Behind public statements supporting climate action, key companies engaged in extensive lobbying against Labor’s flagship climate policy, the Safeguard Mechanism. Callum Foote reports.

Many of the country’s blue-chip, carbon-intensive companies stand accused of supporting action on climate change while at the same time successfully undermining a key plank of the Federal government’s push to deal with heavy carbon emissions.

Research by InfluenceMap, a global pro-climate think tank, reveals a host of big-name corporates that professed support for climate action and yet lobbied against Labor’s safeguard mechanism when it was proposed in March this year.

Their lobbying efforts proved successful, with Labor agreeing to water down several key elements of the policy. The eventual reforms were cheaper for and less-onerous on emission-intensive industries.

‘Clear hypocrisy’

The companies included oil and gas leaders Origin, Woodside and Alinta, miners Rio Tinto, Fortescue, Glencore and Whitehaven Coal and heavy industrials players BlueScope Steel and Adbri.

Interestingly, only one emissions-intensive company, BP, publicly supported climate action and the Safeguard Mechanism reforms, according to InfluenceMap’s analysis of public statements on both issues.

InfluenceMap senior analyst Tom Holen says that “while they (the companies) publicly endorse climate action, their active opposition to key elements of the Safeguard Mechanism reforms demonstrates a clear hypocrisy.”

The Safeguard Mechanism, first introduced in 2016 by the Abbott government, is the primary federal greenhouse gas emissions reduction policy. It is targeted at facilities that emit more than 100,000 tons of carbon dioxide a year and covers half of Australia’s total greenhouse gas emissions.

Labor’s reforms, first signalled in the lead-up to the 2022 election, were designed to tighten the rules over emissions and ensure that Australia’s largest emitters proportionally curbed emissions in order to meet Australia’s 2030 and 2050 greenhouse gas targets.

Holden says InfluenceMap’s work also showed how, “the overwhelming dominance from a few negative sectors in the policy debate” placed Australia’s 2030 and 2050 greenhouse gas targets at risk.

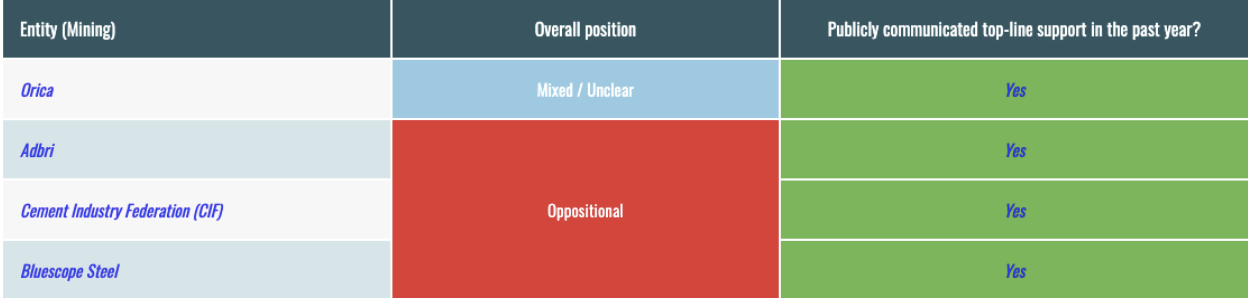

Mining industry stance on Safeguard Mechanism reforms and public commitments. (Source: Influence Map)

Mining industry stance on Safeguard Mechanism reforms and public commitments. (Source: Influence Map)

Industry bodies such as the Minerals Council of Australia, the Australian Petroleum Production and Exploration Association were far more critical of the government’s proposed reforms than individual companies, according to Holen.

What does lobbying get you?

Three clear concessions were won by heavy emitters from their lobbying. The first is to do with the introduction of a price cap. Under the Safeguard Mechanism, carbon credits can be bought by heavy emitters to meet their emissions reduction obligations. The final reform put forward by Labor included a price cap of $75 per ton on carbon credits used to meet Safeguard Mechanism obligations.

If the price of carbon credits rises over $75/ton then it is the taxpayer who is on the hook for the difference.

The original consultation paper from August 2022, stated that “there may not be a need at this stage for further price stability measures” regarding carbon credits. However, both major fossil fuel advocacy bodies APPEA and the MCA advocated heavily for a price cap to limit potential costs for their members in the consultations in 2022.

The second concession won by heavy emitters was around the use and borrowing of carbon credits. Successful lobbying meant that heavy emitters can now continue to sell old carbon credits back to the government, instead of relying on the newly introduced Safeguard Mechanism Credits. The interest rate charged by the government for companies borrowing new carbon credits was also heavily reduced.

Carbon credits backdown

The government had originally intended to limit the amount of time that carbon credits sold to the government would count towards reducing a facility’s emissions. Instead of the original proposed two-year limit, heavy emitters can now sell old carbon credits back to the government for the full length of their contract and count that as reduced emissions.

This was strongly advocated for by several industrial groups including Orica and the Association of Mining and Energy Companies.

Additionally, the government had originally proposed a 10% interest rate on new Safeguard Mechanism Credits that heavy emitters borrowed to meet their commitments. However, after pressure from APPEA and Rio Tinto among others this dropped to 2%.

The final concession won by heavy emitters was that heavy emitters who export their product overseas, namely most mining, steel-producing and fossil fuel companies, had their minimum baseline decline rate cut in half from 2% per year to 1% per year. Companies such as BlueScope Steel advocated for this measure directly.

