In Japan, they pay a lot less for Australian gas than we do in Australia.

Last month, the spot price in Japan was $US4.27 per gigajoule whereas the average spot price paid in Sydney, Brisbane and Adelaide in June was $US6.87/GJ. Australian consumers paid, on average, 60 per cent more for gas produced in Australia than did our customers in Japan.

This is even more bizarre when you consider that, before the gas is shipped six thousand kilometres to Japan at a cost of $US0.75GJ, it first has to be liquefied at an LNG plant at a cost of $US1.50/GJ.

We are being skewered; every consumer and every business which uses gas is being gouged. Spiralling energy prices – electricity costs have doubled in recent years too – are all part of the train wreck which is Australia’s energy policy.

Not only is our East Coast gas market controlled by a cartel of three producers, Santos, Origin Energy and the Exxon/BHP marketing nexus in the Bass Strait, but gas distribution is also controlled by a fabulously profitable pipeline troika.

It’s the sort of return which would have been quite acceptable to Joaquin “El Chapo” Guzman’s Sinaloa Cartel in Mexico.

Australian Energy Regulator (AER) data shows the return on equity of one pipeline asset is a dazzling 159 per cent – the sort of return which would have been quite acceptable to Joaquin “El Chapo” Guzman’s Sinaloa Cartel in Mexico.

As pensioners shiver this winter – “energy poverty” is on the rise – the gas cartel may also send more manufacturing businesses in Australia to the wall, or drive them offshore, as has been the case with leading fertiliser group Incitec.

The spot gas market run by the Australian Energy Market Operator (AEMO) is illiquid, lacks depth and is tightly controlled by the three dominant players. Although they call it a “market”, it is not really a market at all. A real market requires transparency and price discovery. This is a cartel and cartel prices recently spiked to $14.40/GJ on July 5.

To lend global perspective, the average spot price on that day, July 5, of $US10.80/GJ, was more than three times the spot price of $US2.69/GJ on the same day in the US, where there is a true market.

Yet, it is not merely against the efficient US market where Australian gas prices seem grossly inflated. Our largest export market is Japan. On that same day in Japan the contract price was $US7.23/GJ.

Besides the stranglehold of the producers’ cartel, gas prices have shot up because the transmission system in Australia, that is the pipelines, is extremely expensive.

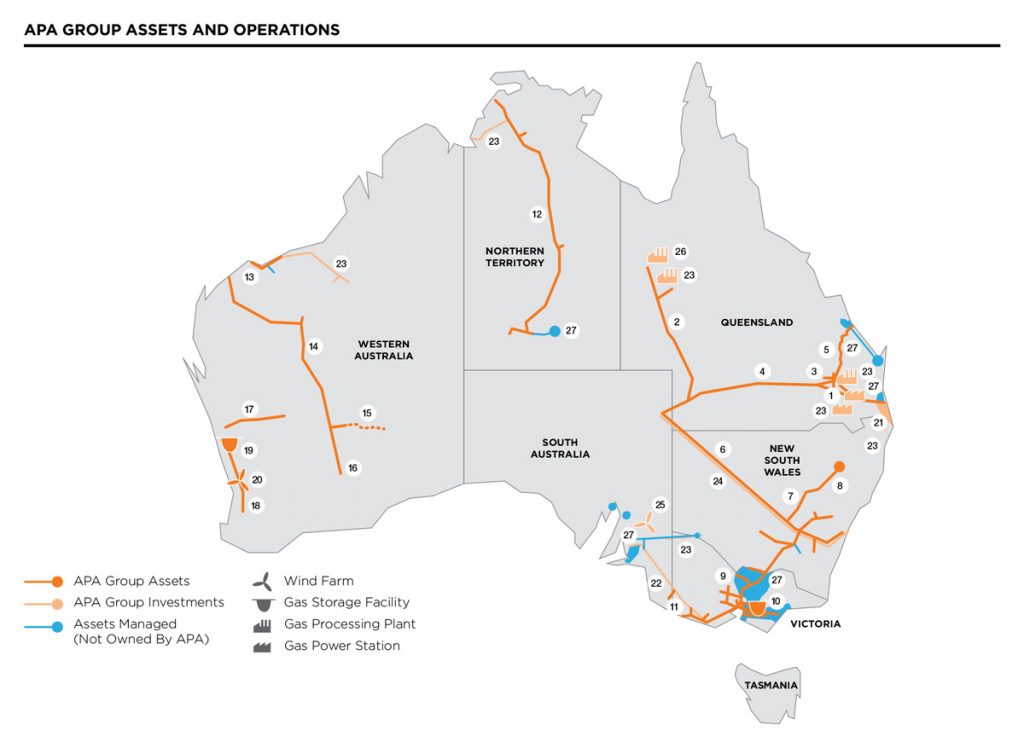

Gas transmission is dominated by the pipeline-owner APA Group.

