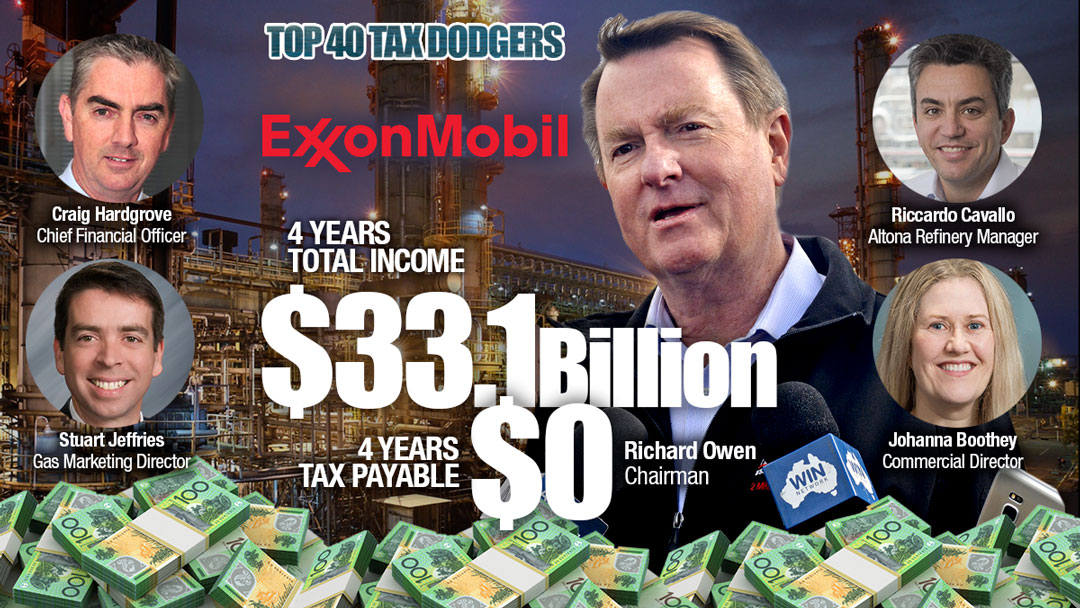

ExxonMobil Australia Pty Ltd

Whether it is misleading the Parliament of Australia, cutting its workers’ wages, paying zero tax while racking up $33 billion in sales, sending gas prices into the stratosphere or dudding the poor people of Papua New Guinea, Exxon has flair.

They are also masters of intrigue. You won’t find the financial reports for ExxonMobil Australia on its website, you won’t even find the names of the directors, despite the enormity of this operation. You certainly won’t find their photographs without googling madly and paying for company searches.

You absolutely won’t find mention of the 585 entities Exxon has in the Bahamas, or a for that matter, any breakdown of related tax haven associations.

How is it that this, the biggest of the US oil majors, a corporation which has been making fabulous profits in Australia for fifty years, can pay zero income tax? How does it skin its taxable income in this country back to zero?

The Esso/BHP Billiton joint venture drilled Australia’s first offshore well in 1965 when it discovered the Barracouta gas field in Bass Strait.

Two years later Kingfish was found, the first offshore oil field, which to this day remains the largest oil field ever discovered in Australia.

How is it that with record, eye-watering gas prices, that Exxon pays no income tax? Its financial statements provide a few clues: massive “debt-loading” – its Australian companies borrow billions of dollars from other Exxon companies overseas and funnel hundreds of millions of dollars offshore via interest payments on the loans.

And finally they’ve been pinged for it. Its 2018 financial report discloses that the Tax Office has been investigating Exxon’s related party loans and has busted them for being slippery, issuing amended income tax assessments for the 2010 and 2011 years.

Exxon menacingly notes it might sue the Tax Office, as it continues to “negotiate” over what it claims is fair pricing on its inter-company loans. These fighting words are typical of a bullying multinational oil giant. Yet it also notes the fight with the ATO has implications for the 2012 to 2017 years and Exxon is acutely aware of what fate befell its peer, Chevron, which muscled up to the ATO and lost an historic court case, for pretty much the same sort of rort – aggressive “transfer pricing of money”.

