The “corporatisation” of Australian farming continues apace. Almost 14% of agricultural land is now owned by foreign investors who, according to a ruling by the ATO, do not have to pay capital gains tax on water rights. Callum Foote reports.

A recent private ruling made by the Australian Tax Office has revealed foreign residents are exempt from capital gains tax on water profits. It is quite possible therefore, that when Angus Taylor’s Cayman Islands associates won their record $80m windfall from selling water rights, they incurred no capital gains tax.

The Tax Office ruling confirms what many farmers have known for years, that large, often foreign-owned, agribusinesses enjoy significant advantages over Australian farming families; not only because of their sheer size, and access to cheaper capital, but also tax.

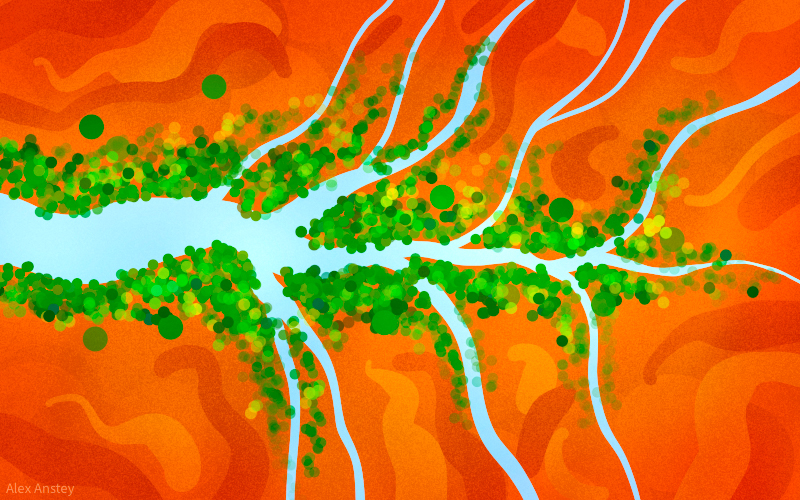

Land and water, the big corporate buy-up

Australian farming is being increasingly corporatised:

- The ATO’s report into foreign ownership of agricultural land shows that, as of June 2019, almost 14% of all agricultural land is held by foreigners.

- The Register of Foreign Ownership of Water Entitlements shows that as of 2018 10.4 percent, or 4035GL, of Australia’s water entitlements have some degree of foreign ownership.

- Of foreign investors in Australian water entitlements, China and the US are the biggest, sitting at roughly 2% each, followed by UK investors at 1.1 percent.

- In 2019, there were 89,000 agricultural businesses across Australia, down 34 percent from 2010.

Helen Dalton, the member for Murray and advocate for transparency in NSW’s water market, called the ruling “a form of treason. Our own government is giving foreign corporates a huge advantage over Australian farmers.” Further:

“The Nationals have turned our water market into a Casino… The fact that foreign corporations can make millions trading our water, while our towns run out of water, is a national disgrace.”

Dalton has had her water Transparency Bill, which would create a register of all water entitlement owners in NSW, voted down by the Coalition four times in 2021.

Melinda Pavey, the NSW Water Minister, has previously voiced her support for international investment in Australia’s water market.

Water Market (In)efficiency

Murray Darling Basin expert Maryanne Slattery, director of Slattery and Johnston, believes that “the water market has been a disastrous experiment not just for the environment but for a whole lot of our industries and communities”.

Slattery finds arguments in favour of a water market a bit like “first-year economic students claimed that the water goes to the highest value use”. A vast amount of water is being drawn away for various new foreign-owned tree nut farms downstream in the Murrumbidgee, she says.

Farmers like Reece Glenn, a small irrigator who has worked his property at Mathoura since 1946, is one of countless family businesses driven near bankruptcy, a result he says of the “reckless mismanagement” of the Murray.