https://www.apa.com.au/globalassets/documents/annual-reports/apa-2015-annual-report.pdf

https://www.apa.com.au/globalassets/documents/annual-reports/apa-2015-annual-report.pdf

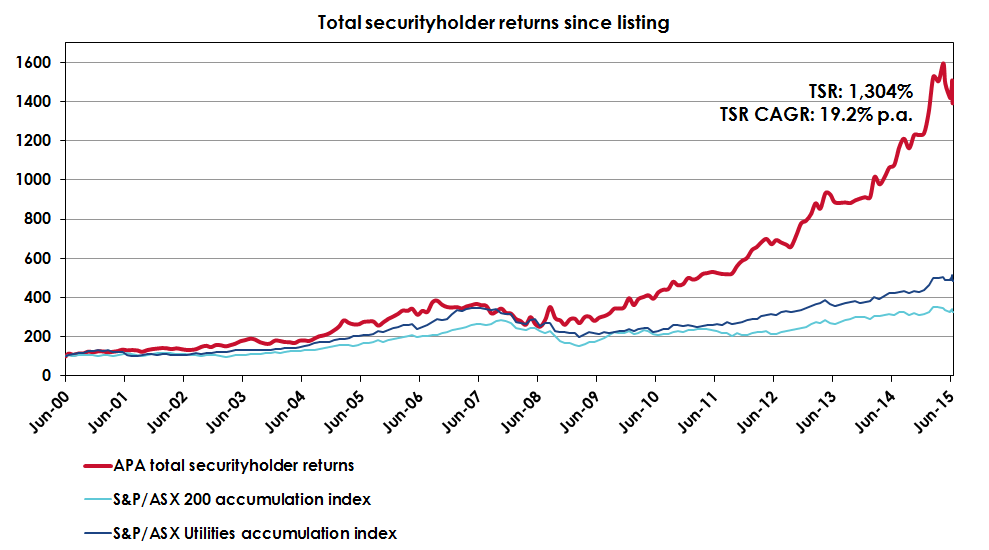

APA is one of the very best performers on the Australian Securities Exchange (ASX). Since floating in 2000, its shares have delivered investors a return of 1304 per cent. In share market vernacular, this is a “13-bagger”, increasing in value 13 times its original investment in 15 years. A truly phenomenal run, and a credit to management.

Their shareholders’ gains though have been their consumers’ losses.

APA’s Outsized Returns

Source: https://www.apa.com.au/investors/adding-value-at-apa/

How does an essentially dull business deliver such scintillating profits though? It runs unregulated monopolies charging its customers monopoly prices.

The recent Australian Competition and Consumer Commission (ACCC) Inquiry into the East Coast Gas Market produced a number of examples of price gouging by the monopoly gas transmission providers. The other two are Jemena and QIC.

While the ACCC did not name the offenders, its dominance suggested to most observers, including APA itself, that APA must have been one of them. For its part, APA denies predatory pricing, instead putting its success down to lifting pipeline capacity, getting more gas through its artery of pipes and other infrastructure.

Chief executive, Mick McCormack told the audience at an industry dinner in Sydney last week transmission charges made up only 5 per cent to 10 per cent of retail gas prices.

“So the pipeline industry hasn’t been the party putting very steep price increases to the market – we’ve just charged what we’ve always charged and tried to grow the gas market.”

Ominously, he also flagged a research report from investment bank JP Morgan estimating prices would rise a further 40 per cent over the next decade.

Responding to questions for this story, an APA spokesperson said the group was making the same rate of return as it did when it listed, saying the 66 per cent rise in prices was mostly due to the effect of trebling of demand from the three LNG projects at Gladstone in Queensland (offshore demand had sucked away domestic supply).

“What is certain is that the pipeline transmission charges have not contributed to increases in the domestic gas price. APA has not increased pipeline tariffs on its east coast pipelines in real terms for at least a decade, so any increase in delivered gas prices hasn’t come from APA so called “gouging” its customers,” said the statement.

In its inquiry, the ACCC noted many examples of price gouging in the transmission industry and it found that price rises would not have been nearly so rampant if the monopolies were regulated.

“So too does the internal analysis carried out by one pipeline operator, which indicated that it is earning 70 per cent more revenue than it would if it was subject to full regulation.”

