While many still struggle with high prices and unaffordable housing, the Australian economy is showing signs of improvement. Alan Austin with the charts.

Every week this year, the Australian Bureau of Statistics (ABS) and other authorities have reported exceptional economic outcomes. Not only has the economy achieved a smooth, soft landing, but it turns out the duration of the danger flight was much shorter than expected and costs well under estimate. All on board seem fit and well.

Australia appears to have moved out of its 2021-23 cost-of-living crisis into a phase of increasing wealth, steadily reducing poverty, lower interest rates, strong consumer spending, and open enjoyment of the luxuries of life.

The Australian Bureau of Statistics reported last week that overseas trips taken by Australians for business or pleasure reached a new quarterly record of 3.08 million in September and a new annual all-time high of 11.6 million in December.

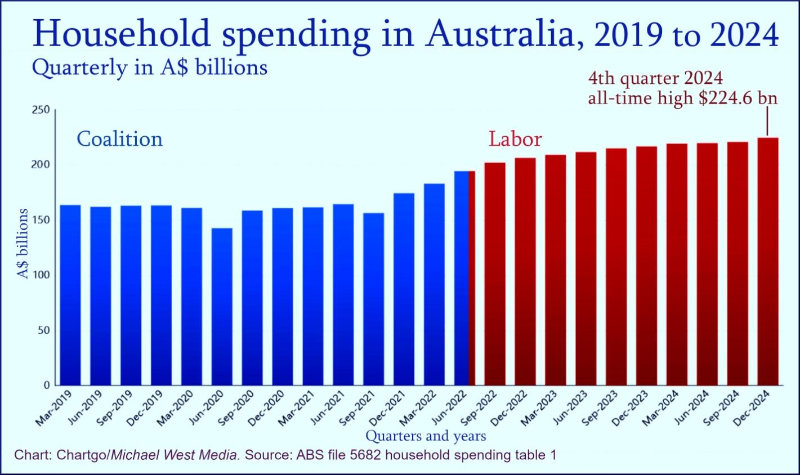

The ABS has confirmed this transition into a consumer spending boom with several recent outcomes, most of which make colourful charts.

Record retail sales

Australia has enjoyed a retail surge since May 2024, when monthly turnover exceeded $36B for the first time. Fresh records were then set in June, August, September, October and November.

Total retail sales for the December quarter of 2024 reached an all-time high of $110.8B. This was 3.7% higher than the December quarter in 2023, which was a record then, and a thumping 14.7% higher than December 2021 before the change of government.

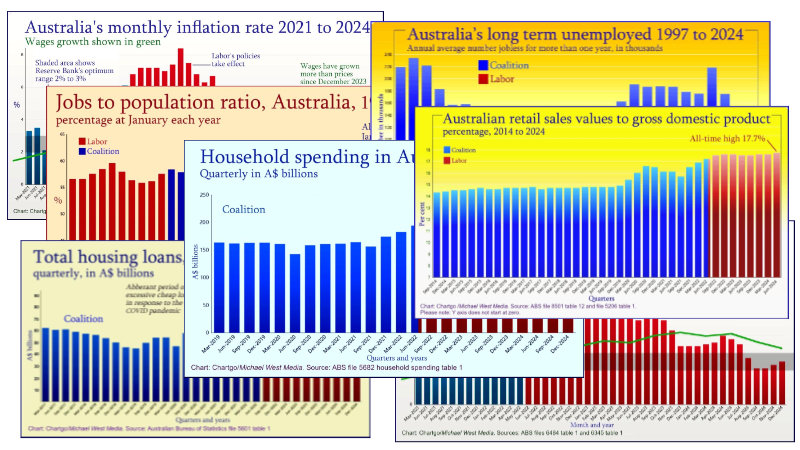

Relative to gross domestic product (GDP), turnover is the highest since records have been kept, reaching 17.7% when the last GDP figures were released.

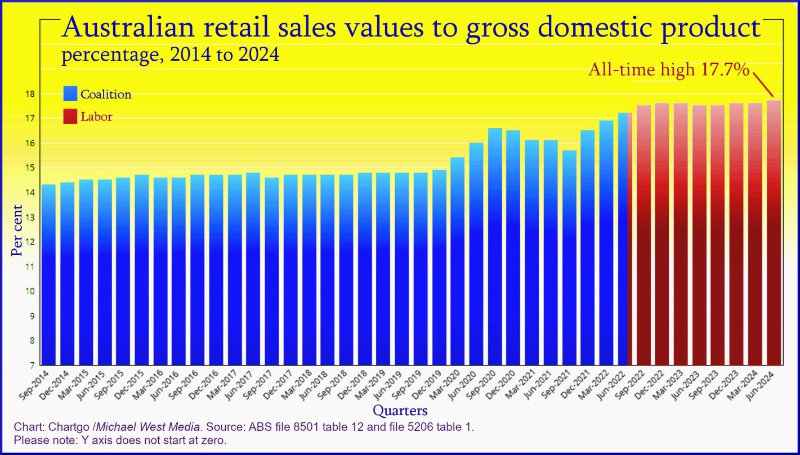

For the last three years, spending on essential food has been below 39.8% of retail sales. That’s down from 41.1% in 2019, pre-Covid. That, incidentally, was the average of all eight years under the Coalition.

