When a Senator, John “Wacka” Williams, agitated strongly for the 2017 Banking Royal Commission. He is now an advisor to Commbank CEO Matt Comyn. Is there more to the story, Kim Wingerei asks?

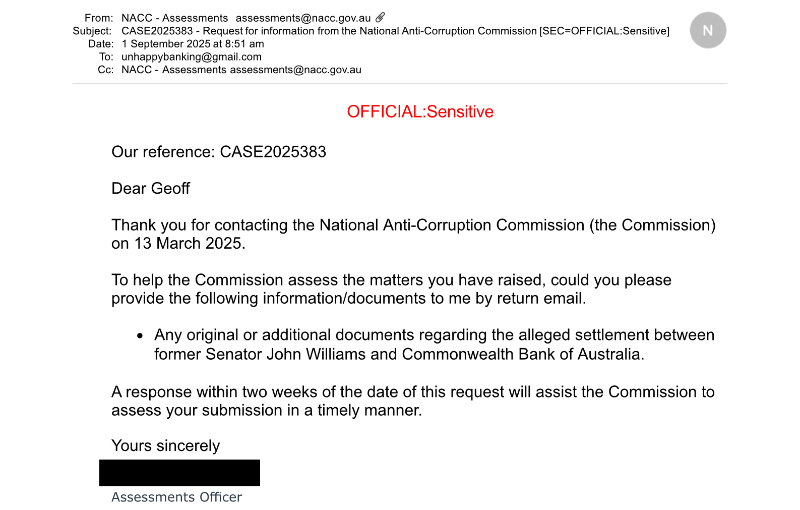

The revelation that John Williams is an advisor to CommBank chief Matt Comyn comes at an interesting time. The National Anti-Corruption Commission (NACC) is looking into ASIC’s handling of a case directly linked to Comyn’s role in orchestrating a settlement to the former partner of another bank agitator, Geoff Shannon.

“It feels like a steamy thriller novel with endless twists,” Shannon told MWM. “There is the affair between a bank victim’s advocate’s girlfriend and a top National Australia Bank (NAB) executive, complete with pillow-talk emails. Later, that same woman, Natasha Keys, spilled 16,000 documents to ASIC to torpedo her ex-boyfriend’s career—right after scoring a secret $300,000+ payout from rival bank CBA.”

Shannon is the rambunctious founder of Unhappy Banking, who rallied hundreds of CBA-Bankwest victims against predatory lending, and who walked free in November 2023 after a Queensland Magistrates Court slammed the door on ASIC’s case. Charged under section 206A of the Corporations Act for allegedly pulling strings at Business and Personal Solutions Pty Ltd (BAPS) while bankrupt, Shannon was acquitted when Magistrate M Bamberry ruled the prosecution couldn’t prove he intentionally or recklessly meddled in the company’s core decisions.

The court dissected the tangled ties between Unhappy Banking (a high-profile advocacy outfit) and BAPS (a fee-charging consultancy), siding with witnesses like original BAPS director Robert Fitzalan, who swore Shannon was just a consultant, not a shadow boss.

“Hi Babe” Case: ASIC witnesses mauled in court, Commbank embarrassed, evidence ends abruptly

During the trial, a web of infidelity, fat-cat settlements, and regulatory blind spots was exposed. And now, nearly two years on, Shannon’s fight is with the National Anti-Corruption Commission (NACC), asked to dig into claims of political backroom deals that Shannon suggests ignited the whole mess.

Leaked emails and late-night confessions

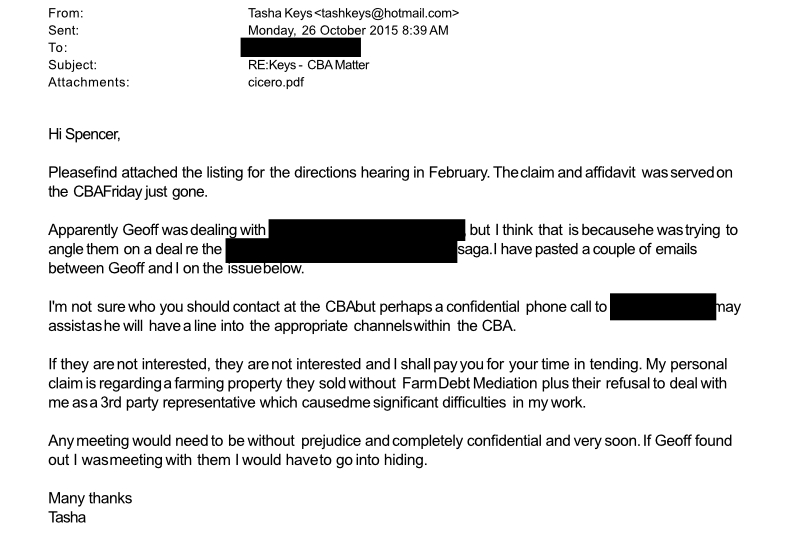

It started innocently enough in 2014, or so it seemed. Keys, then Shannon’s partner and BAPS director, was juggling client disputes with the big four banks. But court transcripts later revealed an affair with Simon Graystone, NAB’s director of corporate banking. While championing victims against the very institutions bleeding them dry, Keys was whispering secrets in the sheets.

