American coal giant Peabody, alongside auditor EY, is involved in the industry-wide coal-fraud scandal which has rocked Australian miners since 2020, documents obtained by MWM reveal. Callum Foote reports.

In 2020, the $6 billion laboratory business ALS confessed that almost half of the results it produced from coal tests over a period of 13 years had been “manually amended without justification.”

These amended test results uniformly misrepresented the quality of the coal to boost results in line with contractual obligations. They effectively faked the results to make Australian coal look better quality than it was, and to fetch more money for it from buyers in Korea, Japan and China.

In light of this week’s revelations about a corporate whistleblower being raided by 6 armed police officers and ‘frisked’ while in bed, the revelations of collusion and fraud by coal multinationals again put the spotlight on double standards in dealing with crime.

In the coal fraud scandal, big names such as Peabody, Macquarie Bank, Glencore and Anglo have been mentioned. MWM has been able to find detail about quality faking involving the biggest coal company in the US – Peabody.

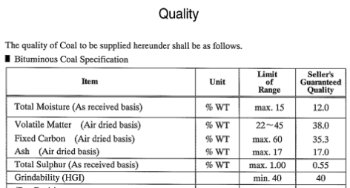

How were the results altered? Measures such as the moisture content and the grindability of the coal were particularly targeted by the bad actors at ALS and Peabody.

Grindability is measured by the Hardgrove Grindability Index (HGI), a measure of how easily coal can be crushed. Coal users prefer easily grindable coal for their furnaces, a higher score is better.

ASIC in action, at least with Terracom

While the big names in the coal fraud scandal have yet to see enforcement action, corporate regulator ASIC has launched a civil action against coal miner Terracom for breaches of continuous disclosure obligations and whistleblower provisions of the Corporations Act. It is unclear whether ASIC have advised TerraCom or other coal companies to appropriately account for their fraud, inform cheated customers or aside funds for future claims.

This follows testing giant ALS’s admission that nearly half of its coal export certificates issued over 13 years had been “manually amended without justification”.

Peabody Energy

Documents obtained by MWM show that the same scam was being perpetrated by Peabody as early as 2005.

The documents also show coal export certificates produced by testing laboratory CASCO, now owned by the Swiss-based testing giant SGS, recording coal from the then-Peabody owned Wilkie Coal mine with a grindability score of 40.

The contract for the sale of this coal, again obtained by MWM, shows that 500,000 tonnes of coal was delivered from Peabody to South Korea. The purchaser was Korea South-East Power Co. Ltd (KOSEP) a subsidiary of the state-owned Korea Electric Power Company – KEPCO.

The contract for the sale of this coal, again obtained by MWM, shows that 500,000 tonnes of coal was delivered from Peabody to South Korea. The purchaser was Korea South-East Power Co. Ltd (KOSEP) a subsidiary of the state-owned Korea Electric Power Company – KEPCO.

KEPCO is majority owned by the people of South Korea and its shares are publicly traded in South Korea and on the New York Stock Exchange. It is a regulated utility and must comply with South Korean Government Procurement policies. Additionally, it must comply with the laws of the United States of America with respect to fraud and foreign bribery.

The contract in question specified a minimum rejection limit for grindability of 40.

A 2019 civil trial between former joint venture partners, one of them involving a Peabody subsidiary inadvertently confirmed Peabody’s 2005 fraud.

Coal marketing veteran and former Peabody managing director Ross Crump, appeared as an expert witness for Peabody and let slip that it was impossible the coal he sold from Wilkie Creek would have met the grindability of minimum 40, despite his executing contracts where such was required.

In his testimony, which is found in this official court transcript, Ross Crump speaks to a ‘special arrangement’ in relation to the supply of coal to KOSEP.

Crump agrees when questioned by the plaintiff’s lawyers that the contractually specified minimum rejection limit for grindability was 40, but that the coal coming out of Wilkie Creek did not meet that requirement.

