Can Dominic Perrottet and Chris Minns “do a Palaszczuk” and hike coal royalties on multinationals now reaping super-profits from the War in Ukraine, or are they too scared of a coal lobby backlash? Michael West reports on the Budget crisis facing NSW as voters head for an election in three months.

NSW is about to go into election mode. The big day is March 25 and leadership contenders Dominic Perrottet and Labor’s Chris Minns have a dilemma.

The fall in property prices and sales volume is about to hammer the state budget. NSW net debt is estimated to blow out from $53bn to $114bn over the forward estimates yet there are no new revenue ideas of any significance. In the face of a savage backlash from the Queensland coal lobby, Premier Annastacia Palaszczuk brought in a staggered regime for coal royalties, in the mode of a progressive tax system where the more you make the more tax you pay.

Yet of course, royalties are not taxes, they are the payment a company makes to the state for digging the state’s resources out of the ground and exporting them. Coal royalties are tipped to deliver an extra $5bn for the Queensland coffers this year.

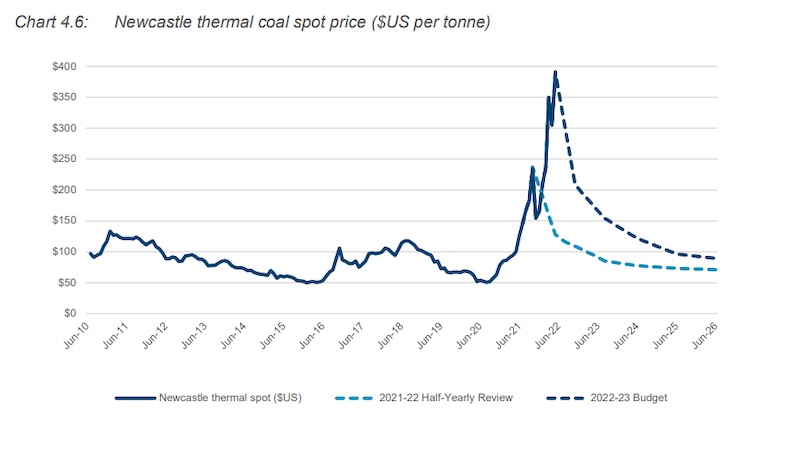

Like Queensland, NSW is a massive coal producer. And it’s dirtier coal. Whereas in Queensland, the bulk of production is metallurgical coal for steel production, the vast majority of NSW coal is thermal coal for electricity. And the price of that coal has shot up from $100 a tonne to $390 a tonne.

If the state were to adopt Queensland’s reform to a staggered regime for coal royalties, the NSW government could deliver an extra $23bn. But here they are still subsidising their multinational coal producers with public hand-outs.

In NSW, we have a $100 million Coal Innovation Fund. It funds things like “clean coal” technology (carbon capture and storage) which is widely debunked as commercially not viable. This sort of thing:

“A $15 million grant from the Fund will help establish a new facility at South32’s Illawarra coal mine, featuring cutting-edge technology, to tackle fugitive methane emissions. The grant will establish a pilot Ventilation Air Methane (VAM) abatement project that will be used to demonstrate the effectiveness of the innovative technology for industry. The pilot project, which is being co-funded by South32 with a co-contribution of $4.5 million, will help to encourage greater investment in, and uptake of, VAM abatement technologies to significantly reduce fugitive methane emissions from coal mining operations in NSW.”

Just like the federal government, which caved in and subsidised coal companies such as Rio Tinto and Origin Energy via its coal caps system announced just before Christmas, NSW has perennially failed to stand up to the muscle of the coal lobby. And heading into the election in March, it is unlikely to attract a campaign such as the $40m ad campaign pledged by the Queensland Resources Council against the Palaszczuk government.

Still, the numbers are compelling:

This chart shows the Perrottet government is borrowing from the future to pay for today. With transfer duty (stamp duty) being the largest revenue line item ($14b per annum) for the NSW state government (besides GST collections) faces a sharp revenue decline.

NSW gross debt – from latest budget – is projected to rise from $135bn to $221bn by June 2026.

That’s almost $17k per head in gross debt (using NSW population) rising to $28k by June 2026. And note the tail of the Budget papers says, “The RBA’s forecasts in May assumed that interest rates will continue to lift, reaching around 1.75% per cent by the end of 2022 and 2.5% per cent by the end of 2023.

NSW Treasury forecasts are broadly consistent with RBA assumptions. So the Budget forecasts are already way off with the cash rate now 3.1%.

The politics of trying to capture coal super profits is interesting. Palaszczuk was the one to confirm the Albanese government’s secretive and reluctant subsidies for coal-fired power plants. Coal caps do not benefit the states and their royalties income.

Better than Buckleys: a real plan to tackle energy prices, climate and the Budget to boot

Michael West established Michael West Media in 2016 to focus on journalism of high public interest, particularly the rising power of corporations over democracy. West was formerly a journalist and editor with Fairfax newspapers, a columnist for News Corp and even, once, a stockbroker.