Albo’s wonder-stroke or Waterloo? Labor is staring down hysterical fossil fuel threats to strike a deal with the Greens and shunt its Energy Price Relief Plan through the Senate this week. The result will be just as big a relief for gas and coal companies as consumers. Daniel Bleakley reports on the actual numbers.

“A band-aid on a festering wound” is how Senate powerbroker and former rugby international David Pocock frames it.

After months of saying “everything is on the table” regarding its options for dealing with Australia’s crippling energy crisis, on Friday the National Cabinet agreed to the Energy Price Relief Plan which places caps on domestic coal and gas prices and provides modest taxpayer funded subsidies for electricity bills.

The plan does nothing to secure tax revenue from coal and gas exporters who continue to make obscene profits exporting natural resources which ultimately belong to all Australians. In the UK, Boris Johnston’s Tories hit fossil fuel companies with a super profits tax at 25%; his successor Rishi Sunak is hoisting it to 35%.

Nothing of the sort here. Over the weekend, the Prime Minister seemed to indicate that, in cases where the cost of coal production is higher than the proposed price cap, then taxpayers could end up subsidising production to ensure supply.

Parliament has been recalled to sit on Thursday to pass the federal government’s end of year energy deal. The Coalition is firmly opposed to the bill and the Greens have said the bill is missing a crucial component which is funding to help households get off gas completely. The Greens have also indicated they want assurances there will be no taxpayer subsidies going to coal production.

After six months of big wins the government is keen to end the year on a high, but the Greens support for the bill is still in doubt as negotiations with Greens leader Adam Bandt come down to the wire.

Balance of power

In addition to the Greens, the government will also need the support of at least one additional Senator. The Jacqui Lambie camp is thought to be in favour, Pauline Hanson too. MWM touched back with Senator David Pocock yesterday afternoon to gain a sense of his position. He’s waiting to see the draft legislation, expected this afternoon.

“Clearly people across the country are feeling the pinch when it comes to cost-of-living and we have to find solutions to that.” Senator Pocock said. “Coal and gas companies are making eye-wateringly high wartime profits.”

This package provides short-term relief but is essentially a band-aid on a festering wound that has arisen from long-term failure of energy policy to plan for the transition to renewables.

“We need to look beyond the short-term cost-of-living relief to help households get off coal and gas, unlocking savings for them year-on-year into the future.”

Senator Pocock said he would look at the details of the package and continue pushing the government on the bigger picture transition.

The real picture – relief for multinational fossil giants

The plan’s major components include a $1.5 billion “Nationally Targeted Bill Relief”, which will be federally funded but administered by the states, directly subsidising electricity bills. A 12-month temporary price cap on domestic gas of $12 a gigajoule and a price cap on domestic coal of $125 per tonne.

Right on queue, the fossil fuel sector’s merchants of fear have begun churning out their hyperbole and predictions of Armageddon. Claims that the bill is “near nationalisation” and represents “a declaration of war on the gas industry” are completely absurd. In fact the opposite is true. The sector’s phoney howling makes it seem like the Albanese government is actually doing something significant.

It’s not.

The price caps only apply to the domestic market and the vast majority of Australian coal and gas is exported. Around 75% of gas extracted in Australia is liquified into LNG and exported to the global market.

In the coal industry it’s even higher with around 90% of black coal produced in Australia going to exports which are currently fetching close to A$600 a tonne FOB at the Port of Newcastle. So 90% of coal produced in Australia is selling for almost 5 times the proposed price cap of $125.

With this in mind, claims by fossil fuel giants like Exxon Mobil that domestic price caps will divert investment away from Australia are simply laughable and must be called out in the strongest terms.

In addition to the caps only applying to just a fraction of the industry, the price caps set by the government are actually a win for producers.

Just last week the Institute for Energy Economics and Financial Analysis (IEEFA) released a report showing that the price cap for gas should be just $7 a gigajoule and that all gas fields in Eastern Australia would remain profitable at this rate. A $7 price cap is 40% lower than the government’s $12 cap and would dramatically reduce the cost of gas and electricity for consumers while keeping producers profitable.