Spending on luxuries, including cosmetics and dining out, reached an all-time high percentage of retail turnover in the December quarter at 21.3%.

Inflation impact

Of course, the cost-of-living crisis that impacted most of the population from mid-2021 to mid-2023 will leave the nation with elevated prices of many goods and services for some years to come. The consequences of a period of mismanagement cannot be erased immediately.

The data indicates clearly that the crisis phase is over, despite the mainstream media’s false mantra that it’s ongoing.

Inflation has been in the optimum band for five months now, and wages have been growing faster rate than prices for the last five quarters.

Standards of living improving

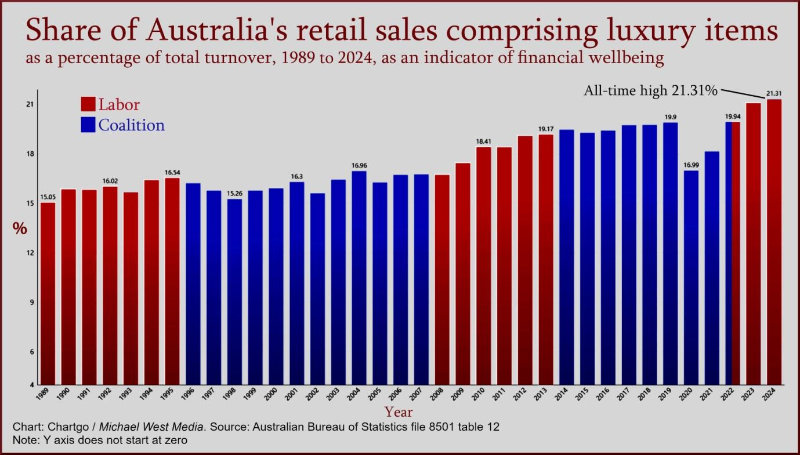

More Australians are now in work than ever before. The total workforce hit a record yesterday of 15.26 million, of whom 14.63 million are in work. That’s a lift of 1.19 million since the last election. The participation rate has hit another record at 67.32%, and the employment-to-population ratio is also at a fresh high of 64.55%.

As noted here earlier, underemployment has fallen dramatically and full-time jobs to the adult population are at an all-time high.

Labor’s credit. A strong job market and inflation coming down

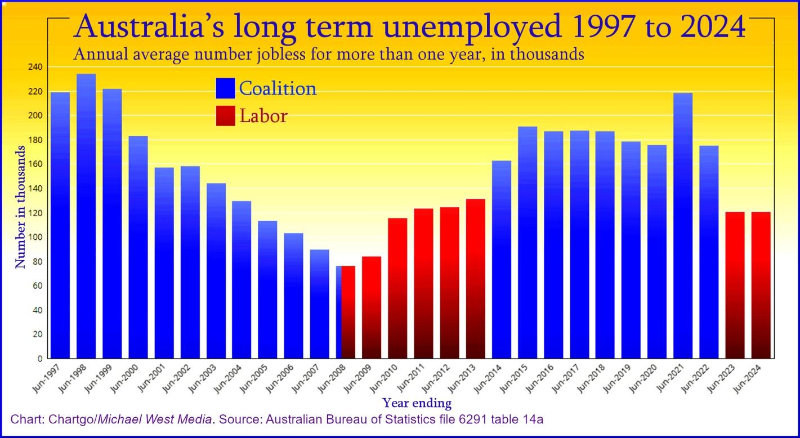

The long-term unemployed, while not at a record low, has also declined since the last election and is trending in the right direction.

This combination of a strong jobs market, positive wage growth, inflation under control and lower interest rates means the majority of Australians have more disposable income than ever before.

Higher property investments

Some of this extra income has been saved, some spent on luxuries and some, as both the Government and the Reserve Bank have been hoping, invested in housing.

A new ABS file (Lending Indicators, released this month for the first time) shows 83,206 new home loans were approved in the 2024 December quarter, 3,229 more than a year earlier (+3.8%). Total loan approvals reached $87.2B, the highest since the 2022 March quarter. This continues a steady rise over the last two years.

Affirmation from abroad

Overseas agencies are affirming the strength of Australia’s current boom in wealth, income and consumer spending. The 2024 edition of the UBS Global Wealth Report reveals Australia has the world’s second-highest median wealth per adult, at US$261,805 (A$409,100) and the fifth-highest average wealth, at $US$546,184 (A$853,100).

(Editor’s note: The average is the weighted mean, achieved by dividing the total wealth of all citizens by the number of citizens. The median is the level above which and below which half the population sit.)

Australia now has a more equal distribution of wealth since Labor has been in, so the median has shifted upwards towards the mean. In countries with vast wealth concentrated in the hands of a small number, the median will be much lower than the mean.

Loading...

Loading...

Mendacious media coverage

Regrettably, virtually all the mainstream newsrooms continue to misreport ($) the economy with a steady stream of distortions ($), omissions and frequent outright lies $), including the ABC.

Australians deserve better from their media, but, unfortunately, this is what we have come to expect in an election year.

Finally a rate cut but did the RBA Review cost Labor the election?

Alan Austin is a freelance journalist with interests in news media, religious affairs and economic and social issues.