Post the four-year ATO tax transparency figures, Exxon’s latest financial statements show more of the same. Thanks to spiking gas prices, cashflow jumped from $8.2 to $11.3 billion in one year. Profits though were wiped out by Exxon’s massive related party debt. It is this monster debt which is the oil major’s main weapon of tax avoidance: some $1.8 billion in finance charges over the past two years on debt of $17.6 billion.

Tax rose from $341 million to $508 million in 2017. But guess what, not in Australia. This tax booked in the Australian entity, although the accounts don’t specify it, and although Exxon executives refused to be interviewed about it, represents tax paid in other countries, namely Papua New Guinea and Indonesia.

Further, they have lobbed in PRRT as income tax when it has the quality of a royalty for extracting non-renewable resources from the seabed. It is the PRRT, an incredibly generous regime of tax incentives which has allowed Exxon to match off the costs of new exploration against the dazzling profits of its established operations – and get away with paying no tax.

Meanwhile the debts owed to itself allow Exxon to export its profits along with the gas.

Exxon declined to answer specific questions for this story, even about where, which countries, it pays tax. Directors and executives declined to be interviewed. The following statement was issued. The company declined to corroborate its claims.

We have made significant contribution to Australia’s economic wellbeing through the reliable supply of energy that helps fuel growth. We have invested A$40 billion in the country.

ExxonMobil Australia has a long history of paying its fair share of taxes in Australia, having paid more than A$2 billion in corporate income tax alone since 2000, as well as more than A$13 billion in Petroleum Rent Resource tax since 1990. On average more than $600 million has been paid to the Federal Government each year for over a quarter of a century.

With a total investment of more than $21 billion since 2010, of which 85 per cent has been invested over the past six years, we are a substantial investor in the Australian economy and a major contributor to the wealth of the nation.

Public support is vital so that we can continue to investigate and publish articles that tell truth to power. Subscribe with a monthly contribution if you can, see below. Join our newsletter, share and like posts, if you can not make a financial contribute.

2019 METHODOLOGY

We are counting down the Top 40 Tax Dodgers. There are now four years of tax transparency data published by the Tax Office and we have used this data to work out which large companies operating in Australia have paid the least tax, or no tax.

Notable new economy players such as Google, eBay, Booking.com, Expedia are not near the top of the ATO list. That’s because they don’t (yet) recognise all income earned here; instead, they book Australian revenue directly to their associates offshore. They will be ranked in due course.

For other large corporations, and in particular, multinationals, the main steps in avoiding tax are made by reducing their taxable as much as they can; usually by sending it offshore in interest on loans, “service” fees or other payments to foreign associates. So, we have set a threshold. We have included only those companies which managed to wipe out 99.5 per cent or more of their taxable income over four years.

Qantas, therefore, is not on this list, although it has enormous income and has paid no income tax in Australia for many years. It misses the cut-off due to it not eliminating more than 99.5 per cent of its total income.

The airline had made large losses which were offset against profits. Many large corporations which have paid zero tax in ATO data, have legitimately made losses and have therefore built up “tax-loss shelter”.

Further explanation of methodology can be found here.

Many others however, such as ExxonMobil and EnergyAustralia, are on the list as they managed to eliminate all or most of their taxable income by “debt-loading” or other means of aggressive tax avoidance.

In this, the second iteration of michaelwest.com.au corporate tax rankings, we have ranked companies purely on the Tax Office data. We will also publish a list of Australia’s better corporate taxpayers, those companies who contribute most to the country in which they operate.

The Tax Office data is not a perfect guide. It does not record refunds, only tax payable and is often at odds with disclosures made for accounting purposes. In some cases, there are multiple entities with the same ultimate offshore parent reporting. One entity may pay zero tax, another may pay at the statutory 30 per cent rate (even if on low taxable income). We endeavour to be fair in our reporting to recognise these issues.

The data also recognises trusts as well as companies. For trusts, it is the members (investors) rather than the trusts who are ordinarily required to pay the tax. In many cases however it is fair to recognise trust structures for what they are, as tax is often the main reason these vehicles have been structured as trusts.

Companies are welcome to debate their rankings or to touch base to clarify or defend their tax practices. We will append or link these submissions.

Hydrox has been taken off the list as it never made a profit.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.