Environmental lobby group takes two Federal government finance bodies to court over concerns they are funding destructive projects — and not being upfront about the consequences, Zacharias Szumer reports.

Two of Australia’s biggest providers of taxpayer-funded finance have been slapped with a lawsuit that seeks to force them to disclose the environmental impacts of the projects they support.

The claim, filed today in the Federal Court, takes aim at Export Finance Australia (EFA), which provides finance to boost Australian exports, and the Northern Australia Infrastructure Facility (NAIF), a $7 billion fund that was established to fill infrastructure financing gaps in northern parts of Australia.

Jubilee Australia (JA), the human rights and environmental organisation behind the lawsuit, says that neither agency discloses the full environmental impacts of the risky new fossil fuel projects they prop up.

“Most people don’t realise that the Australian Government is using taxpayers’ money to fund new fossil fuel projects and infrastructure,” said JA’s executive director Dr Luke Fletcher. “The real environmental impacts of EFA and NAIF’s activities are enormous, and taxpayers deserve to know.”

EFA and NAIF’s support to fossil fuels

As private banks and super funds become more hesitant to lend to fossil fuel projects, public financiers are taking a more important role in helping coal, oil and gas projects get off the ground. In 2021, Jubilee released a report that sought to estimate the size of EFA and NAIF’s investments in fossil fuels.

The report estimated that, between 2009 and 2020, the EFA had provided over $1.5 billion in financing for fossil fuels. It suggested that, as of mid-2020, NAIF had provided $91.3 million to fossil fuel projects and a further $522 million to projects with a fossil fuel component.

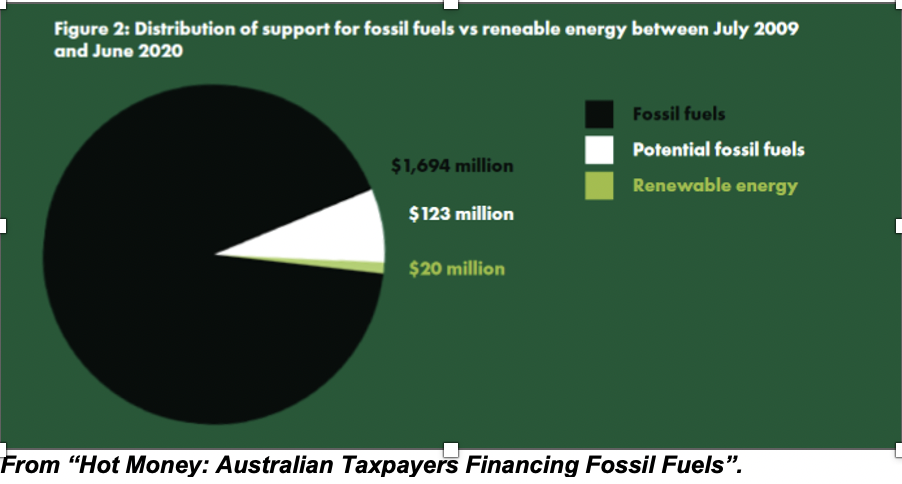

The report – titled “Hot Money: Australian Taxpayers Financing Fossil Fuels” – found that EFA’s investments in fossil fuels far outstripped investments in renewable energy.

Conversely, the report said, NAIF’s renewables funding was larger than its financing for fossil fuels. And the EFA has reportedly increased its funding of renewables since 2020.

One of the most consequential projects supported by the EFA has been the Gladstone LNG terminal. This terminal was the vital link in opening up LNG exports from Australia’s east coast, which many consider to be a key part in driving up Australia’s domestic prices by pegging them to international markets.

In 2016, NAIF gave “conditional approval” for a loan of up to $1 billion for a rail line linking Adani’s Carmichael mine with port facilities. Due to public outcry, the Queensland government quashed the loan approval.

