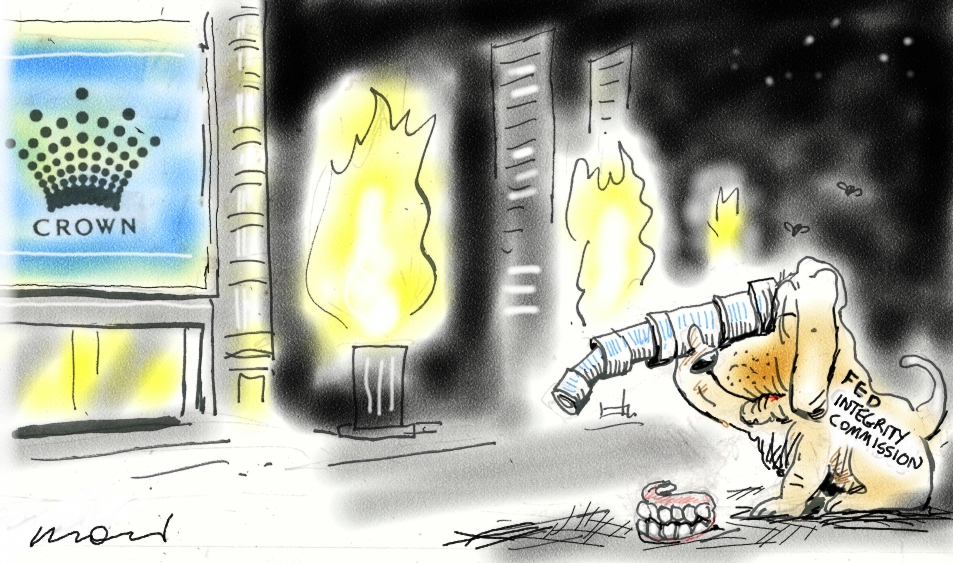

Where does “the buck” stop? When it comes to corporations, the buck stops with the board. This is why directors are paid big bucks. They are ultimately responsible when allegations of corruption arise, as is the case this week with dramatic revelations of Crown Resorts facilitating organised crime. Michael Sainsbury reports.

IN A nation where the concept of mateship is an integral to the culture, it’s hardly a surprise that nowhere is mateship writ larger than in the boardrooms of Australia’s listed companies.

And perhaps no company has epitomised this hallowed tradition as the board of Crown Resorts and its predecessor companies: Crown Casino and before it, Publishing and Broadcasting Limited. It’s always been the mates’ mates of boards.

Until very, very recently the listed playthings of the Packer family – first Kerry, then his only son James – by dint of their controlling shareholdings, were among the most blatant in corporate Australia at stacking their boards. The boards were loaded, not with people who represented their shareholders or who, at face value, or indeed in practice over decades, had much independence, but with their mates.

The problem with accepting the “honour” of being on any board is that directors have a very clear duty under the Australian Corporations Act.

There are criminal penalties under the Act that that can incur a prison sentence of 15 years — penalties recently raised from five years after the banking Royal Commission including, as noted by the Australian Institute of Company Directors, for:

- Recklessly or dishonestly breaching directors’ and officers’ duties (s184).

- Dishonestly failing to comply with financial and audit obligations (s344(2)).

- Intentionally or recklessly breaching the duties of officers or employees of the responsible entity of a registered scheme (ss601FD, 601FE).

- Knowingly or recklessly providing defective disclosure documents or statements (ss952D, 952F, 1021D).

This dear reader, is why they get paid the big bucks. Risk. To sit on these boards therefore brings directors’ fees, in many cases, of several hundreds of thousands of dollars each year. In Crown’s case, over the past decade, up to $285,000 — John Horvath’s fee for 2018.

It is not Newstart. It is not money for old rope. It’s not a payment to cover up company misdeeds. It is a payment for keeping an eagle eye on management. A payment for protecting the reputation of the company and the interests of its shareholders. It’s a payment for making sure the company does not hurtle off the rails.