Heavy Industry stance on Safeguard Mechanism reform and public commitments (Source: InfluenceMap)

Heavy Industry stance on Safeguard Mechanism reform and public commitments (Source: InfluenceMap)

Lash out at the Green-Labor deal

The oil and gas industry also kicked a concerted stink up at the deal between Labor and the Greens which got the reforms through the Upper House.

The Greens had originally opposed the reforms in the upper, arguing for a complete ban on new gas and coal projects. The compromise was that there would be a hard cap on overall emissions from facilities covered by the Safeguard Mechanism as well as stringent restrictions on new gas developments.

APPEA Chief Executive, Samantha McCulloch, stated that the Labor-Greens deal will make Australia’s climate change targets harder and more costly to achieve, adding that “new gas supply is essential to support the country’s climate objectives, avoid energy shortfalls, and reduce prices.”

The CEO of the Australian Pipeline and Gas Association, Steve Davies, threatened that any hampering to new gas investment would mean higher costs to Australian households.

“The APGA is committed to reducing emissions rapidly and economically. While we welcome the certainty of the Safeguard Mechanism, there are questions over whether the flow-on effects of any additional restrictions on gas supply will be borne by Australian households and businesses who are already facing major increases to energy bills due to the transition.”

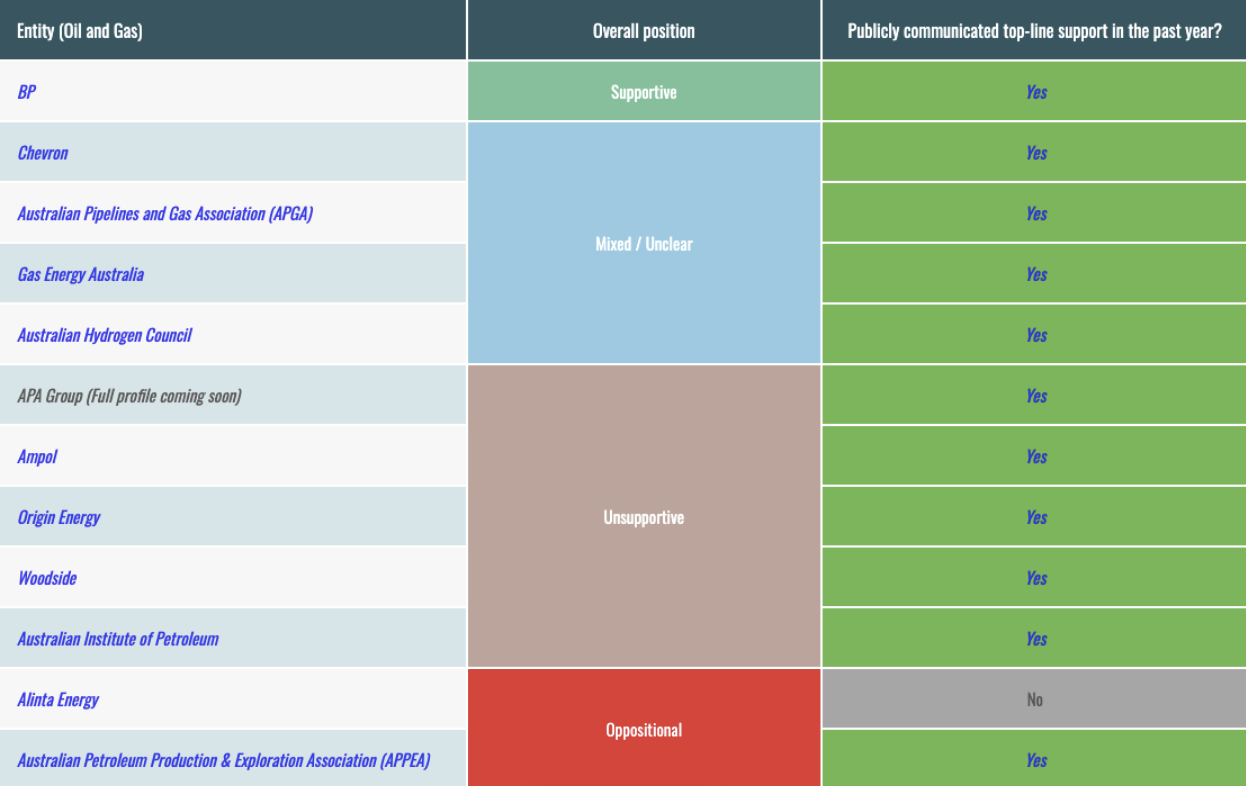

Oil and gas industry stance on Safeguard Mechanism reforms and public commitments. (Source: InfluenceMap)

Oil and gas industry stance on Safeguard Mechanism reforms and public commitments. (Source: InfluenceMap)

Santos CEO Kevin Gallagher appeared to criticise the Australian government for “handing power to the Greens” in the final design of the Safeguard Mechanism Reforms, saying that this has escalated sovereign risk in Australia for investors.

Beetaloo Basin fracker Tamboran Resources’ CEO, Joel Riddle, refuted claims that the Safeguard Mechanism Reforms restrict the Beetaloo Basin’s development and claimed that their sustainability plan aligns with the amendments.

He also added that the deal “is a decisive political failure for the Greens, who have campaigned to destroy industry, jobs and real progress on emission reductions.”

These efforts, while highly publicised, were not able to prevent the passage of the amendments to the bill.

Callum Foote was a reporter for Michael West Media for four years.