Australia’s fossil fuel miners and drillers may be receiving more in government subsidies than they pay in royalties. An investigation by Callum Foote lifts the lid on the transfer of wealth from the public to foreign-controlled resources companies.

In 2019-20, the fossil fuel industry earned $115 billion from selling Australia’s petroleum and coal resources and paid state and federal governments an estimated $7.3 billion in royalties.

One year later (in 2020-21), the industry received more than $10.7 billion in subsidies, according to a report released by The Australia Institute based on state budget papers.

It appears that federal and state governments pay billions of dollars more in subsidies to multinational fossil fuel miners than they pay in royalties to governments.

In a research report for the Neroli Storytelling Colvin Foundation published last week, Michael West Media calculated that powerful mining lobby Minerals Council of Australia and its experts from Deloitte had exaggerated tax and royalties payments by $45 billion over ten years. The report found a return of less than 10% to the owners of the minerals – the Australian public – on $2.1 trillion in mining exports.

Mining lobby exaggerates taxes and royalties paid by $45 billion

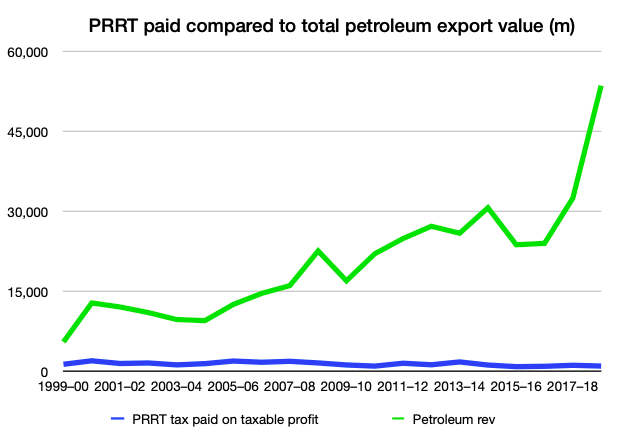

Further, thanks to a change in legislation regarding the Petroleum Resources Rent Tax (PRRT), which covers LNG exports, Australia now receives less in PRRT payments than it did 20 years ago even though petroleum export revenues have soared by more than $50 billion.

Labor’s minister for resources Martin Ferguson presided over a number of the legislative changes which allowed gas extractors to avoid tax before he retired from politics and became a fossil fuel lobbyist. Ferguson is one of many former politicians in the fossil fuels lobby.

Fossil fuel royalty revenue

In 2019, the last year for which we have royalties data, the multinational fossil fuel miners paid an estimated $7.3 billion in royalties. Most of the revenue, some $5.4 billion, came from coal; petroleum royalties amounted to just $1.8 billion.

Yet the value of coal exports was $54.6 billion while petroleum exports were 10% higher at $60.2 billion. Petroleum extractors paid royalties, including PPRT payments, of just 2.9% on their export revenue in 2019.

In comparison, last year coal mine royalty payments averaged 9.8% of total export value, which was also significantly higher than the average of the previous 10 years. Thermal coal royalties averaged about 8%; metallurgical coal payments averaged 9%.

However, Australia’s royalty payments on coal are still less than rates of payments globally. In the US, the coal royalty is 8% for underground mines and 12.5% for surface mines.

So why do the petroleum companies which operate in Australia get away with such small royalty payments compared to their coal colleagues?

In Australia, all royalty schemes for mineral commodities are operated by states and territory governments. The one significant exception is offshore petroleum, which is the sole jurisdiction of the federal government.

Up until 1987 there was no system to ensure multinationals paid royalties for offshore petroleum. The Hawke government introduced the PRRT to ensure the public received a fairer payment in return for access to the resources. However, the PRRT has failed to deliver this.

PRRT: a failed tax

Bruce Robertson, an analyst with the Institute for Energy Economics and Financial Analysis, describes the PRRT as “a broken tax”. He says that most countries with resources such as Australia build the wealth of their nation through royalty payments.

“These resources are non-renewable. There should be long-term sovereign wealth funds for future generations because they’re going to be left with huge clean-up bills from the projects.”

Revenue from the Petroleum Resource Rent Tax has declined since 1999 despite a 990% increase in revenue from petroleum exports.

Figure 15: ATO Taxation statistics 2017–18, Table 5: GST and other taxes – Petroleum resource rent tax, Resources and Energy Quarterly Historical Data

In 1999, LNG revenue was $5.5 billion, and PRRT was $1.3 billion. By 2018-19, however, annual petroleum export revenues had grown by almost $50 billion, yet the royalty payments to the Federal Government had dropped by $300 million to $1 billion.

Comparing Australia’s petroleum royalty schemes with the world’s next biggest LNG exporter, Qatar, demonstrates just how much money Australia is losing on one of its biggest exports.

In 2020, Australia overtook Qatar to become the world’s largest exporter of LNG. Yet, Qatar collects a massive $26.6 billion in annual royalties alone from LNG, according to Tax Justice Network Australia. Australia, by comparison, collects a measly $1 billion annually.

What is wrong with the PRRT?

Diane Kraal, a senior lecturer at Monash University’s Monash Business School, highlights a number of problems with the PRRT.

She says that multinationals can choose the price that one entity sells the gas to another subsidiary before it is processed and turned into liquids for export. So they can sell gas to themselves at a lower-than-market price to reduce taxable income and PRRT.

Furthermore, significant tax credits can be accrued during the offshore exploration phase and losses can be deducted against profits elsewhere. Efforts to address the faults in the scheme, including by parliamentary inquiries, have dismally failed amid lobbying by APPEA and other fossil fuel associates.

These tax deductions are not capped, and they grow every year, calculated by a method which is arbitrary and favours the industry, so a producer will not pay any PRRT until all the capital deductions are exhausted.

For example, the oil and gas industry’s largest project, Chevron’s $70 billion Gorgon LNG facility, will pay nothing for the gas it extracts, while the Northern Territory’s Ichthys project will export $195 billion worth of LNG, LPG and condensate from Darwin over the next three decades yet will pay zero PRRT.

The Neroli Storytelling Colvin Foundation sponsored Michael West Media to produce this work of environmental journalism. This report and the associated articles are the result of that funding.

Callum Foote was a reporter for Michael West Media for four years.