Japan’s economy contracted an annualised 1.8 per cent in the July-September quarter, the first fall in six quarters, due to a hit to exports from US tariffs.

Government data released on Monday showed the decline, while not as steep as expected, could complicate the Bank of Japan’s plans to raise interest rates further.

Analysts are now focusing on how soon the world’s fourth-largest economy will overcome the tariff impact and rebound.

The decrease in gross domestic product was narrower than a median market estimate of a 2.5 per cent fall in a Reuters poll.

It followed revised growth of 2.3 per cent in the previous quarter, when the economy got an extra boost from solid exports that reflected front-loading shipments to the US as Japan’s tariffs negotiations lingered.

Washington formalised a trade agreement with Tokyo in September, implementing a baseline 15 per cent tariff on nearly all Japanese imports, down from the initial 27.5 per cent on autos and a 25 per cent duty threatened for most other goods.

The third-quarter reading translated into a quarterly fall of 0.4 per cent, better than the median estimate of a 0.6 per cent contraction.

Private consumption, which accounts for more than half of economic output, rose 0.1 per cent, matching a market estimate.

But that cooled from the 0.4 per cent rise in the second quarter, indicating that high food costs kept households reluctant to spend.

Net external demand, or exports minus imports, knocked 0.2 of a percentage point off growth, versus a 0.2 point positive contribution in the April-June period.

Capital spending, a key driver of private demand-led growth, rose 1.0 per cent in the third quarter, versus a rise of 0.3 per cent in the Reuters poll.

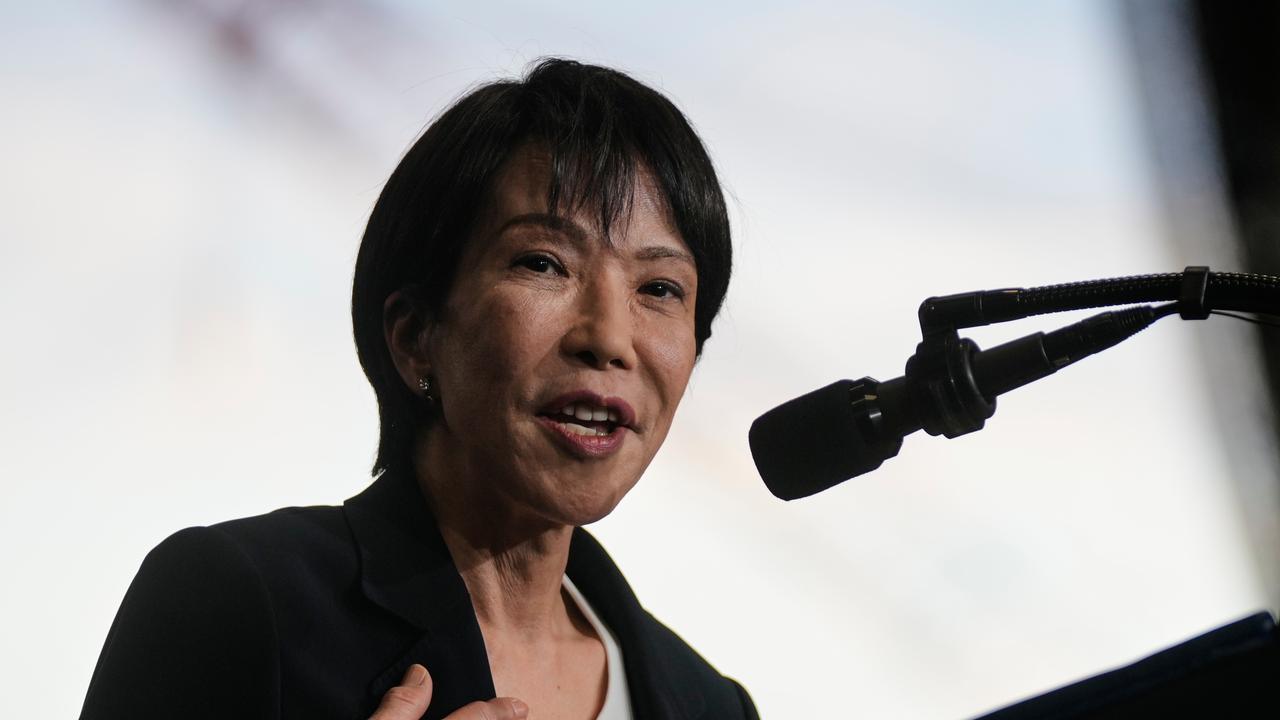

The weak GDP data comes as new Prime Minister Sanae Takaichi’s government is compiling a stimulus package to cushion the blow to households from the rising living costs.

Close economic advisers to Takaichi have cited a likely sharp GDP contraction as a reason for aggressive stimulus measures.

The latest data could embolden those advisers to call for the BOJ to go slow in raising interest rates, analysts say.

Australian Associated Press is the beating heart of Australian news. AAP is Australia’s only independent national newswire and has been delivering accurate, reliable and fast news content to the media industry, government and corporate sector for 85 years. We keep Australia informed.