“The almond farmers downstream have the deep pockets. They come first. All us smaller operators are cast aside” Mr Glenn told The New Daily.

Foreign-controlled farms, like those of the largest holder of Australian water, the Canadian superfund PSP Investments, can out-compete the productive and established rice and dairy industries for water entitlements.

PSP Investments has huge water interests, making up 2% of available water entitlements, after acquiring the Chris Corrigan-controlled Websters Investments for $2bn. No, with the recent confirmation from the Tax Office, it appears the Canadian super fund has (CGT) tax advantages in Australian water not even afforded long time heroes of the Liberal Party such as Corrigan.

According to Terri Butler, the Federal Shadow Minister for the Environment and Water,

“The Morrison Government would be aware of community concerns about speculators in the water markets.

Farmers and regional communities deserve an explanation, particularly given how poorly the Morrison Government has managed water, our most precious resource.

In addition to concerns about speculation, there is also a lack of trust within the Basin more broadly. This has been made worse by the fact that the Morrison Government is asleep at the wheel when it comes to integrity issues in the Murray Darling Basin.”

Just over half of all water entitlements on the issue in Australia are located in the Murray-Darling Basin. Of this, 9.4%, or 1800GL, are foreign-owned.

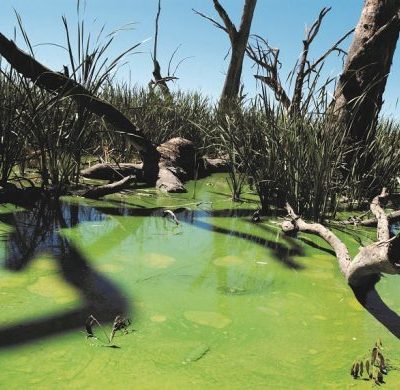

Murray Darling algae bloom. Photo by Arthur Mostead.

The Murray Darling Basin Water Market inquiry’s interim report estimated the Basin-wide market’s annual value at more than $1.5 billion per year, meaning basin-wide there is approximately $141 million in foreign-controlled water assets.

Kate Washington, NSW’s shadow minister for the environment also recognises the need for increased oversight over the Murray Darling basin:

“We already know the water trading scheme is flawed from top to bottom. But if thousands of gigalitres of foreign-owned water is being traded with unfair tax advantages, that could skew the market even more to the detriment of local farmers and our environment.

The National Party and the Water Minister have encouraged private foreign owners buying our water. Clearly, they need to explain why foreigners are getting tax breaks that aren’t available to Aussies. At a state and federal level, what are they going to do to make the system fairer?”

Keith Pitt, the Federal Minister for Environment and Water declined Michael West Media’s invitation to comment.

Why do foreign corporations get a tax leg up?

Explaining the ruling, an ATO spokesperson elaborated:

“Water entitlements are generally separate from the underlying land and not taxable Australian real property. This means that a foreign resident would disregard any capital gain from the sale of a water entitlement. In contrast, Australian resident entities are required to account for gains or losses on their worldwide assets, which includes assets in Australia like water entitlements.”

According to Professor Michael Dirkis of the Ross Parsons Centre for Commercial, Corporate and Taxation Law at the University of Sydney, “Prior to 2005, Australia had had a comprehensive things Foreign Residents had to pay Capital Gains on. After 2005, the Federal Government reduced the subjects more consistent with OECD approach. If a foreign resident has an interest in real property, then any capital gain associated is going to be caught.”

In the way that water is legally structured it no longer ‘counts’ as real property, like buildings and land. Professor Dirkis notes that “one might assume that water which has run through an area of land might be considered part of that land by some”. However it is not under Australian taxation law.

The Howard government finalised the decoupling of water from land in 2004, formalising Australia’s water market to attend to over-allocation of water entitlements that had been plaguing the Murray Darling.

Val Shopping: Barnaby Joyce department paid 57 times over for #watergate rights

Callum Foote was a reporter for Michael West Media for four years.