The latest numbers on Australia’s economy show again that the RBA has got it wrong on interest rates. Michael Pascoe reports.

Another day, another set of numbers that say the Reserve Bank doesn’t understand what’s going on with Australia’s economy, and is running late in cutting interest rates.

At the core of that tardiness remains the econocrats twisting themselves in knots over a labour market they have failed to believe.

Having been forced to admit the Bank had been wrong for years about what the old NAIRU (non-accelerating inflation rate of unemployment) might be, the new regime wraps itself in multiple employment market indicators thus hoping to divine what “full employment” might be.

The exercise is demonstrably piffle.

Labour market “tight”?

It’s actually rather obvious if the labour market is too “tight”: wage rises push up inflation. For some 18 months now, the availability of labour, as indicated by pool of officially unemployed, has been steady around 4.1 per cent and all the while inflation has been falling.

What’s more, if wages are rising too fast, the growth in wage rises tends to accelerate. Instead, market wage rises have been getting smaller.

Ipso facto, the labour market is not too “tight”. The RBA held off trimming rates earlier because of confusion about what its raft of employment indicators might mean, worsened by its business liaison saying there’s a shortage of good workers. Memo RBA: business will always say there’s a shortage of good workers except in the depths of recession.

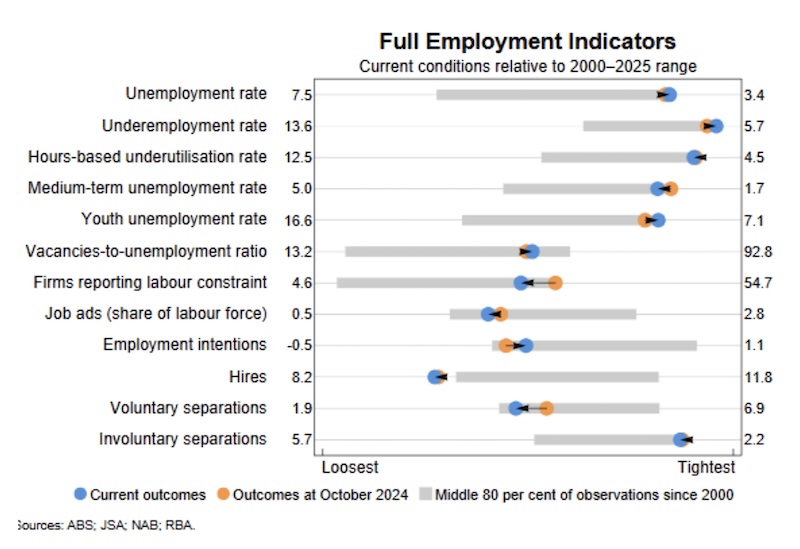

Instead of concentrating on the bleeding obvious, the RBA’s quarterly statement on monetary policy digs into everything else that might be related. To wit this chart from the May statement on monetary policy:

The reality is that at this stage, unemployment is low by historical standards, but that does not mean it’s tight. It is not.

That is an unrecognised triumph, not a problem for economic policy. If policy wasn’t driven by risk aversion above all, the econocrats would be cautiously seeing if they could get unemployment a bit lower.

The rearview mirror

But risk aversion is all the rage, despite that being risky. The bank continues to demonstrate that it drives via the rearview mirror, waiting for old statistics to justify moving rates and then, as admitted in the latest board minutes, not daring to move more than the money market expects.

At her May media conference, Governor Michele Bullock indicated the bank ignore the monthly CPI figures provided by the ABS, relying only on the quarterly numbers.

The monthly numbers are not as detailed but they have proven to be reliable indicators of where inflation is heading and better at that than the quarterly figures. “Fresh is best”, after all.

Now the rear vision mirror of the March quarter national accounts has told us economic growth is weak back in the first quarter of this year and could do with some help from monetary policy – and this before the worst of the Trump mania.

The RBA had no feeling for that reality. It was still working on 2024 figures and a fear of a non-existent “tight” labour market.

And now forecasts for growth, employment and inflation are being downgraded.

A partial excuse for not cutting rates at the April meeting – as it absolutely should have – was uncertainty about Trump. There was no uncertainty about whether there was going to be an upside to the Toddler King, only how bad the downside might be.

A board with the courage of having convictions would want to get in some retaliation early. This board wanted to wait and see. It failed.

Michael Pascoe is an independent journalist and commentator with five decades of experience here and abroad in print, broadcast and online journalism. His book, The Summertime of Our Dreams, is published by Ultimo Press.