Jubilee says that, due to a lack of transparency, a comprehensive list of projects funded by the EFA and NAIF is difficult to compile. However, both organisations announce some of their funded projects. And Jubilee has managed to bring some of the undisclosed ones into the light:

Major finance for fossil fuels, courtesy of Australian taxpayers

| Agency | Year | Details |

| EFA’s predecessor (the Export Finance and Insurance Corporation) | 2009 | Loan of US$350m to PNG Liquified Natural Gas project |

| EFA | 2011-12

|

Guarantee worth $94.2 million to the Wiggins Island Coal Export Terminal in Gladstone. |

| EFA

|

2011-12

|

$254.7m guarantee to Santos for the Gladstone LNG terminal. |

| EFA | 2018 | $124.65 million loan as part of the refinancing of the Wiggins Island Coal Export Terminal. |

| NAIF | 2017-18 | $16.8 million loan for the Onslow Marine Support Base, a shipping base supporting the offshore oil and gas industry |

| EFA | 2018 | $164.12 million to the refinancing of the Ichthys LNG Project |

| NAIF | 2019 | $300 million loan to the Darwin harbour shiplift, which will benefit offshore oil and gas producers alongside other industries |

| NAIF | 2021 | $175 million loan to Olive Downs Coking Coal Project |

| NAIF | 2022

|

$255 million loan to the Pilbara Ports Authority and Water Corporation to Perdaman’s Pilbara gas manufacturing urea project. |

| EFA | 2022 | $269 million loan to Perdaman’s Pilbara gas manufacturing urea project. |

Table compiled from information in Jubilee’s ‘Hot Money’ report and press releases from NAIF and EFA

Undisclosed investments and environmental impact

The “Hot Money” report noted that EFA has a partial exemption from Freedom of Information laws that relate to its commercial and national interest account transactions. The report says that this makes it “virtually impossible for taxpayers to find out where this government body is directing its funds.”

Refinancing arrangements are reportedly the hardest to track. In a 2022 letter to the EFA board and newly elected Labor ministers, Jubilee said that EFA had totally failed to disclose two “massive” fossil fuel projects: “a contribution to the Ichthys LNG project in 2020 of $164.12 million and a $124.65 million contribution as part of the refinancing of the Wiggins Island Coal Export Terminal in 2018.”

The lawsuit launched today doesn’t focus on disclosure per se, but on forcing the two agencies to report on the climate and biodiversity effects of their activities.

The lawsuit’s legal foundation is a section of the Environmental Protection and Biodiversity Conservation Act 1999 (EPBCA), which requires government agencies and departments to provide reports on environmental impacts of their activities.

David Barnden from Equity Generation Lawyers, the law firm representing Jubilee, said that the EPBCA also requires government agencies to report on the measures they’re taking to minimise the environmental impacts of their activities – a responsibility that he doesn’t believe they’ve been sufficiently fulfilling.

As a result, he says that the lawsuit is “the first in Australia that asks government agencies to own up to the real climate impacts of their activities.”

“When EFA and NAIF implement their overarching governing legislation, which is to provide various forms of subsidised financial products and services to projects that wouldn’t otherwise go ahead, you’re talking about potentially a lot of quantifying and describing the effect of those activities on the environment.

“This action could set a precedent for other government entities to report the true impacts of their activities,” said Barnden, who has been called “Australia’s most active climate litigator.”

Lack of effective climate limitations

Fletcher says Jubilee had hoped that legislation introduced by the Albanese Labor government “would help embed emissions reductions into the objectives and functions of key agencies and government departments.”

Alongside the 2022 bill that established a 43 percent emissions reduction by 2030 and net zero emissions by 2050, Labor also made amendments to incorporate emissions reduction targets for Commonwealth bodies like the EFA.

As a result, the EFA must now “have regard to” an emissions reduction targets. However, groups like The Australia Institute say that “does not go far enough” and is “unlikely to prevent financing of fossil fuels, given the export-oriented nature of EFA.”

Emissions generated by the burning of exported fossil fuels, known as scope-3 emissions, aren’t counted as part of an exporter country’s carbon budget.

“There’s been a fair bit of chat [in Australia] around our responsibility, or lack of responsibility, for exported emissions. This claim should cut through that, or tries to cut through that,” Barden told MWM.

The Teals and Greens pushed for stronger limitations to be included in a 2023 bill that raised NAIF’s budget allocation from $5 billion to $7 billion. However, Labor was unmoved, and the NAIF continues to operate without strong limitations on fossil fuel investments.

Groups like Jubilee fear that, without sufficient limitations, the EFA and NAIF may be used to fund projects such as the Middle Arm export terminal in Darwin and the opening up of the Beetaloo Basin to fracking. The Beetaloo Strategic Basin Plan, for example, makes specific mention of the NAIF providing possible support to infrastructure for Beetaloo.

A spokesperson for EFA declined to comment. The NAIF did not return calls and emails.

Zacharias Szumer is a freelance writer from Melbourne. In addition to Michael West Media, he has written for The Monthly, Overland, Jacobin, The Quietus, The South China Morning Post and other outlets.

He was also responsible for our War Power Reforms series.