And that is precisely what has embroiled the directors of Crown Resorts, not once, but twice in the space of four years. If even a sliver of the allegations, funded upon a treasure trove of internal documents are true, it is one of the epic board failures in Australian corporate history.

It should be noted that today the directors have placed ads in major newspapers denied any wrongdoing by the company. They have gone on the offensive, labelling the allegations in Nine media as unsubstantiated and sensationalised.

“Much of this unbalanced and sensationalised reporting is based on unsubstantiated allegations, exaggerations, unsupported connections and outright falsehoods,” the directors said.

Yet the allegations of serial lawbreaking, even including alleged Crown contractual arrangements with an entity whose principal has been involved in human trafficking, are based on internal company documents and the testimony of at least one former employee on the record.

Before we go into just how badly the Crown Directors appear to have dropped the ball, so badly that they may well find themselves in a poultice of legal trouble for failing to execute their duties under Australian law, let’s run through the Crown board.

John H Alexander BA

It is led by Executive Chairman John Alexander, a former journalist, media executive and long-time Packer lieutenant. Alexander was paid $4,696,068 by Crown in 2018, up from $2, 203, 123 previously.

And here are the rest, in the order that they are named on the Crown website, replete with all the letters and fulsome honorifics which Crown, unusually for an Australian corporation, insists on advertising for its directors. It could be just this reporter, but it would seem that the running order has little to do with their experience or capacity as directors and more to do with their name recognition but, like Fox News, we will leave that for you to decide.

The Honourable Helen A Coonan, BA, LLB

Second on the list is The Honorable Helen Coonan, LLB (that is a law degree) BA, the last of John Howard’s communications ministers and, when she retired in 2007, the highest ranked woman ever in the parliamentary Liberal Party. That her portfolio included the regulation of the media sector, in which the then PBL was a major player, may well have helped in her selection for the board.

Coonan has been keeping herself busy since leaving the Senate she appears to have enough chairs to open a furniture shop. She is Chair of the Australian Financial Complaints Authority (AFCA), Chair of the Minerals Council of Australia (MCA), and a Director of Snowy Hydro Limited. She also chairs Supervised Investments Australia Limited.

She is a member of the J.P Morgan Advisory Council and Co-Chair of PR firm GRACosway (a subsidiary of the Clemenger Group). Importantly, she is the Chairs of Place Management NSW. This was formerly the Sydney Harbour Foreshore Authority.

Further, Helen Coonan is a non-executive director of Obesity Australia Limited and of the Australian Children’s Television Foundation. She is a consultant to Samsung Electronics Australia and Chairs the Advisory Board of Allegis Partners. She also serves on the Corporate Council of the European Australian Business Council and the Australia-Israel Chamber of Commerce Advisory Council. She is also a member of Chief Executive Women.

In addition to all of this, Coonan is an ambassador for the Menzies School of Health Research and of the GUT Foundation and serves on the Advisory Council of the National Breast Cancer Foundation as well as being a mentor at start up fin-tech hub Stone and Chalk. Helen was paid $200,000 last year by Crown.

Andrew Demetriou, BA, BED

Helen Coonan is followed in the Crown pecking order by Andrew Demetriou, who displays a BA and a BED. You may remember he ran the Australian Football League for quite some time and was the in the news a lot, like Helen Coonan. Andrew is on the Risk Management Committee, which puts him somewhat in the spotlight for this Triad scandal.

Andrew Demetriou was paid $218, 620 by Crown in 2018.

Geoffrey J Dixon and Margaret Jackson AC

Next up is Geoff Dixon, a man who does not need any letters after his name, nor much introduction, as he stands alone as the only airline executive in not just Australia, but the world who has tried to sell the airline not just to a management buyout consortium which included himself.

Geoff is Chair of the Risk Management Committee, a committee he was also on when 19 Crown employees were detained in China in 2016 and later charged with criminal offences (promoting gambling services). These employees all have criminal records in China. If news reports are to be believed, this is the second major failure in risk management. Geoff has been paid over $2 million in Crown directors fees over the years and last year’s cheque was $200,000.

