Monetary policy can be helpful but fiscal stimulus is also clearly needed to halt Australia’s flagging economy. Such was the latest message from the Reserve Bank Governor Philip Lowe as the Coalition stubbornly clings to its budget surplus. Alan Austin reports.

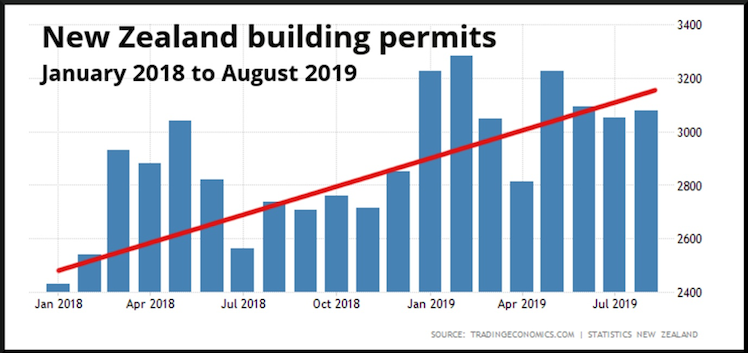

Despite their shock loss to England in the rugby world cup, New Zealanders are getting on with life. After a consoling glass or two of South Island Single Malt whisky, they are back taking full advantage of the buoyant global economy and building new homes at a near record rate.

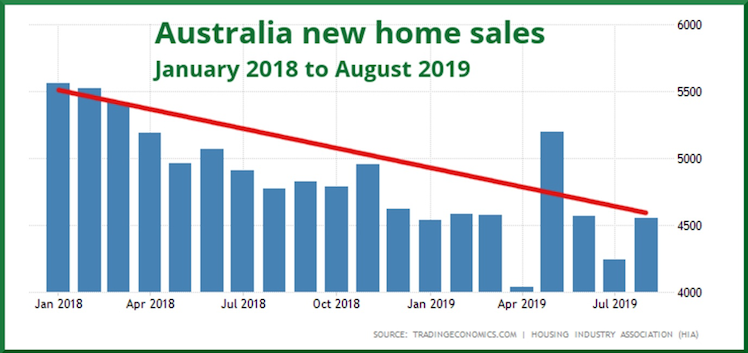

The contrast with Australia is stark. The focus in Australia is the Spring racing carnival, the tipple is a local lager, and new house construction is close to an all-time low.

The Reserve Bank of Australia (RBA) recently released its annual report which confirms observations here at MW and elsewhere that too little of the wealth generated by the current record exports is being shared with the citizens.

Or, to quote the RBA Governor Philip Lowe:

“Household spending has been affected by ongoing subdued growth in household incomes.”

and

“A pick-up in wages growth and a further reduction in unemployment would both be welcome.”

Despite his measured tone, Lowe is intimating the Government’s current economic policies are failing the people of Australia:

“Monetary policy can play a helpful role here, but so too can other arms of public policy.”

What the RBA does well – which is a great service to those wishing to understand the economy – is provide extremely useful data about how rapidly it is deteriorating under the Coalition’s current settings.

Unfortunately, the bank cannot openly condemn Coalition incompetence in words, but the numbers it publishes do so eloquently. We will summarise the RBA’s latest findings in four critical areas: housing loans, consumer credit, interest rates and the Aussie dollar. They are damning.

Homes Alone: despite record rates, Australia lags world as housing crisis grips

Take-up of housing loans

Being able to pay off a bad credit loan over two or three decades has been the foundation of the private wealth of the Aussies. Throughout post-war history, credit extended to home buyers to help them achieve their dream has increased every single year.

Even through the global financial crisis (GFC) the lowest rate of growth in home loans was 4.4%. That was in the first quarter of 2013, as the world emerged, shaken, from the crisis. This gradually lifted, reaching 4.9% in September 2013, when Labor lost office. It continued to rise thereafter, as the global recovery picked up pace, peaking at 7.5% in late 2015. (Data is from RBA file D1: Growth in selected financial aggregates, column C.)

Alarmingly, in mid 2016, after two Coalition budgets had changed many of Labor’s settings, the take-up rate of mortgages fell.

In February this year, this hit 4.2%, the lowest since this RBA file started in 1977. Every month since February it has fallen to a new all-time low, the latest being 3.1% in August.

Global comparisons

Meanwhile, new housing is expanding steadily in all other well-performed economies across the globe. This is clear from both housing starts and building permits at tradingeconomics.com.

Examining the latter, we have data for 26 wealthy OECD member countries. Nine have housing starts chugging along nicely, 11 are surging strongly, and four are at or close to all-time highs. These are New Zealand, Canada, Germany and Latvia. That leaves just two poorly-managed economies with new housing lagging badly – Turkey and Australia. Clearly, there are no global headwinds.

The chart above shows Australia’s new home sales for the last two calendar years. This closely tracks building permits, for which there is no equivalent chart. The chart below shows New Zealand’s building permits for the same period. This is typical of all soundly-managed economies today.

