The mining industry has exaggerated its contribution in taxes and royalties to Australian governments by an estimated $45 billion over the past 10 years. Callum Foote reports on the findings of an independent research project by Michael West Media.

The mining lobby and its “independent experts” from Deloitte Access Economics have routinely overcooked the contribution that mining companies make to Australia.

Michael West Media was commissioned to undertake an investigation into Australia’s mining royalty regime by the Neroli Colvin Foundation.

The report, A Fair Share?, found the mining lobby exaggerated by 19% its contribution to Australian government revenues through royalties and taxes for the period where government data has been made available, or an estimated $45 billion over the past decade.

The mining industry sold $2.1 trillion worth of Australian resources overseas in the past decade but Australian governments received less than a 10% return. The actual rate – 9.1% – covers royalty payments and taxes paid. If we consider only royalties, then the rate drops to 5.6% of the value of exported resources.

The mining industry regularly combines royalties and taxes but this is misleading when talking about its contribution to Australia.

Less than 10% of $2.1 trillion worth of Australian resources is perhaps not the “staggering” contribution as described by Resources Minister Keith Pitt earlier this week on the release of the latest Minerals Council report.

This is particularly the case given that the large mining houses are owned by foreign shareholders, so are the largest beneficiaries of Australia’s mineral wealth.

Michael West Media has found that, on average, mining companies make a 1654% revenue mark-up on Australian commodities.

Peak lobby group the Mineral Council of Australia commissioned Deloitte to showcase the contribution that mining companies supposedly make to the Australian economy. Deloitte estimates that between 2010 and 2019 the mining industry paid a total of $238.8 billion in company tax and royalties to the States, Territories, and the Commonwealth.

Deloitte relied on data from the Australian Taxation Office (ATO) and the Australian Bureau of Statistics (ABS). Michael West Media relied on the same data (as well as a range of other sources). The large discrepancy in findings between the two sources appears to come down to Deloitte’s estimates.

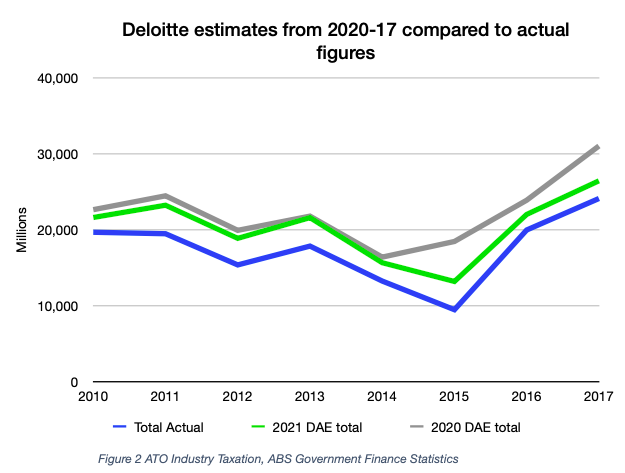

When comparing Deloitte’s estimates for the years where we have data available, between 2010 and 2017, we found the figures provided by Deloitte in its May 17 report had been exaggerated by an average of 19%.

If this same 19% exaggeration were consistent for the whole period analysed in the report, then Deloittes appear to have exaggerated the payments to Australian governments by an estimated $45 billion.

A Deloitte spokesperson said “we absolutely stand by our analysis and its estimates of royalty payments and gross company tax. Otherwise, we don’t comment on client matters”.

Combining royalties and taxes is a mischievous tactic often employed by the mining lobby and rarely questioned by the media.

In Australia, all mineral commodities below the earth are owned by the Australian people. It is up to State and Federal governments to sell these commodities to mining companies that wish to extract and process them for selling. In accounting terms, royalties are deemed to be a “cost of goods sold”.

Just as a baker must buy raw flour from a mill and process it into bread to sell, royalties are the payment made by miners to the Australian people for the raw commodities that they then sell internationally.

Deloitte’s most recent report is more accurate than previous estimates of mining taxes and royalty payments. Michael West Media had contacted the firm for comment before it published this report because it was found that royalty and taxation figures were previously exaggerated by 33%, or $78 billion, for the period between 2010 and 2017.

The firm declined to discuss its methodology and analysis.

Between 2020 and 2021 Deloitte also revised its estimation of historical taxes and royalties paid by the industry, despite claiming that they were providing actual historical data.

Deloitte refused to answer why it had revised its previous estimates, or whether it was using ‘actuals’ in the first place.

ATO Industry Taxation, ABS Government Finance Statistics

As the graph shows, the estimates provided in Deloitte’s 2020 report are approximately 10% higher than those of the 2021 report, yet the most recent figures are still between 10% and 40% higher than the ‘actuals’, for an average exaggeration of 19% for the period shown.

Unfortunately, the ATO doesn’t make available comprehensive data on tax paid by the industry for the past two years, so we cannot know exactly the mining industry’s payments. We did check company reports filed with ASIC but it is not possible to conclusively find tax and royalties payments due to disclosure issues.

However, if we assume that Deloitte’s 19% inflation of the figures between 2010 and 2017 are consistent, then the industry has paid an estimated $193 billion to Australian governments in the form of royalties and taxes over the past 10 years.

This massive figure pales somewhat when discussing it as a proportion of the total revenue of the industry over the period.

The total export value of Australian commodities over the period, which is indicative of the revenue these companies have made from selling Australian resources overseas, is $2.1 trillion. This means that only 9.1% of the export revenue made by these companies has been paid to state and federal governments.

To read the full report ‘A Fair Share: mining royalties and taxation in Australia’ and its findings please see here.

Minerals Council’s masterclass in spin and corporate lobbying

The Neroli Storytelling Colvin Foundation sponsored Michael West Media to produce this work of environmental journalism. This report and the associated articles are the result of that funding.

Callum Foote was a reporter for Michael West Media for four years.