“A serious tax cheat” is how his biographer David Cay Johnston describes Donald Trump. Johnston reports on the New York Times investigation into the finances of the US president, revealing Trump has previously lost two income tax fraud trials.

The richly detailed examination of Donald Trump’s taxes in the New York Times carries two crucial but unstated messages. One is about Trump. The other about what chumps we Americans are when it comes to our income taxes.

Trump paid no income taxes in 10 of the last 17 years while raking in as much as $153 million in a single year.

The year he ran for president he paid just $750. He paid the same sum during his first year in the Oval Office. That’s less than the average monthly rent paid by Americans, which was $1,023 in 2018.

That Trump is a serious tax cheat is no surprise to DCReport readers. Four years ago, I revealed that Trump lost two income tax fraud trials. He fabricated a consulting business in 1984. It showed no revenue, yet Trump claimed more than $600,000 in deductions. He could not produce a single receipt.

Trump’s longtime tax lawyer and accountant, Jack Mitnick, testified during one of the two civil fraud trials that Trump forged the tax return. Mitnick was Trump’s witness, by the way, showing just how much chutzpah Trump has.

The forgery testimony would have justified a criminal charge. It was also part of a pattern. In 1983, New York City Mayor Ed Koch took note of Trump’s multiple sales tax frauds. The mayor said Trump belonged behind bars. One city audit of his first big project, the Grand Hyatt in Manhattan, showed Trump hid and destroyed records so he could cheat the city out of $3 million a year.

Learning Only How to Fight

But Trump learned nothing. Getting caught cheating, again and again, didn’t turn him into anything even vaguely resembling an honest taxpayer.

What Trump did learn long ago from his mentor and “second father”, the notoriously corrupt lawyer Roy Cohn, was to lie, cheat, steal and never apologize or concede any fact. Just tie the authorities up for years and make them pour their limited resources into a case so they will give up and cry uncle.

The New York Times report makes clear Trump continued into this century making up tax deductions out of thin air. That’s criminal and should be prosecuted, but our federal government has a policy of not indicting presidents no matter what crimes they may commit, leaving the task up to Cy Vance, the Manhattan district attorney

In just two years, 2008 and 2009, Trump took $1.4 billion in tax deductions. Nothing in The Times report suggests he had assets and income that would justify such huge write-offs.

The paper also showed Trump took deductions for his oldest son’s personal legal bills, a definite no-no. He deducted more than $70,000 for his hair styling. And he gave daughter Ivanka more than $700,000. The president called that money to Ivanka a fee, but it looks like a disguised gift in which Trump both evaded the gift tax and deducted it as a business expense. That’s also a no-no.

In tax matters our federal government never prosecutes a single act of tax cheating. Instead, it goes after repeated misconduct. People have been sent to prison for cheating the government out of less than $1,000 because of a policy that is intended to intimidate people of every economic level into voluntarily complying with our tax laws.

Two separate, unequal tax systems

The newspaper’s other unstated message is aimed at the rest of us. We are chumps.

We have elected representatives, senators and presidents who have created two separate and unequal income tax systems. One is for most of us – workers, pensioners, students on scholarship and stock market investors. In that system all our income is reported to the Internal Revenue Service (IRS) and taxes are taken out before we get our money.

We can’t cheat. The computers will catch us if what the IRS has been told by our employers and others differs by as little as $10 from what we report on our tax returns.

But Trump operates in the other tax system. The one for people who control privately held businesses. Trump has more than 500 of them.

A toothless IRS

Trump and his ilk tell the IRS how much money they took in. There is little or no verification. These rich people pay whatever tax they want, which you can be sure is never more than the legal minimum, subject to audit.

This is a system designed to enable cheating. IRS studies, court cases, experiments by state tax agencies and official reports to Congress all show, as I have been reporting for decades, that this system is utterly corrupt.

Think about this for a moment. Congress doesn’t trust you, but it trusts the Donald Trumps of the country to pay what the law requires.

Fewer audits of super-rich

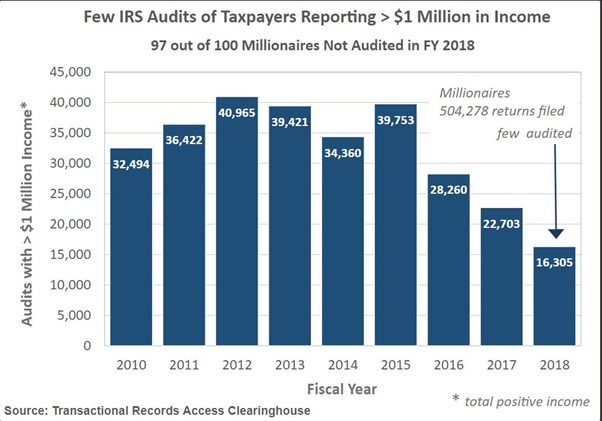

Audits have become rare and getting ever closer to extinction. That’s because Congress has cut and cut and cut the IRS staff. The number of IRS revenue agents, as auditors are called, has been cut from almost 14,000 in 2010 to fewer than 9,000 in 2018. Trump is cutting their ranks even more.

In 2012 the IRS audited almost 41,000 taxpayers with incomes of $1 million or more. By 2018 just 16,300 were audited.

This decline took place while the number of people making millions and billions of annual income has been growing fast, almost doubling since 2010 to more than 504,000 households.

In 2010, eight out of 100 millionaires were audited: in 2018, fewer than three of every 100.

In 2010, audits identified $5.1 billion of income taxes owed by millionaires and billionaires: in 2018, only $1.9 billion of unpaid taxes were found, according to data that a federal court ordered the IRS to give to the Transactional Access Clearinghouse at Syracuse University.

Many IRS audits are cursory. When I was The Times tax reporter, I reported on the trend toward what disgusted revenue agents called “audit lite”, a term intended to foster an image of thin and tasteless low-calorie beer. So even the audits now under way may not catch the cheats.

The politicians who have supported ever tighter rules on verifying the income of most Americans and stripping away most of their ability to deduct charitable gifts, state and local taxes or mortgage interest are conservative Republicans. Some Democrats have gone along; others have fought for a bigger IRS to pursue business owners who cheat on their income taxes.

DCReport’s founder and editor is Pulitzer Prize-winning journalist David Cay Johnston, author of seven books including ‘The Making of Donald Trump’ and ‘It’s Even Worse Than You Think: What the Trump Administration is Doing to America’. His reporting persuaded two presidents to change their tax policies, stopped tax dodges that Congress valued at more than $250 billion in the first decade alone, and promoted the passage of many federal and state laws and regulations. The Washington Monthly calls David “one of America’s most important journalists.”