A drastic slide in home ownership, mirrored by an equally dramatic rise in mortgage debt and renting, is a direct result of failed government policy. Spiralling inequality in the “Land of the Fair Go can be addressed, ironically, by stronger lending standards. Economist and Senate candidate Steve Keen on the crisis in affordable housing.

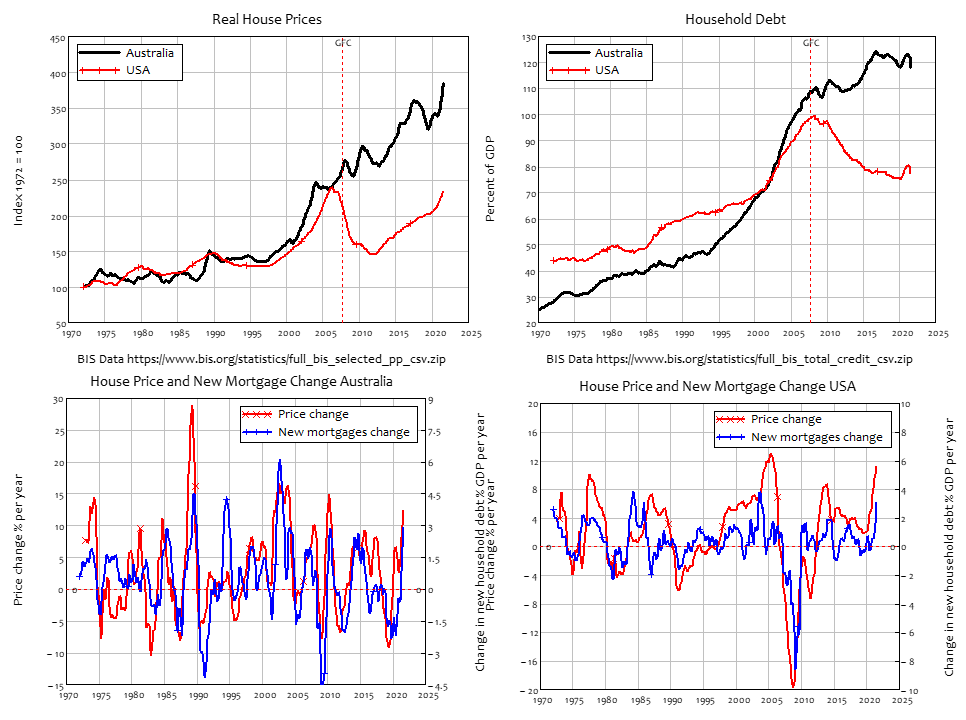

At the 1998 Census, 43% of Australians owned their houses outright, 29% had a mortgage, 18% rented from private landlords, and 6% from the government (the remainder were in hotels, homeless, etc). Twenty years later, only 30% owned their houses outright, 37% had a mortgage, while 27% rented from landlords and 3% from the government. And yet the objective of housing policy, under both Liberal and Labor governments, was to increase home ownership.

Einstein didn’t say “insanity is doing the same thing but expecting different results”, but it’s nonetheless true. The policies enacted by Labor and Liberal governments boosted demand by cash grants to first home buyers, tax enticements to investors, or reduced lending standards. This has driven house prices up and housing affordability down. The New Liberals (TNL), a new party focused primarily on establishing a federal ICAC with teeth after this election, has decided to do something completely different, to reduce demand via stronger lending standards.

They propose to cap the maximum amount that can be borrowed to buy a property at a multiple of the income-earning potential of that property. Initially, that would start at the current mortgage-to-rent ratio of about 20:1, but it would be reduced over time to 10:1.

Equity matters more than price

That, almost certainly, would cause house prices to fall. So, what happens to the 2/3rds of Australians who own their own home, either outright or with a mortgage? Here, The New Liberal’s Housing Affordability Policy focuses on the fact that, while many homeowners are obsessed with the price their homes can fetch, what really matters is the equity in their home; the gap between what it could be sold for, and what is owed on it. TNL’s objective is to keep this gap constant, while also reducing house prices.

They call their method to achieve this a “Monetary Reset”. They note that, while both major parties obsess about Australia’s level of government debt, which, at 57% of GDP, is one of the lowest in the world, they ignore household debt, which is more than twice as high as government debt, at 118% of GDP.

This has almost trebled since 1990, when it was 45% of GDP. Since, as the Bank of England confirmed in 2014, bank lending creates money, more than 100% of the money created by the private banking system since 1990 has been created by mortgage debt (corporate debt has fallen by 7% of GDP). This growth in debt is what, in turn, has caused today’s eye-watering house prices.

Rising levels of new household debt cause rising house prices

Letting banks create so much debt-based money was a policy blunder, they argue, which was largely caused by governments trying to reduce government debt by running a surplus. This was driven by the belief that the government borrows from the public when it runs a deficit, but this is mistaken. As Stephanie Kelton argues in The Deficit Myth, a deficit creates money for the public.

| Assets | Liabilities | ||

| Reserves | Bonds | Loans | Deposits |

| +Bank Lending | +Bank Lending | ||

| +Government Deficit | +Government Deficit | ||

| +Treasury Bonds | -Treasury Bonds |

Both new private debt and net government spending create money. They differ in that bank-created-money is backed by private debt, whereas government-created-money is backed by reserves, which are then swapped for treasury bonds when the government sells to back its deficit.

The New Liberals propose using this same mechanism to replace credit-based money with fiat-based money. Their “Monetary Reset” policy would give every adult resident the same sum of money, which would have to be used to reduce debt, or for those with less debt than the reset, to buy treasury bonds. The end result would be no net creation of money, but a dramatic drop in the level of indebtedness, which would benefit current mortgage-holders, while owners and renters would receive government bonds.

The difficult balancing act these policies aim to achieve is to make owners and mortgagors no worse off, with reduced debt and income-earning government bonds offsetting the fall in house prices. On the other hand, renters would be strict beneficiaries, making up for decades of policies that penalized them by boosted house prices and caused rising rents through increased competition for rental properties.

It’s a bold policy, which may scare many people, and large-scale landlords might not like it at all. But the alternative is to continue with policies that don’t work, and which have divided Australian society. As they put it, “there is no such thing as expensive affordable housing”.

Editor’s Note: Steve Keen is standing as a Senate candidate for The New Liberals (TNL) at the next election. TNL leader Victor Kline is on record saying the Liberals have threatened mainstream journalists with blocked access if they cover TNL and its policies. It seems to be working, although TNL is proposing to run 19 candidates across Australia.

Professor Keen is a Distinguished Research Fellow at UCL, economist, author and Senate candidate for The New Liberals.