Is the Morrison Government’s HomeBuilder scheme another case of pork-barrelling which targets the Liberal base? Financial adviser Harry Chemay says it will benefit some first-home buyers and the building lobby – but can also be accessed by wealthy self-funded retirees to increase the value in their home and access the pension.

The new HomeBuilder scheme, announced by the Morrison government late last week, is a time-limited grant program ostensibly to help the residential construction industry get through the COVID-19 pandemic.

It will see the provision of $25,000 tax-free grants to owner-occupying individuals (companies and trusts are ineligible) who meet certain criteria and are willing and able to spend between $150,000 and $750,000 on their primary residence.

The announcement has been applauded by the various construction groups. Master Builders Australia (MBA) has been particularly effusive about the scheme, claiming that HomeBuilder “will be a lifeline for an industry facing a valley of death in the coming months”.

The eligibility criteria

To qualify for a HomeBuilder grant the applicant(s) must be over 18, an Australian citizen, and either have income less than $125,000 as an individual or $200,000 combined as a couple.

In addition, applicants must be able to enter into a building contract between June 4, 2020 and December 31, 2020 to either:

- build a new dwelling as a principal place of residence where the property value does not exceed $750,000; or

- “substantially renovate” an existing principal place of residence, where the renovation contract is between $150,000 and $750,000, and where the value of the existing property does not exceed $1.5 million.

In either case, construction or renovation, the building works must commence within three months of the contract date.

Happy days for greenfield residential developers

Given the highly targeted nature of the scheme, questions have been raised as to who could possibly benefit from the HomeBuilder program.

The answer is, in three words, “shovel-ready projects”.

The scheme will have particular appeal to those buyers, especially first home buyers, who were already on the journey and may now bring forward their plans.

This is precisely what the MBA and other building lobbyists would like to see happen, with the residential construction industry fearful of a near 50% decline in new dwelling commencements by the end of the year.

With the $750,000 cap, it is clear that greenfield residential construction of new houses on the urban fringes of capital cities and in regional Australia will most easily meet the grant criteria.

The main beneficiary, from a commercial perspective, will thus likely be the large construction players who dominate greenfields development. Companies like Sunland, Mirvac and Stockland. Do they really need a further boost in government support?

A Towering Hide: Mirvac and property giants board JobKeeper gravy train

Working-age renovator’s delight? Definitely not

Existing home owners have been less enthusiastic about the new scheme.

That’s understandable. The “substantial renovation” requirements are far more constrained.

The $1.5 million limit on property value will exclude most of the inner and leafy eastern suburbs of both Sydney and Melbourne, especially for free-standing property. The economics of spending at least $150,000 on a renovation for a $25,000 grant will also simply not stack up for many.

Then there is the pressure of the December 31, 2020, deadline and the three-month building commencement requirement.

Anyone who has had anything to do with renovations will know that 10 months is barely enough time to get plans into, and through, council.

Quite simply, if you’re doing a substantial renovation (say a second floor) and don’t already have your plans at an advanced stage in council you can forget about the HomeBuilder grant.

An opportunity for wealthy retirees to access age pension

There is one segment of the population, however, for whom HomeBuilder may potentially be worth many times the $25,000 grant.

They are the self-funded retirees who sit just outside part age pension eligibility, and who now have an opportunity to re-organise their affairs to top up private pensions with the taxpayer-funded age pension.

For some, HomeBuilder will be a way to access the age pension, the full value of which to a 66-year-old male is north of $500,000 over an actuarial life expectancy.

Here’s the dilemma some wealthy retirees now face. The age pension is asset tested. To get even a dollar of the pension a home-owning couple now must have less than $869,500 (as at March 21, 2020) in financial assets.

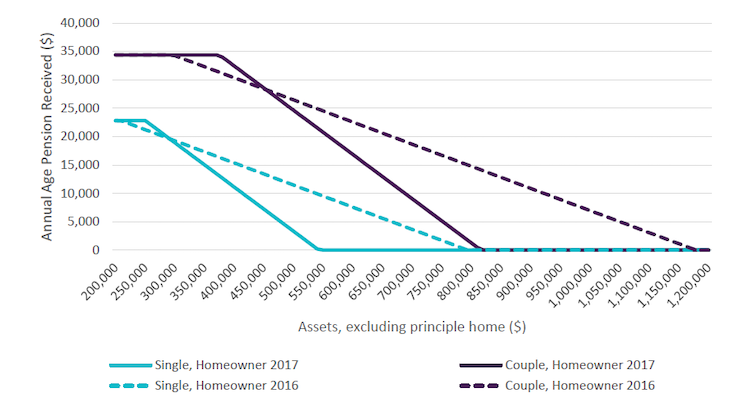

For very many retiree couples, this amount was around $1.2 million before January 1, 2017, when the so-called “taper rate” (the rate at which the age pension cuts out as private assets rise) changed. As a result, some lost access to a part pension, and with it the various concessions and discounts that pensioners receive, as depicted in the chart below.

Source: Michael Rice, The Age Pension in the 21st Century, paper presented to the Financial Services Forum 2018.

Here, however, arises a twist. As the family home is not asset tested, one can conceivably live in a $5 million mansion and, with financial assets less than the maximum allowable limit, receive a part age pension.

For self-funded retirees with significant investment wealth, the age pension was probably less relevant while the flow of excess franking credits helped maintain a comfortable lifestyle.