“And I don’t think there’s any dispute that Wilkie Creek coal didn’t have an HGI of 40, did it?” the lawyer asks.

“Wilkie Creek did not have a HGI of 40” Crump replied.

Crump defends signing the contract, promising a grindability of 40 by reference to the fact that the coal coming out of Wilkie Creek was blended with coal from another source that itself only barely had the required grindability. Implying that when the two coals were blended they could still not meet the contract limit Crump agreed to. Under later questioning Crump conceded that even the blend could not have had a HGI as high as 40.

“So I suggest to you that the HGI value of that blend could not have got as high as 40?” the lawyer asks Crump.

“Possibly, yes” he responds.

No documents were tended in the court case to suggest that Peabody’s Wilkie Creek supplied coal with a HGI below 40, and that KOSEP simply accepted that despite their contractual entitlements and Crump’s assurances that supplying coal out of spec in these circumstances was OK. Conversely MWM has many certificates of analysis of Peabody’s shipments in respect of the ‘blend’ Crump refers to certified at exactly 40.

Peabody & EY

EY has been Peabody Energy’s auditor since 1991.

Confidential sources say that far from preventing Peabody’s fraud their long-standing auditor EY actively audited for and found examples of Peabody’s fraud. They reveal that Peabody Energy were so actively aware of their fraud that they worried their own employees would accept bribes from customers to perpetrate the same fraud against Peabody. Peabody was allegedly so worried that their employees would cause shipment results to be certified at worse quality than they really were to under-charge clients and then ‘share in’ the discount that they had EY audit for this.

While fully aware that Peabody was permitting fraud EY failed to note such in Peabody’s financial statements, in fact in many years they simply gave Peabody a clean bill of health. At a bare minimum EY’s knowledge of Peabody’s fraud ought to have required liabilities for such to be reported, forecast revenue to be revised, notes on income source to be made and asset values to be reduced. The cosy relationship between Peabody and EY regrettably seems to mirror that of Enron and Arthur Anderson.

ASIC vs Terracom

ASIC’s case against Terracom is still ongoing with all four defendants, all Terracom executives, filing their defences at the end of September.

ASIC is alleging that Terracom knowingly altered its coal export certificates in order to satisfy contractual obligations.

No other miner, or any testing laboratory, has come under ASIC or a police force’s focus. The case against Terracom is limited to potential Corporations Act violations. The criminal offences of fraud, for which sources tell MWM there are mind numbing volumes of evidence supplied by ALS to police, foreign bribery and money laundering are not being actioned by police at this time. It is unclear whether ASIC or any law enforcement authority have informed customers they have been cheated in the order of millions of dollars. Such customers include Japan’s JERA and four of the five South Korean subsidiaries of Korea Electric. Since much of ALS’s fraud occurred in NSW, ALS was obliged to report the criminal actions of its employees to Police because failing to do so would itself have been a criminal offence. Section 316 of the NSW Crimes Act makes it a criminal offence not to report to conceal a serious indictable offence.

Last November, independent Tasmanian MP Andrew Wilkie named a string of companies including Glencore, Macquarie Bank and Peabody, as all involved in the coal fraud.

Wilkie has said that the “limited scope of the ASIC investigation is very concerning.”

Disappointingly, my concerns have been largely ignored by the Australian Government and regulators, in a pattern of behavior that extends to the previous Government as well.

Andrew Wilkie

“I hold out hope that the legal proceedings will finally blow the lid on the widespread use of fraudulent coal quality testing. They have been used for years by Australian miners and exporters to give the impression that Australian coal is cleaner than it is really is, and to falsely show that shipments are compliant with contracted metrics.”

Do you know more about Peabody, EY, Macquarie Bank, Anglo or Glencore? Contact Callum Foote confidentially and securely on Proton mail: [email protected]

Callum Foote was a reporter for Michael West Media for four years.