A former ANZ employee’s previously unshared testimony raises questions about how active banks and regulators have been in cracking down on suspected money laundering. Zacharias Szumer reports.

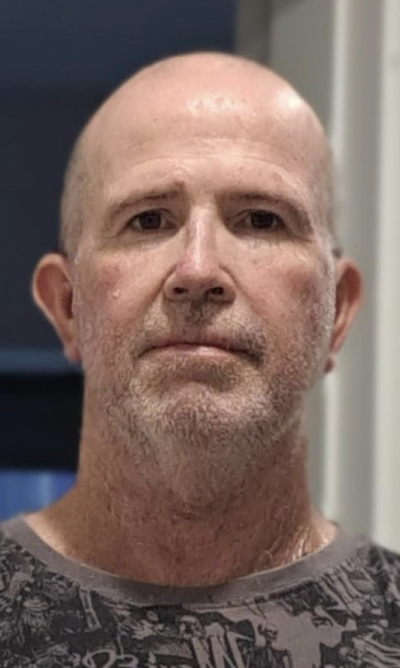

Tim Bryer had been scrutinising high-value transactions at ANZ for over 15 years when he started noticing something strange happening with a few Crown casino accounts.

Bryer recalls seeing cheques from Crown’s Perth and Melbourne accounts escalating to values he’d never seen before – in one case as high as $20 million.

This was in 2017 – around two years before Nine-Fairfax newspaper reports began to lift the lid on one of the most high-profile cases of money laundering in Australia’s history.

After a litany of media reports, three major government inquiries and a Federal Court case, Crown’s reputation has certainly taken a hit.

But given the casino was one of ANZ’s major customers throughout this period – and what Bryer says he saw in his time working there – he’s surprised the bank managed to come out of the whole episode looking clean.

“That there was no penalty or censure for ANZ seems surprising.

However, that they were not even mentioned is absurd.”

Suspicious transactions

When Bryer’s suspicions were first raised by the Crown transactions in 2017, he followed protocol and contacted the casino’s account controller, who said the cheques were legitimate.

However, he wasn’t entirely satisfied with their response. As he wrote in a submission to the Perth royal commission into Crown in 2021, in addition to the vast sums, he’d seen:

“Cheques made out to Chinese names and deposited into ANZ accounts not bearing the payee’s name [and] an unexplained increase of activity and Crown accounts where money was going in and out for what purpose I couldn’t really tell”.

Bryer – who had previously worked seven years in various finance related roles within the Department of Defence – decided to inform his superiors.

He prepared a suspicious transaction report for the bank’s internal investigations unit, a process he describes as “quite intense”.

A person filing such a report is not allowed to discuss it with anyone – colleagues, managers, friends, family, etc. – nor make a copy of the report. It must be immediately deleted from one’s email as soon as it’s sent, he recalls.

The bank tells employees who file such reports not to expect a response, so Bryer wasn’t surprised when he didn’t get one.

Later that year, Bryer’s position was made redundant.

Like so much of the money being washed through Crown accounts, his job was being offshored to China.

‘A door to much more’?

Two years later, Bryer began seeing the media reports that Crown had knowingly partnered with gambling junket operators who had links to organised crime groups involved in drug and human trafficking, which were using the casino to launder the proceeds of these crimes.

As was later revealed, the combined turnover for gambling junkets involving customers identified as having a high money laundering risk was $69 billion – more than the annual GDP of many small nations.

Given what Bryer had seen in 2017,

he was surprised that ANZ wasn’t mentioned in the reports.

Likewise, when royal commissions into Crown were launched in Victoria and Western Australia in February and March 2021, respectively, he awaited mention of something that would at least indicate that authorities had received his complaint.

The sounds of ANZ silence

The Victorian Royal Commission handed down its findings in October 2021 – largely supporting what had already been reported in the media – but it still didn’t contain anything related to Bryer’s complaint.

He had considered making a submission to that inquiry, but held back out of fear:

“Did I want to drop a bombshell on a former employer? … Did I want my name and face associated with this?”

Having missed the cut-off for the Victorian royal commission, he wrote to the Perth royal commission in November 2021 suggesting that they request from ANZ the report he’d made in 2017.

He told the commission he “strongly believe[d]” the report “would be of immense interest and assistance”

and would be “a door to much more”.

He’s not sure if the commissioners ever requested the suspicious transaction report from ANZ.

When the Perth royal commission handed down its report, the only reference to ANZ was similar to one found in the Victorian report – a section detailing how the bank had met with Crown to discuss and subsequently close in 2015 two casino-linked accounts on suspicion that they were being used for money laundering.

Banks tip off money launderers?

Bryer says ANZ’s approach to this matter was the “exact opposite” of what employees like him were taught in the bank’s money laundering training.

“Is that how banks handle multi-billion dollar money laundering concerns? Tip the launderer off?”

After ANZ shut the accounts, Crown reopened them with other banks and the accounts continued to be used in ways that showed clear hallmarks of money laundering.

It was not revealed if ANZ reported the matter to Australia’s anti-money laundering regulator AUSTRAC and

the bank did not answer questions put to it by MWM.

In May 2023, AUSTRAC lodged a case against Crown in the Federal Court, for which Bryer also submitted evidence.

He told MWM that, according to phone conversations he had with AUSTRAC investigators at the time, the information he provided to them included details of which they were previously unaware.

When he later saw AUSTRAC’s federal court filing, he said there were multiple aspects of the allegations that bore resemblance to the red flags he first saw in 2017, including

- Cheques being used an instrument of laundering

- New Crown bank accounts being opened for the purposes of laundering money

- Layering (using a complex web of transactions between multiple parties to obscure a money trail).

- Third-party bank account activity

- Customers using their in-house accounts as if the casino were a bank.

The case was settled in mid-2023, with Crown ordered to pay $450 million – “one of the largest penalties ever ordered against a casino globally,” AUSTRAC’s acting CEO said at the time.

Known unknowns

Bryer still doesn’t know what happened with the report he filed to ANZ’s internal investigations team. Neither does MWM – although, trust us,

we asked both ANZ and AUSTRAC.

ANZ’s only legal responsibility in situations like this is to report suspected money laundering to AUSTRAC, and for all we know ANZ passed on Bryer’s concerns.

What happened beyond that, inside the black box of AUSTRAC, is anyone’s guess.

If the agency agreed with Bryer’s suspicions, they may have told ANZ to keep the accounts open to observe activity.

Suburban Casinos: will AUSTRAC bring an end to pokies money laundering?

If so, it took the agency over five years to lodge its case against Crown.

Presuming AUSTRAC got the report in 2017, that’s still three years before either royal commission was launched.

If AUSTRAC told ANZ to close the accounts, this certainly wasn’t mentioned in any of the royal commission reports or the AUSTRAC v Crown court documents Bryer and MWM has seen.

Neither AUSTRAC nor ANZ responded to a request for on-the-record comment.

Zacharias Szumer is a freelance writer from Melbourne. In addition to Michael West Media, he has written for The Monthly, Overland, Jacobin, The Quietus, The South China Morning Post and other outlets.

He was also responsible for our War Power Reforms series.