The Tax Office has hung out to dry the man who saved them $300m. Michael West reports on whistleblower Tony Watson’s quest for justice.

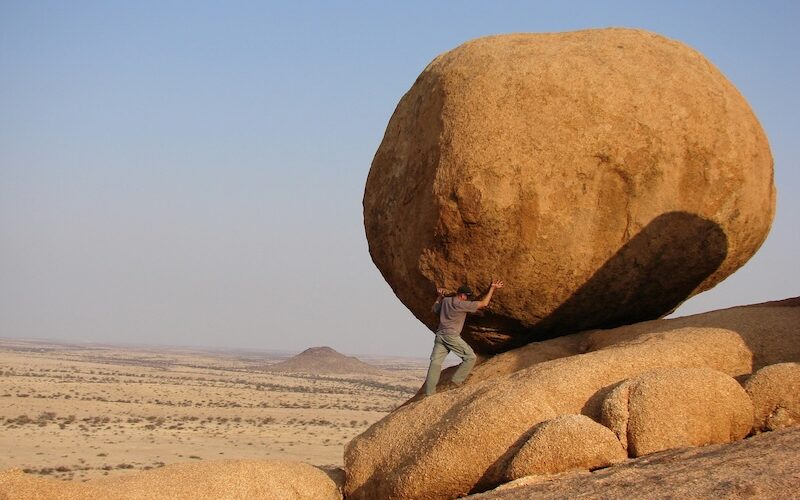

Talk about David and Goliath. Thirteen to one? When Tony Watson turned up to court earlier this month to face off against property giant Lendlease and its advisors PwC – and their phalanx of lawyers – he found himself alone at the bar table on the left-hand side of the court against no less than 13 lawyers repping for the Big End of Town.

Thirteen-to-one. Thirteen paid lavishly by our superannuation dollars, defending a tax scam, versus a guy with no money who had already mortgaged his house to get this far.

Despite blowing the whistle on the mammoth Lendlease tax fraud, Tony Watson personally saving Australia $300m, and losing his home to the ‘justice system’ in the process, the Tax Office has refused to help Watson with any legal assistance, telling MWM: “The Commissioner is not a party to the proceedings. Information on tax whistleblower provisions can be found on our website”.

Duh. Not a party to proceedings … oh great, and nothing more enjoyable than reading the ATO website to find out nothing about anything.

Not a party to doing the right thing.

Will they ever have another whistleblower come forward now that ‘doing the right thing’ – indeed doing your job – involves losing your job – and your home? That question, put to ATO Commissioner Rob Heferen, was ignored. Too hard for Rob. Neither did Rob furnish MWM with legal reasons why he would not help out.

No doubt Rob hopes to be on the same deal is his predecessor Chris.

But Tony … Tony Watson had to mortgage his house and has run out of funds fighting Lendlease and his former employer Greenwoods (since bought by PwC) in court for four years over his dismissal.

He unsuccessfully sought leave to appeal to the High Court. But Australia’s whistleblower laws are broken and Tony Watson has found himself alone against the legal muscle of the Big End of Town, the very people, financed by our superannuation, who conspired to rob the nation of hundreds of millions of dollars with their retirement village tax scam in the first place.

We literally broke this story in 2018 and it took the Tax Office 6 years to get any money out of Lendlease while they lied to their shareholders year after year. They still haven’t amended their accounts.

Watson used to be Lendlease’s tax lawyer, working for Greenwoods & Herbert Smith Freehills, but he turned whistleblower when he confronted them about their ‘double dipping’ tax scam. You can’t do that, he said, it’s illegal.

Though nothing is illegal if you are big enough, it seems.

Years later, the ATO agreed with Watson, issuing a draft ruling which found ‘double dipping’ was wrong. Lendlease paid $113m in an amended assessment last year, the first of three tranches of ‘pay-back’. The $113m gotcha.

And now here he is, Watson, facing years in the courts with no money, having saved Australia $300m but barely able to seek recompense through the justice system without doing it on his own, self-representing against a slickly-greased Big End gravy train lavishly financed by other people’s money … our superannuation.

The gravy train

At his case management hearing in the Federal Court earlier this month, Watson faced no less than 13 barristers and solicitors – funded by our superannuation – including a coven of KWM Mallesons solicitors for Lendlease and a gaggle of pettifoggers from the world’s biggest law firm Dentons acting for PwC.

It would have been even bigger and more expensive but Michael Hodge KC for PwC and Elizabeth Collins SC, the Lendlease senior counsel, were not there on the day.

They probably will be there on June 13 though when the 9 day trial kicks off, possibly even at the second case management hearing on May 6. Whatever the case, it will have cost well over half a million by the time Justice Raper opens the trial in June.

Now that they can’t take Watson’s house anymore, because they already have, their leverage is somewhat lessened but that will not stop them from stringing the matter along and munching through the fees … because they can.

The whole thing is grotesquely unfair. At the time the ATO issued its amended assessment they included primary tax and interest. But no penalties for Lendlease. As the construction giant is a ‘significant global entity’, penalties could have been applied at 150% of the tax avoided. But they weren’t applied. Auditor KPMG since 1957, advisor to the shonky transaction PwC.

It reeks of a cosy deal.

Lendlease. Drains taxpayer, does cosy deal, drains whistleblower

And the sheer time.

Here’s the thing. At the time the ATO issued this amended assessment they included primary tax and interest. But no penalties. Lucky Lendlease was no ordinary taxpayer, like you or me. As Lendlease is a ‘significant global entity’ penalties could have been applied at 150% of the tax avoided. It looks like special treatment, a mollycoddle.

The ATO issued the amended assessment on May 10 last year. Lendlease would have responded to this, its objection was due July 9, 2024. It had 60 days. And it has not disclosed whether the ATO has made a determination on that objection. The ATO can allow or disallow so we can assume the ATO has not made a decision.

On May 10, it will be one year since objection. Why has it taken another year to determine?

It’s a retirement village scam at issue – where the dodgy tax deductions were made. Lendlease sold the 25% tranche of equity, a 25% stake, to village the Dutch pension fund APG in the tax year ended June 2018. So it would have put that return in on March 2019.

That means, while Watson was losing his house, the ATO audited them for 5 years – they sat on it for 5 years and now they have taken another year to determine the objection.

Too good to be true? The unravelling of Lendlease, and the big hit to come

Imagine saving Australia $300m – what a hero you would be, should be – imagine blowing the whistle on a massive tax scam at the Big End of Town … but then losing yr home in a legal fight against the scammers. Imagine losing yr home – even if the government had said, yep, you were right.

You can help Tony Watson here.

Whistleblower persecutions. The cost of ignoring those who dare speak out.

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.