Now, however, with the banks cutting dividends in the face of COVID-induced profit declines, wealthy self-funded retirees face a new dilemma.

How #FrankingCredits delivered victory to Boomers over own kids

Do I trim my retirement lifestyle or do I sell some of my portfolio to maintain it?

Well, thanks to the HomeBuilder scheme, some lucky retirees will have to do neither.

Retirement reno to the rescue

For those with existing homes worth less than $1.5 million (which will exclude many retirees who own free-standing homes in Sydney or Melbourne) it may be possible to shift up to $750,000 of financial assets into the home to potentially gain access to the age pension.

It would work as simply as this hypothetical case.

John and Margaret own their own retirement home in Byron Bay. It is valued at $1.35 million. They also have a self-managed super fund (SMSF) worth $1.5 million. The fund produced $45,000 across Australian fully-franked dividends and a little bit of interest during 2019.

With the banks now slashing dividends, John and Margaret fear their 2020 investment income might fall to around $35,000.

They could, of course, dip into their capital and sell some shares to maintain their $45,000 lifestyle.

Or, they could spend some of their SMSF wealth on their house and move under the $869,500 asset test limit.

John and Margaret commit to a $500,000 renovation by selling down some shares. They gut and remodel two bathrooms and the kitchen, upgrade all glazing, lay down premium hardwood flooring and install a battery-based solar system.

My rough guesstimate is that they would thereafter receive some $10,000 per year in combined partial age pension. Hey presto, lifestyle restored with the taxpayer footing the bill. And a substantially more valuable house to boot (an indirect benefit for their children when they pass).

This is a highly simplified example, but it serves to illustrate the opportunity now available to legally shelter assets outside the reach of the assets test.

In other words, for taxpayer dollars to once again be directed to objectively wealthy Australians who can hold their wealth in lightly taxed structures.

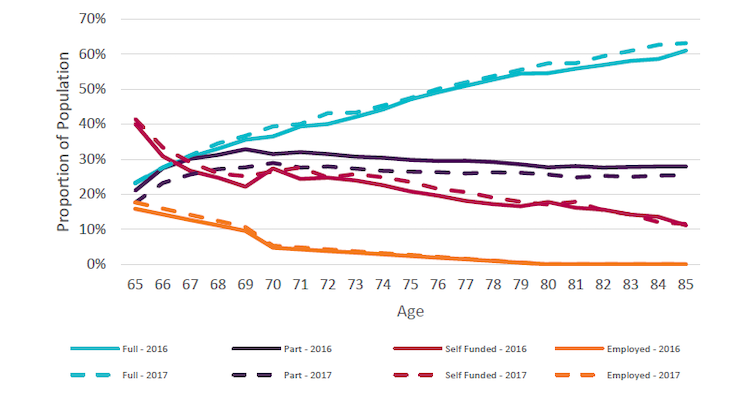

The chart below indicates that by age 70, only some 26% of retirees are fully self-funded.

If more wealthy retirees move on to a part age pension, the impact on the Budget (currently estimated to be around $50 billion per year) may be significant.

Source: Michael Rice, The Age Pension in the 21st Century, paper presented to the Financial Services Forum 2018.

.

As a former financial planner to predominantly wealthy retirees, I took little time to identify this opportunity. It is a near-certainty that there are already conversations taking place between advisers and some of their retiree clients about “doing that long overdue reno”.

If this doesn’t serve as an impetus to revisit the exemption of the family home from the age pension asset test, I shudder to think what would.

Who loses out in the scheme?

The $688 million forecast for HomeBuilder is not being applied in the most constructive way; pun intended.

It is abundantly clear that whole swathes of the economy, from the arts/entertainment sector, to university casual staff and temporary visa holders, have effectively been frozen out of the JobKeeper program. Some of the HomeBuilder funds could surely be better directed to their needs.

If not JobKeeper, then to support newly jobless renters who find themselves in a legal limbo, with the moratorium on forced evictions rapidly winding down.

Of direct contrast, however, must be the relative lack of stimulus spending on social housing, a sector that accounts for more than 350,000 dwellings in Australia. It is an area of desperate need to which some of the HomeBuilder funds could have been allocated.

A recent article by energy efficiency advocates One Step Off The Grid suggests $25,000 would be enough to pay for a full energy efficient retrofit for much of the social housing stock in Australia, leading both to a boost to employment and better outcomes for those dependent on social housing.

Australians could get a lot more bang for the buck using the HomeBuilder funds to support such spending, rather than directing taxpayer dollars to large residential construction companies and already wealthy retirees.

But that would require the sort of policy fortitude that this Government is not exactly known for with its ballistic level of pork-barrelled grants schemes.

Disclosure and Disclaimer:

This article has been prepared by Harry Chemay, an authorised representative of Clover.com.au Pty Ltd (AFSL No. 479416) (“Clover”). Clover is a registered financial services provider. However nothing in the above article should be construed as personal or general financial advice. The content of this article is meant to be of an informational nature only, and primarily reflects the opinions of the author.

————————-

Emergency piggy-bank: superannuation’s Achilles heel exposed by virus

Harry Chemay has more than two decades of experience across both wealth management and institutional asset consulting. An active participant within the wealth and superannuation space, Harry is a regular contributor to investment websites in Australia and overseas, writing on investing and financial planning.