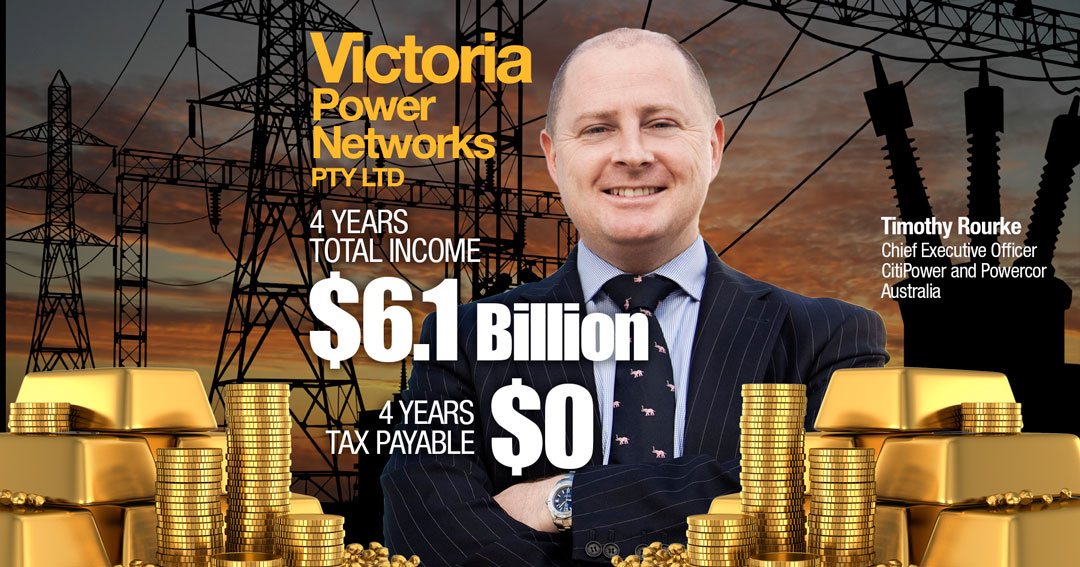

They dodge tax, they gouge their customers. They even have their paws out for government grants. Michael West reports on the debut of Victoria Power Networks.

It is fitting that this company kicks off our Top 40 Tax Dodgers chart for 2019. Victoria Power Networks has all the hallmarks of the unscrupulous corporate tax cheat: tax haven connections, Asian billionaires, a history of Tax Office probes, a devious corporate structure, huge loans to itself, and a conflicted Big Four auditor.

What is it about Australia, that we are so prone to privatise essential monopolies then happily let their new foreign owners march off to the Caribbean with super-charged profits … while hundreds of thousands of people shiver through winter because they can’t afford their heating bills?

VicPower operates the CitiPower and Powercor electricity networks. It is the dominant operator in Victoria and is controlled by the family of Hong Kong billionaire Victor Li. The Li family is the biggest owner of energy assets in Australia.

But get this: a perusal of its most recent set of financial statements – a supposedly public document which any old body can access for just $40 from the Australian Securities & Investments Commission (ASIC) – shows, interred in the notes to the accounts, that this mob actually gets government grants.

Not only did it siphon off $143 million to its offshore associates in interest on loans last year, not only has it soaked up courts costs and public resources battling the Tax Office in court, not only has it been investigated for price-gouging its customers but it has also been compelled to disclose that it picked up $6 million in “research and development grants” over the past two years.

What for? Who knows … but to think this is part of a multinational enterprise which has ripped off 26 million Australians via its murky tax practices, then tapped governments for taxpayer-funded grants on top … say no more.

Except there is more to say, much more.

APA: why do foreign energy giants covet Australian assets? We’re a soft touch

According to the Tax Office transparency data, of which there are now four years of disclosures, VicPower recorded $6.1 billion in total income during the four years to 2017.

It managed to wipe out every cent in costs, which is the stock-in-trade of the multinational tax dodger, that is, book as many costs as you possibly can here in the high-tax jurisdiction, whisk away as much as you possibly can to your offshore associates, and therefore eliminate your obligation to pay income tax in Australia.

So off we went to the world’s most expensive corporate database to see how they did it. Armed with a set of their 2017 financials, $40 later, and we find VicPower has conveniently struck a loan agreement with its related companies – unspecified companies – for $1.4 billion.

But get this. The interest rate on this subordinated loan of $1.4 billion from this mysterious unnamed party is 10.85 per cent, more than three times the cost of its senior US borrowings. So, the company is paying interest rates of almost 11 per cent to itself but just 3.52 per cent to its unrelated US lenders.

We invite the board of directors of Victoria Power Networks to respond to this question: please explain how this deal does not constitute a rip-off of Australian taxpayers?

From these related party loans, VicPower managed to funnel out $167 million to its associates last year in interest and charges. These guys are past masters at manufacturing costs.

In fact they have even been prosecuted for it by the Tax Office, not once but twice.

Victoria Power Networks is majority-owned by CK Infrastructure and Power Assets Holdings, which are in turned controlled by Hong Kong billionaire Richard Li (son of Li Ka-Shing) via the CK Group. Spark Infrastructure, which is listed on the ASX, controls the other 49 per cent of CitiPower and Powercor.

CK Infrastructure and Power Assets Holdings, which are members of the CK Group, hold a 51 per cent stake in our business. The CK Group operates in over 50 countries with about 310,000 employees.

VicPower, according to its financial statements did pay a smidgeon of tax last year, $168,000. Revenues were $1.5 billion but it managed to bulk up costs to the point that no tax was owed. Indeed, the group has been pinged for this before.

Its accounts concede that it lost a case to the Tax Office for “deductibility of capitalised labour costs”. It appears to have settled last year after launching the inevitable appeal. Bear in mind that its legal costs are subsidised by taxpayers as they are tax deductible. But this lurk is not enough for Australia’s greedy electricity providers.

Last year, Treasurer Josh Frydenberg announced a crackdown on energy providers “gaming” the energy regulators, the AER, by claiming the government pay for its corporate income tax.

This story:

Federal Government crackdown on electricity price gouging by distribution networks could save householders hundreds of dollars on power bills.

A review will be carried out by the Australian Energy Regulator (AER) to ensure energy companies are not charging customers for their corporate tax liabilities.

According to the Minister for the Environment and Energy, Josh Frydenberg, it is “totally unacceptable” for consumers to be charged for corporate tax liabilities they have not incurred.

But back to the tax chicanery.

Spark Infrastructure reached a settlement with the ATO in June 2015 regarding the deductibility of interest on subordinated loans to Victoria Power Networks and SA Power Networks. Spark was forced to cancel a bunch of its fake losses.

One wonders how much of the $1.3 billion in costs in last year’s accounts – including the $449 million in capitalised expenses for labour, construction and professional services … are really real.

Besides the suspiciously high related party loan charges, this crew dabbles big time in the swaps market and other derivatives.

Finally, the accounts are signed off by Big Four auditor Deloitte. Deloitte is also a provider of tax advice and of “other” consultancy services, which suggests they are completely conflicted; on the one hand advising VPN how to fleece the tax system while on the other hand, scribbling “true and fair” on the audit reports, the very reports which have had to be revised in light of prosecutions by the Tax Office.

Public support is vital so this website can continue to fund investigations and publish stories which speak truth to power. Please subscribe for the free newsletter, share stories on social media and, if you can afford it, tip in $5 a month.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.