Jane Halton AO, PSM, BA (HONS) PSYCHOLOGY, FIML, FIPAA, NAM, HON. FAAHMS, HON. FACHSE, HON. DLITT (UNSW)

So to those with less public name recognition, relegated by Crown to the bottom end of its director’s list. They are led by a woman of many, many letters: Jane Halton AO PSM, BA (HONS) PSYCHOLOGY, FIML, FIPAA, NAM, HON. FAAHMS, HON. FACHSE, HON. DLITT (UNSW). Jane Halton was until quite recently a senior public servant. She used to run the federal Department of Health and before that the Department of Finance. She has also been Deputy Secretary at the Department of Prime Minister and Cabinet ( and was in charge of the border protection project after the children overboard scandal) and the Department of Immigration.

Like Helen Coonan, Jane Halton is super busy. She is also a director of ANZ and law firm Clayton Utz, she is the Chair of Vault Systems and Council on the Ageing Australia, the chair of Coalition of Epidemic Preparedness Innovations (Norway) a member of the Executive Board of the Institute of Health Metrics and Evaluation at the University of Washington, Adjunct Professor of the University of Sydney and the University of Canberra and Council Member of Australian Strategic Policy Institute.

It’s amazing that Halton finds time for all this as well as being on Crown’s Risk Management Committee. As she only joined the board in May 2018 she only got $16, 304 fees in that year.

There are many more to come. This is a big board, bigger than corporate governance experts would like and there is a way to go.

Professor John S Horvath AC, AO, MB, BS (SYD), FRACP, FAAHMS, FRCPA (HONS)

Our next director is Professor John S Horvath AO, MB, BS (SYD), FRACP, FAAHMS, FRCPA (HONS). John is a doctor. He was once the Australian Government Chief Medical Officer ( 2003-2009).

He has previous done heaps of things, all in medicine. He currently advises Ramsay Health Care. He is the Chair of Crown’s Responsible Gaming Committee, another board committee which finds itself in the spotlight.

John Horvath’s director’s fees from Crown in 2018 were $285,516 part of more than $2 million he has collected over the years.

Guy Jalland, LLB

Guy Jalland, LLB has been with the Packers for ages, 21 years and he heads James Packer’s private investment company Consolidated Press Holdings that holds the Packer’s stake in Crown.

Michael R Johnston BEC, BA is the Chief Financial Officer of CPH so, like Jalland, has an intimate knowledge of the financial affairs of the Packer organisation.

Antonia Korsanos BEC, CA

Antonia Korsanos BEC, CA appears to be the only non-executive director with any experience in the gambling industry, unless you count Helen Coonan. She’s a veteran of the poker machines manufacturer Aristocrat Leisure. As such, she is an ideal person to have on the board’s Responsible Gaming Committee.

Antonia only joined Crown in May 2018 and received $16,304 in partial directors’ fees.

Harold C Mitchell AC

Oddly a long way down the list is another “name” — director Harold Mitchell, AC (an Australian government honuor). Harold is a well-known advertising industry veteran.

Harold picked up $180,000 from Crown in 2018.

John Poynton AO, BCOM, DCOM

Finally, we have John Poynton AO, BCOM, DCOM. John is also pretty busy and, like Helen Coonan, boasts a collection of chairs, albeit slightly smaller. He is a director of the Future Fund Board of Guardians (Australia’s sovereign wealth fund). He is the Chair of Strike Energy Limited, Sapien Cyber Limited and Jindalee Partners.

John Poynton was only appointed to the board in May 2018 to replace James Packer and did not receive a fee in 2018.

Former board members should not be overlooked either because the alleged bad behaviour by Crown dates back many years. These are led, of course, by James Packer, the company’s effective founder when he switched the family business from media to gambling in 2007. Packer was its long time-chairman before stepping down in 2015 from that role and not long afterwards from the board completely. But until recently, he remained Crown’s controlling shareholder and still holds 20 per cent of the company’s stock. He famously uttered the words in 2013 in his I love China speech to the Asia Society:

“Ladies and gentlemen, I have made many, many mistakes in my life, but investing in China is not one of them.”