So if east coast gas producers are profitable at $7 a gigajoule and the $12 price cap represents an additional 40% of pure profit, how can the gas sector make claims of industry wide armageddon?

So where has the $12 figure come from? As the IEEFA report shows, the figure clearly hasn’t been calculated in the interests of gas consumers. Former Senator Rex Patrick’s new organisation Transparency Warrior has issued a Freedom of Information request to find out. Watch this space.

The $1.5 billion bill relief seems impressive until we realise that it works out to just $58 per person. A trivial amount compared to the enormous increase in electricity bills to which Australians are now shackled. Even more galling is that instead of taxing fossil fuel export profits to cover this trivial amount, it’s Australian taxpayers themselves who are paying for their own bill relief!

Norway’s the way

We can put these breadcrumbs into perspective when we compare Australia’s approach with that of Norway, which has been taxing its oil and gas export profits at 78% since the 1990s.

Make sure you’re sitting down for this. The Norwegian Ministry of Finance estimates that in 2023 the Norwegian public will receive $204 billion (AUD) or $38,000 per citizen from its 78% oil & gas export profit tax. Meanwhile the Australian government expects us to be grateful for our $58 “bill relief” while fossil fuel companies make hundreds of billions exporting Australia’s precious natural resources.

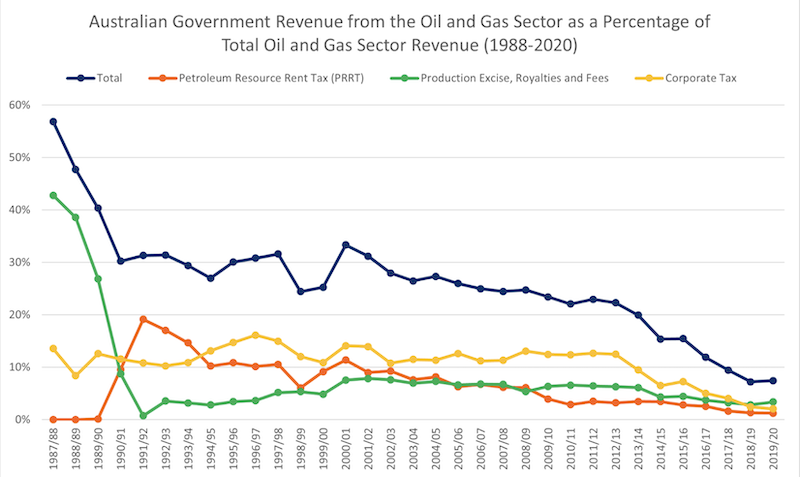

The graph below shows the breakdown of Australian government revenue streams from oil and gas as a percentage of total oil and gas sector revenue going back to 1987 when the PRRT was first introduced.

The trend is clear. Petroleum Resource Rent Tax (PRRT) shown in Orange has dropped from 19% of total revenue in 1992 to just 1% in 2020 and Corporate Tax paid by the sector (yellow) has dropped from 15% in the mid-1990s to just 2% in recent years.

While the industry makes nonsensical claims that we’re “one step short of nationalising the gas sector” the graph above shows the opposite is true, that in fact the oil and gas sector have effectively captured the Australian government.

The Energy Price Relief Plan gives the illusion of strong action but in fact offers breadcrumbs to families experiencing electricity bill stress, while protecting the torrents of windfall profits flowing into the bank accounts of mostly foreign owned fossil fuel exporters.

In contrast, the Norwegian Sovereign Wealth Fund, built with a 78% tax on oil and gas export profits is now worth A$1.5 million for every Norwegian family of four. If Australia’s elected officials can muster some courage, maybe someday we can build something similar here.

It’s a trap: mooted gas cap plays into the hands of the cartel, locks in high energy prices

Daniel is a qualified mechanical engineer, climate activist and former Anne Kantor Research Fellow at The Australia Institute working in the Climate and Energy program. His areas of interest include climate policy, electrification, renewable energy and fossil fuel taxation.