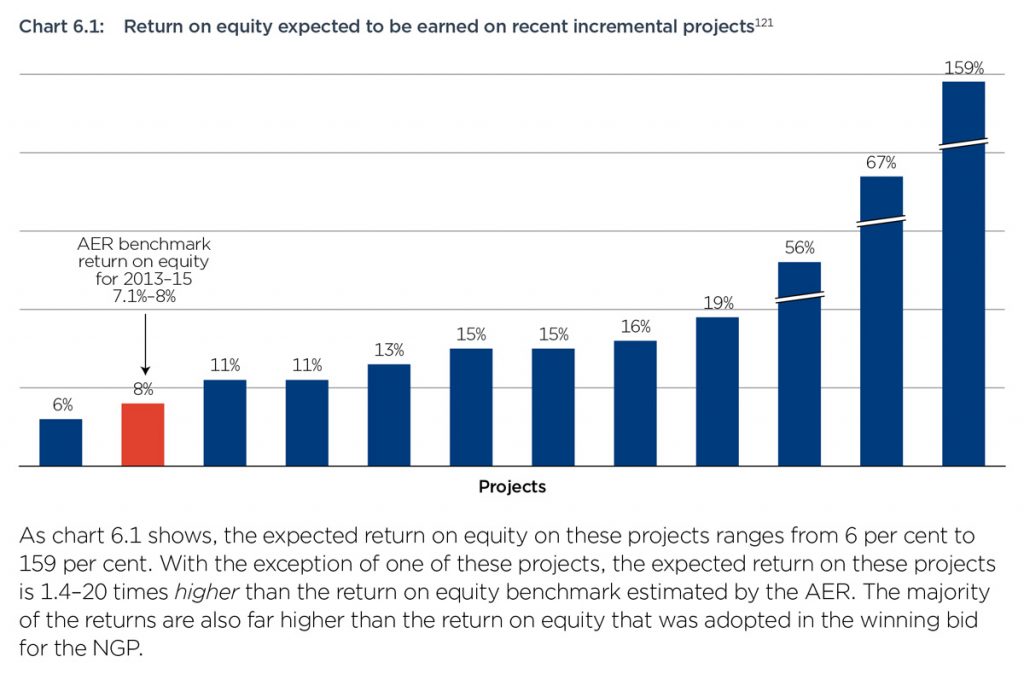

Lest we be accused of selective quotation, the ACCC goes on to detail a selection of pipeline augmentation projects carried out in the last two to three years in the following graph. The Australian Energy Regulator has a benchmark return on equity for 2013-15 on such regulated projects of 7.1 per cent to 8 per cent. For the weary consumer though, these projects were not regulated.

Only one of the projects came in under the AER’s benchmark. The expected returns on these projects being 1.4 to 20 times higher than the benchmark return – with the most extreme example producing a staggering return on equity of 159 per cent.

Source : ACCC Inquiry into the East Coast Gas market Page 105

The lack of regulation of many of APA’s gas transmission pipes is in stark contrast to the situation in Europe, New Zealand and the bastion of capitalism, the US.

It appears that overseas, even in the US, it is recognised that monopolies need to be regulated.

In the US, all major interstate transmission pipelines are regulated unless the pipeline operator can demonstrate that it lacks significant market power. No pipelines have been able to demonstrate this to date.

Even in the US, it is recognised that monopolies need to be regulated.

The US market also demands high levels of disclosure by pipeline operators. They must report on a quarterly and annual basis:

- The pipelines balance sheet, cash flow statement and profit and loss

- detailed information on the value of the pipeline’s assets and accumulated depreciation

- detailed information on the revenue received for transportation, storage and other services and volumes transported

- detailed information on the costs incurred in the provision of services, including the cost of any capital works under construction.

In contrast, customers wanting to use a transmission pipeline in Australia must head into negotiations essentially blind to any of these negotiating tools. The market in Australia is completely opaque with all the information withheld by the transmission companies.

Our governments and regulatory bodies allow this price-gouging, even defend it, despite the encroaching scourge of energy poverty and the deleterious effect of high gas prices on the economy overall.

Globally, the price of gas, along with tumbling crude oil prices, has been crashing but in Australia prices have been marching steadily higher. On the spot market on June 30, the price even touched $A29GJ.

To conclude with one of our favourite themes, tax, APA did not pay tax last year despite its $1.5 billion in income. It received a refund of $141,000 in the prior year. APA forecasts it will pay tax and booked a $171 million tax expense through its income statement. Due however to its complex stapled trust structure it is incumbent on its trusts’ member to pay the tax, many of whom are domiciled overseas or who are super-funds paying half the corporate tax rate.

Bruce Robertson is an analyst with IEEFA.org

Bruce Robertson is an analyst with IEEFA.org

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.