Nothing to see here, found the last Auditor-General’s report on Snowy Hydro 2 – before costs tripled. As the full price veers towards $25B, the Auditor-General is firing up again. Ted Woodley reports.

The Auditor-General recently commenced a follow-up audit on the ‘Delivery of Snowy 2.0’, the government’s hapless pumped hydro-electric storage project.

Let’s hope the Auditor-General and the support team from the Australian National Audit Office (ANAO) aren’t snowed a second time.

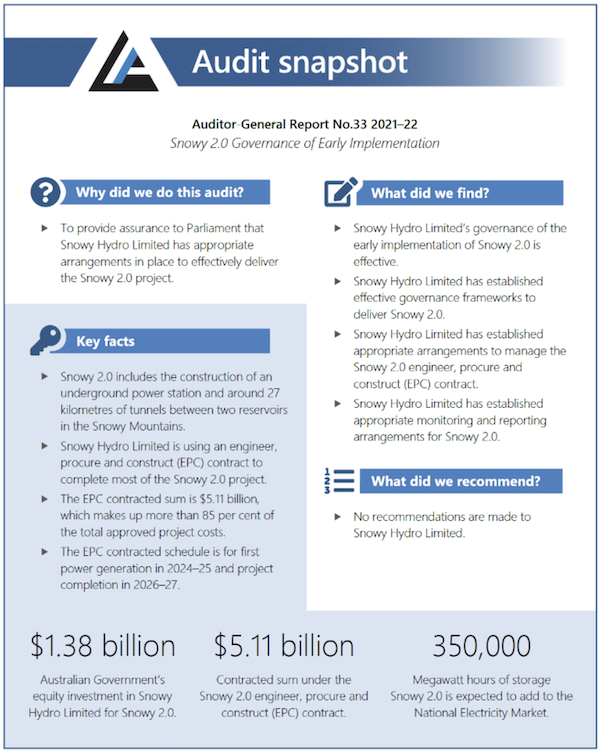

The first audit, published in June 2022 after a ‘rigorous’ eight-month assessment process, concluded that Snowy 2.0 was an exceptionally well-managed project and “provided assurance to Parliament that Snowy Hydro Limited has appropriate arrangements in place to effectively deliver Snowy 2.0 … [including] the engineer, procure and construct (EPC) contract, and monitoring and reporting arrangements.”

The audit made no recommendations for improvement – almost unheard of for such audits.

A model project, que?

The 67-page report even went so far as to present Snowy 2.0 as a model project with many “instances of good practice, which have been identified in this audit and may be relevant for the operations of other Australian Government entities” [including] governance and risk management, procurement, and contract management.

However, these very practices were not being effectively applied and ultimately led to the project having to be totally ‘reset’ (more on that below).

The audit reads like a publication from Snowy Hydro’s media department rather than from the National Auditor-General and Audit Office.

Snowy Hydro’s then CEO, Paul Broad, commended “the highly rigorous yet constructive approach of the ANAO audit team at all times”. He also acclaimed the resounding endorsement of Snowy Hydro’s practices “to govern, monitor and report on the project, including in relation to managing the contract with our Principal Contractor Future Generation Joint Venture (FGJV), … with no recommendations raised”.

Industry experts were gobsmacked by the effusive audit and the presentation of Snowy 2.0 as a model project, having provided extensive evidence of poor management and impossible claims.

Suddenly, Snowy’s cost tripled

Just a year later (in August 2023), Snowy Hydro conceded that Snowy 2.0 was not being effectively managed, the pivotal EPC contract was “no longer fit for purpose”, and the project could not be delivered in accordance with the Final Investment Decision approved by its Board and endorsed by the government.

Snowy Hydro had no option but to ‘reset’ the entire project.

The estimated cost was reset (tripled) from $3.8B ($4.5B max) to $12B.

The completion date was delayed from 2026 to 2028. The $5.1B fixed-price EPC contract was scrapped and replaced by a cost-plus contract “to result in closer collaboration, stronger oversight and alignment of interests between Snowy Hydro and FGJV”. And all outstanding FGJV claims (around $2B) were to be settled.

Worse still, in the 2024-25 budget, the Government announced a further $7.1B of financial support on top of the initial, and supposedly only, $1.4B.

Snowy Hydro’s new CEO, Dennis Barnes, expressed disappointment and apologised – “obviously [we’re] very disappointed in the cost increase and of course we apologise for that”.

Or is it more like $25B?

Though he didn’t mention that the total is more like $25B when all project, financing and transmission costs are included, and a 2028 completion date is impossibly ambitious.

Also, the new cost-plus contract transfers the risk of further cost blowouts (inevitable) from the FGJV contractor to Snowy Hydro (i.e. Australian taxpayers).

Snowy Hydro’s shareholding Ministers (Bowen and Gallagher) slammed the lack of transparency, the hiding of delays, “the design immaturity” and “the [difficult] site conditions and geology that should have been known at the time”, promising transparency and honesty in the future.

But nothing has improved since.

Florence, the now infamous tunnel boring machine, was bogged for a year in soft ground and then was stuck in hard rock for months. In the three years since commissioning (in March 2022), Florence excavated three kilometres of the seventeen-kilometre headrace tunnel. Due to its snail pace, Snowy Hydro has ordered a fourth machine to excavate from the other end of the tunnel.

Pistols at dawn

Even more extraordinary is Snowy Hydro’s recent call for the leaders of FGJV, its EPC contractor, to be sacked. In an uncharacteristically critical public statement triggered by yet another serious safety incident, Snowy Hydro seems to have lost patience with FGJV and “sought an immediate independent safety review and audit, and required changes to principal contractor Future Generation Joint Venture’s leadership on the project”.

As usual, there has been no word of the safety audit results or leadership changes, but management of the project must be seriously askew.

So much for the expectation that the reset of the new cost-plus contract would result in closer collaboration between Snowy Hydro and FGJV. And the current industrial action and strikes, and never-ending pollution fines highlight the entrenched management problems and compound the ultimate cost for taxpayers.

If only the Auditor-General and the ANAO had delved a little deeper in the first audit and identified the poor management, unfit contract, and underlying cost and timing blowouts. Despite the audit uncovering $2B of unpaid claims, nearly half the value of the then fixed-price contract, the auditors were snowed by Snowy Hydro’s explanation that this demonstrated its hard-nosed negotiating.

Had the project’s fundamental flaws been exposed, the incoming Labor Government (in May 2022) would surely have commissioned a comprehensive independent review, as experts had been urging for years, and the folly of the project would have been revealed.

Way over yonder is a place where we’ve been

The Auditor-General has set aside fifty per cent more time to undertake the second audit, with a tabling date of May 2026!

This audit is to examine whether “the 2023 contract reset was informed by sound planning and advice” and “is Snowy Hydro effectively managing contract performance to achieve value for money and to deliver the outcomes required of the project”.

It will be intriguing to see what the Auditor-General reports and recommends to Parliament this time and how the first audit’s assurances of effective delivery, with no areas for improvement, are explained.

Unfortunately, the second audit is likely to be of limited value, being a year away and not being the comprehensive independent expert review (financial, technical and environmental) so urgently warranted for a $25B government project that has been a debacle from its outset over eight years ago.

Ted Woodley is a former managing director of PowerNet, Gas Net, EnergyAustralia and China Light & Power Systems (Hong Kong).