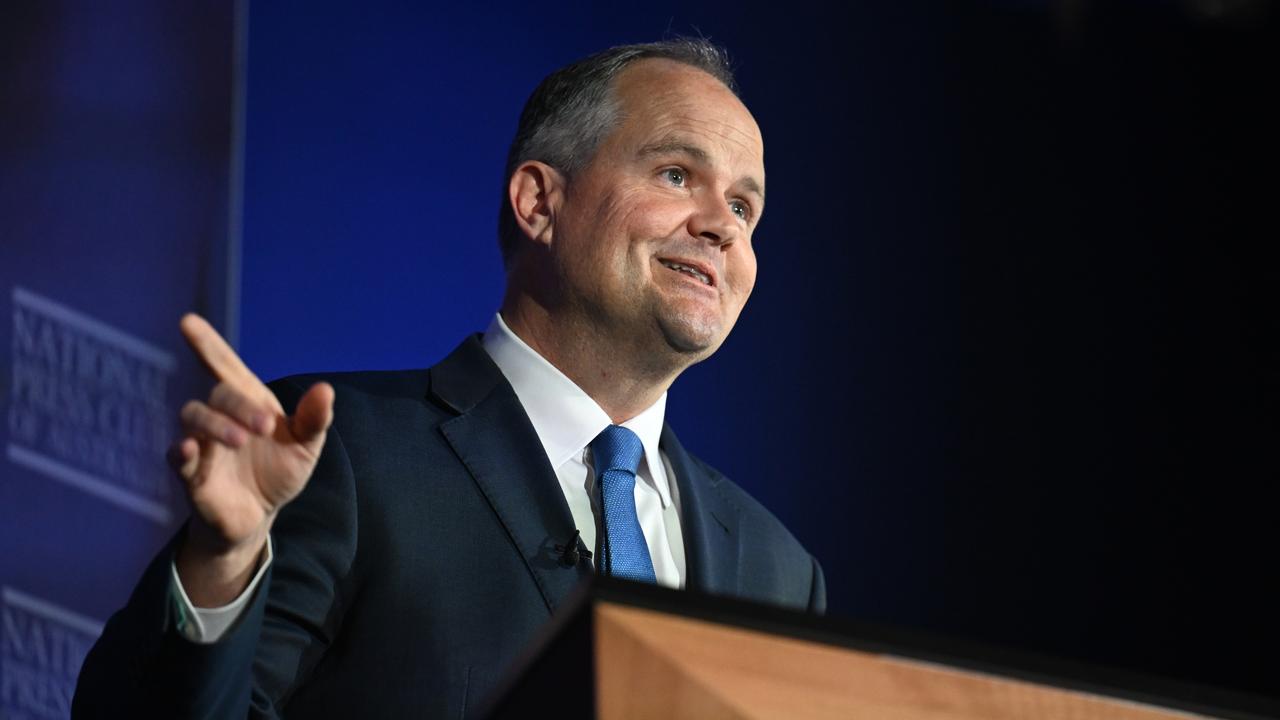

A delighted Treasurer Jim Chalmers cycled through the superlatives as he heralded the result.

“These numbers represent remarkable, outstanding progress when you consider that when we came to office, headline inflation was three times higher than what it is in these numbers today,” he told reporters.

“These are very pleasing, very welcome, absolutely outstanding inflation numbers.”

Economists from all four big banks, as well as accounting firms EY, KPMG and Deloitte, confirmed their rate cut calls.

Money markets firmed their odds of an August 12 rate cut to 100 per cent, having assigned a 95 per cent chance ahead of the release.

Traders were pricing in at least one further cut before Christmas.

CBA economist Harry Ottley predicted the RBA would follow an August rate cut with another 25 basis point reduction in November.

He said there appeared to be more risk that inflation would fall below target than remain too high.

“There appears very little in the inflation basket that suggests inflation risks will re‑accelerate and become a material problem over the forecast horizon,” he said

Equities traders cheered the data, with the Australian share market jumping about half a percentage point.

The headline consumer price index rose 2.1 per cent over the 12 months to June.

“This is the lowest annual inflation rate since the March 2021 quarter,” ABS head of prices statistics Michelle Marquardt said.

Housing, food and health costs drove inflation higher, while falling petrol prices took some steam out of the index, reflecting lower global oil prices.

Shadow treasurer Ted O’Brien said the data offered hope to struggling mortgage holders, who had suffered as a result of interest rates being too high for too long under Labor.

“Comparable jurisdictions saw interest rates cut far sooner than in Australia, with Labor’s addiction to spending keeping rates higher for longer locally,” he said.

A 25 basis point cut would shave $90 a month in repayments off a $600,000 mortgage.

Australian Associated Press is the beating heart of Australian news. AAP is Australia’s only independent national newswire and has been delivering accurate, reliable and fast news content to the media industry, government and corporate sector for 85 years. We keep Australia informed.