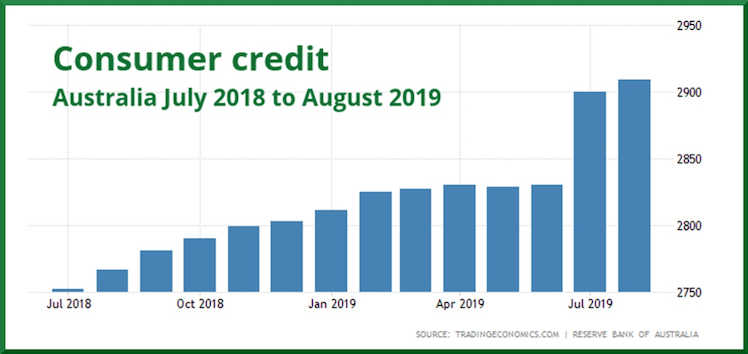

Consumer credit

Consumer credit suddenly shot up in July and August to $2,908.9 billion – a staggering increase of $74.9 billion, or 2.6%. In just two months.

This comprises three elements of private debt – housing loans, private household debt and business overdrafts and other borrowings. (Data is from RBA Table D2: Lending and credit aggregates.)

Over the last two months, housing loans held by Australian families and investors have actually decreased by $32.5 billion, or 1.8%. Over the same period, business borrowings have also decreased by $3.1 billion, or 0.3%.

So how come total credit has soared? The answer is that personal debt, including maxed-out credit cards and payday loans, has rocketed disturbingly. Just in these two months, July and August, the rise has been $24.2 billion, or 16.5%.

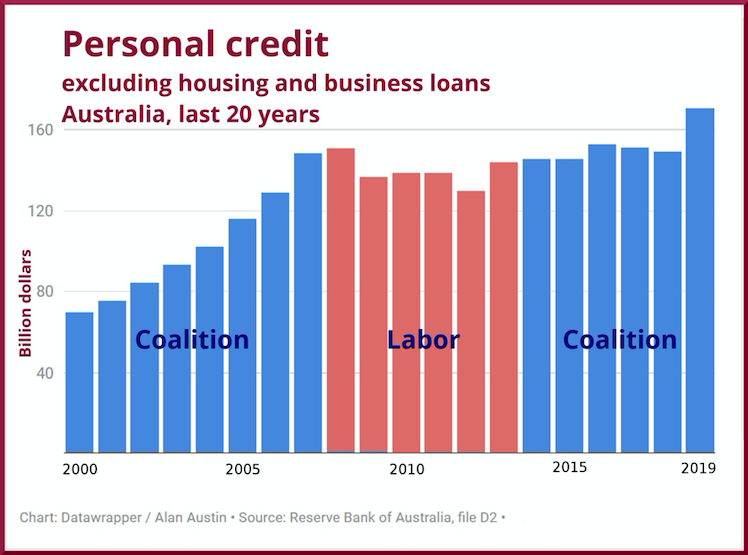

This final graph shows personal debt has increased markedly during Coalition periods, but decreased or remained steady under Labor. This is consistent with other findings regarding the outcomes of policies which shift wealth and income from one sector to another.

Interest rates

Australians relying on interest on investments for their living, notably elderly retirees, have seen their incomes plummet over the last six years. Since 2nd October, interest rates have been at 0.75%, unthinkable in August 2013 when former Coalition shadow treasurer Joe Hockey haughtily castigated Labor for allowing the rate to slide to 2.5%.

There is no excuse for this dismal level now. With the right settings for the prevailing conditions, interest rates ought be within the corridor of comfort between 2.6% and 4.8%. This is the experience now in Iceland, Kuwait, China, Malaysia, Qatar, the Philippines, Colombia and much of Africa and Latin America. Australia maintained this between 2009 and 2013.

Value of the Aussie dollar

The RBA shows the value of the Aussie dollar against 19 currencies every day. These are the main global currencies – the US dollar, the Euro, the Japanese yen and the Swiss franc – and Australia’s major trade currencies – the Chinese yuan, the Singaporean dollar and the Korean won – plus currencies of near neighbours – including the PNG kina, the Indonesian rupiah and the Kiwi dollar.

In an emphatic demonstration of the failure of the Australian economy to keep pace through the current global boom, the Aussie dollar has fallen against every one of these 19 currencies over the last year.

As more wealth and income is shunted offshore, the indicators of the wellbeing of the Australian people must decline. The RBA confirms this is happening.

Stop Press

We reported here two weeks ago that Australia’s net debt was about to breach the $400 billion barrier. This was confirmed on Friday. Not a peep from the craven hypocrites in the mainstream media.

A shot of South Island Single Malt, anyone?

——————

True Lies: Mathias Cormann caught by his own department for economic fairy tales

Alan Austin is a freelance journalist with interests in news media, religious affairs and economic and social issues.