Here are all the others who have been on the Crown board since it began its China business in 2010:

Rowena Danziger, former headmistress of Gretel Packer’s high school, Ascham. She, along with with former Crown casino business chief and board member Rowen Craigie stepped down in early 2018. Rowena’s Crown pay peaked at a snip over $256,00 in 2017.

Others to hold Crown board seats over the past decade are: former Macquarie Banker Ben Brazil, wharves chief Chris Corrigan, television executive and one-time Packer best mate David Gyngell, former CPH boss Ashok Jacob, shopping centre scion David Lowy, and one-time Ernst & Young CEO Richard Turner.

Robert Rankin, Chairman 2015 to mid 2017 (Image courtesy calvinayre.com)

Investment banker Rob Rankin replaced James Packer as Chairman in 2015 and held the job until mid 2017. Crown employees were detained and charged in China during his tenure. He was replaced by John Alexander.

In 2010, Crown’s Directors were entitled to a base fee of $100,000, Directors acting on the Board of Crown Melbourne Limited are entitled to receive a further fee of $60,000 per annum. They also received $20,000 per annum for acting as chair of a Board Committee; or $10,000 per annum for being member of an active Board Committee.

In 2018, Crown lifted its directors fees to $150,000 per year. They also received $25,000 per annum for acting as chair of a Board Committee; or $15,000 per annum for being member of a Board Committee: $60,000 to be a member of Crown Melbourne Board and $75,000 to be on the CrownBet Board.

Rob Rankin, Michael Johnston, Ashok Jacob and Guy Jalland have never collected any fees for their Crown board duties.

Still, the argy-bargy end of the big end of town – and it doesn’t get much bigger than the sinecures in the major boardrooms of a sparsely populated nation where the big companies are generally monopolies or oligopolies – has long dwelt on how onerous the law is for corporate directors; how they are not well remunerated enough for the potential personal risk they take by being on boards. Unkind observers might say that this is an admission by directors that they really have little control over their over remunerated executives.

Nonetheless they are well paid for their risks; not given the track record of regulatory reprisals (which are very few and far between for big company directors) but for theoretical risk.

So this is where the rubber really hits the road for directors and this claimed spectre of high risk. Just whose fault it is – if the allegations of Crown consorting with people smugglers, money launderers and criminal drug dealing gangs are found to be even partially true – is the risk. Because the buck, in corporate Australia, is supposed to stop with directors.

Crown may become a vast test case therefore, if regulators and politicians display the wherewithal to investigate the claims with any conviction. If the claims stack up, will Crown underlings take the rap or will directors be held responsible?

At law, the ball is now in the court of Australia’s regulators. It may soon bounce into the court of Crown directors. Though, the visa rorting allegations, Crown’s lofty political connections and political party donations appears to somewhat compromise government.

In any case, the dramatic revelations present something close to the ultimate test for the Australian Securities Investments Commission to investigate whether Crown’s directors have breached the Australian Corporations Act, even unwittingly.

James Shipton, your time starts now …

James Shipton (Image courtesy ABC)

Editor’s Note: The Directors of Crown Casino have taken out full-page advertisements in major newspapers today condemning what it calls “a deceitful campaign” against the company. Details here.

————————

Michael Sainsbury

Michael Sainsbury is a former China correspondent (now based in South-East Asia), with more than 20 years’ experience writing about business, business politics and human rights across Australia and the Asia Pacific.

You can follow Michael at Little Red Blog or on Twitter @sainsburychina.

Public support is vital so this website can continue to fund investigations and publish stories which speak truth to power. Please subscribe for the free newsletter, share stories on social media and, if you can afford it, tip in $5 a month.

Michael Sainsbury is a former China correspondent who has lived and worked across North, Southeast and South Asia for 11 years. Now based in regional Australia, he has more than 25 years’ experience writing about business, politics and human rights in Australia and the Indo-Pacific. He has worked for News Corp, Fairfax, Nikkei and a range of independent media outlets and has won multiple awards in Australia and Asia for his reporting. He is a fierce believer in the importance of independent media.