The RBA has more than two policy levers at its disposal (tweaking interest rates and jawboning). It can influence interest rates by selling bonds back to government. What’s the scam?

“The Reserve Bank of Australia and Treasury are considering the RBA executing a U-turn on its pandemic “money printing” stimulus and selling federal bonds back to the government,” wrote John Kehoe in the AFR today.

As augured here during the massive QE Pandemic money printing, the central bank would probably move at some point to eradicate the surfeit of bonds (by repaying some bonds, there are naturally fewer bonds on issue and therefore less government debt).

The “problem”, some will say, is that the RBA is getting less than 100c in the $ for its bond buy, so it takes a hit to reduce the government’s debt. Others will even say the RBA is “insolvent” which is impossible. Still others will say that the government has to recapitalise the RBA with exactly the amount of the deficiency, that is, what it makes on cheap repayment. It then has to give to the RBA as capital so … zero sum game.\

The counter argument against early repayment: it’s precisely these low interest bonds that the government should *never* repay. It was the cheapest government financing ever – 30-year bonds at next to zero interest. So keep them.

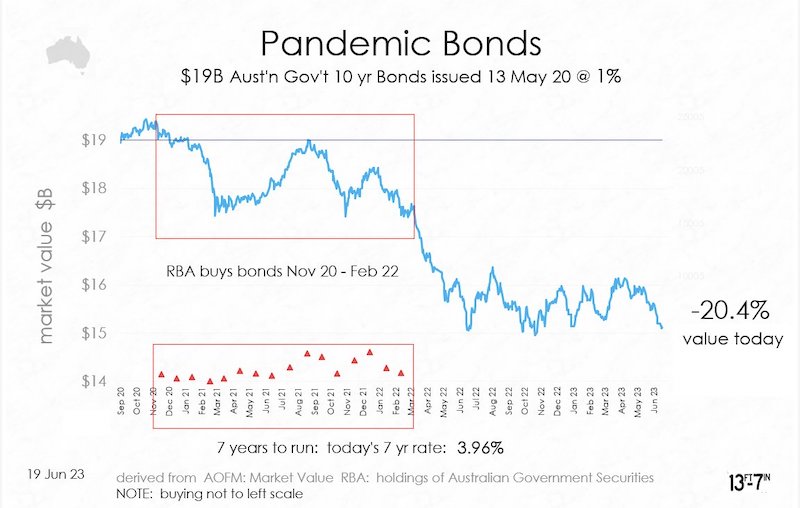

It costs 4% to fund repaying it early (at a 20% discount.

Should Fed'l Gov't repay these $19B pandemic 10 year bonds early?

🔹Costing 1%

🔹7 years to run

🔹 bonds are trading at 20% discount (ie worth $15B)

➤ Fed'l Gov't borrows $15B today at 3.96% (for 7 yrs) to fund repayment of the $19B

or

➤ borrows for 10 yrs at 4% ?#monpol pic.twitter.com/WmgjsrXrC1— 13foot7 (@13foot7) June 18, 2023

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.