In an email read in court, Keys wrote to Graystone, tipping him off about Shannon’s Unhappy Banking’s media blitz on a vulnerable NAB client, a disabled woman being forcefully evicted by NAB from her farm. The plan? Leak the story to Channel Nine’s A Current Affair to force a settlement.

In court, Shannon’s defence barrister, Saul Holt KC, grilled Keys until she invoked privilege against self-incrimination over 30 times. Her credibility shredded, the Emails showed her plotting a rival venture behind Shannon’s back, contradicting her affidavit claiming she quit BAPS because banks blackballed him.

As it turned out, Keys had her own personal battle with CBA, and she had met with CBA CEO Matt Comyn in 2018, negotiating a settlement involving her mortgage of $272,000 vanishing in addition to $309,000 “compensation for loss of equity and personal possessions.”

Why the CEO of Australia’s largest bank, with $1.35 trillion in assets and over 50,000 staff, got personally involved in Keys’ case, remains a mystery. Immediately after her settlement, Keys turned to Journalist Ben Butler to publish stories about Shannon and handed ASIC her document dump and volunteers as a star witness in the case ASIC lost.

Under Holt’s crossfire, ASIC investigator Nathan Miller squirmed, admitting he took Keys’ trove “at face value” without chasing Shannon’s exculpatory evidence. No verification of her affair, no probe into her CBA windfall—just a “one-eyed” rush to trial. The magistrate ordered ASIC to foot the bill for the defence to comb through the undisclosed 16,000 files, a humiliating own-goal.

How did it all start?

Geoff Shannon tells MWM that he believes his troubles started many years earlier. In 2013, he learnt of a hush-hush luncheon between John “Wacka” Williams, then a Nationals senator crusading against bank greed, and then CBA General Counsel, David Cohen.

Williams had his own history with CBA, losing his farm after being lured into the infamous foreign currency loan schemes that the CBA was spruiking in the mid-eighties (as documented in Adele Ferguson’s book “Banking Bad”). When he was elected to the Senate in 2008, he became an outspoken critic of bank behaviour and was one of the chief agitators for the Banking Royal Commission. He retired from the Senate in 2019.

Shannon claims that Cohen and Williams inked a confidential settlement that flipped his script. Suddenly, Williams went soft on CBA scrutiny. Shannon also alludes to the secrecy around the BankWest share deal. He did have a copy, and Williams wanted to see it, but Shannon refused. Williams later strong-armed it via Shannon’s media manager, Ross Waraker.

When Shannon confronted Williams about it, threats flew: “Friends in high places would bury him”.

Enter the NACC

In September 2023, Shannon submitted a case to the NACC, where he alleged that ASIC colluded against him and that Williams wielded his influence with ASIC to go after him. It includes a trove of documents, including a lawyer warning him not to spill to then PM Tony Abbott about Williams’ “secret deal.”

After first dismissing the case, the NACC has reopened another preliminary investigation after Shannon provided it with more documents. Shannon is hoping that this may ultimately validate his belief that his ASIC hellfire stemmed from his knowing too much.

From the earlier ASIC slapdown in 2015 (no disqualification) to this courtroom coup, Shannon has weathered the storm. But as NACC pokes the bear, he declares, “My campaign isn’t over. Political strings pulled my ASIC troubles from the start.”

“And what of this alliance between CBA’s Comyn and Williams? A deeper quid pro quo, or mere coincidence?”

With banks still devouring the vulnerable and regulators playing favourites – why chase a small fry when casino kings walk free?

Shannon’s saga spotlights the rot. Will justice finally bite back? Stay tuned, this tangled tale of sex, secrets, and settlements is far from its final chapter.

MWM put questions to both CBA, who merely referred to media reports, and to John Williams, who replied,

“I first met Matt when he became CEO. He made the effort to come to Inverell to meet with me. Just prior to my valedictory speech, February 13th 2019, Andrew Hall, who was PA for Matt, told me about the Advisory Committee Matt had formed. It is a committee of around 8 people from various industries, and asked if I would be part of the committee. I agreed to join it as it gave me a direct link with CBA once out of politics. I see my job on the Advisory Committee is to inform Matt on regional issues.

Yes we do get paid for each of the three meetings a year but you wouldn’t rely on the payments to keep you alive.”

Did Commbank, corporate cops and senior journos collude to take down bank victims advocate?

Kim Wingerei is a businessman turned writer and commentator. He is passionate about free speech, human rights, democracy and the politics of change. Originally from Norway, Kim has lived in Australia for 30 years. Author of ‘Why Democracy is Broken – A Blueprint for Change’.