The economy in general and the cost of living in particular have been two of the main themes of the election campaign, with both major parties claiming to be the better managers. Alan Austin reports on what the IMF and the ABS have to say.

The latest half-yearly report from the International Monetary Fund (IMF) shows Australia climbing most global rankings, reversing the slide under the Coalition.

The IMF allows global comparisons by showing outcomes for 117 countries from 2016 to 2024 on twenty indicators. These include budget deficits/surpluses, tax revenue, government spending, national debt and net financial worth. It also shows projections through to 2030, although those were made before Trump’s tariff wars. So we shall see.

Housing affordability. The crisis the major parties are too scared to fix

Low taxing and low spending

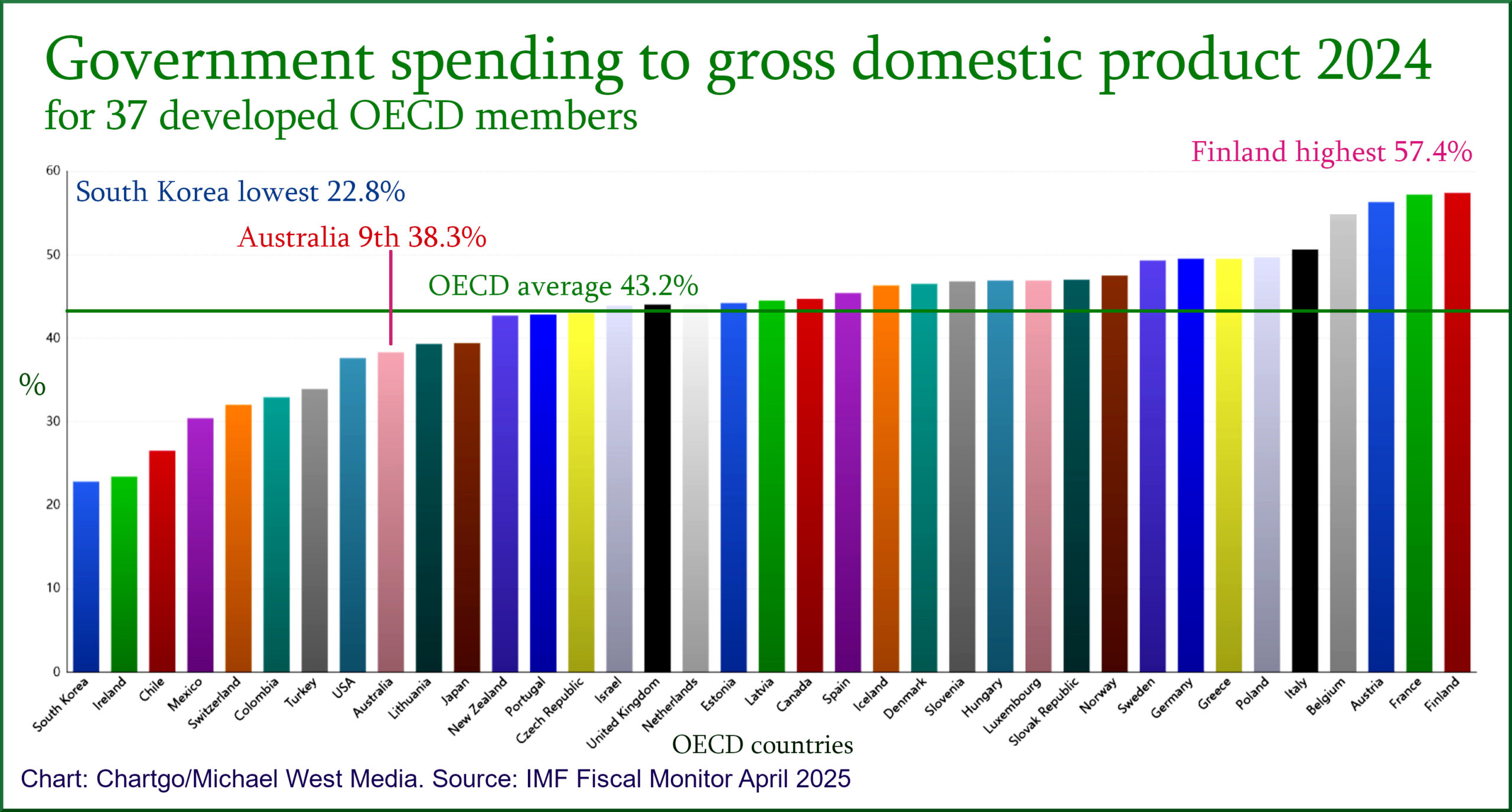

The tables on government revenue and expenditure confirm Australia is a relatively low-taxing and low-spending nation.

Australia ranked tenth on taxes collected relative to gross domestic product (GDP) among 37 wealthy OECD countries in both 2023 and 2024. That’s up from 11th or 12th between 2016 and 2019, pre-Covid, under the Coalition.

Australia ranked ninth out of 37 on government spending in 2024, up from 12th or 13th between 2016 and 2019. Government expenditure at 38.3% of GDP is well below the OECD average of 43.2%, and a far cry from the nine successful European economies spending more than 49.0%.

Debt declining

The IMF shows Australia’s net debt was just 30.1% of GDP in 2024, down 5.5% from the 2021 peak of 35.6% – in just three years.

Fewer than half the OECD reduced their net debt in that period – which was nowhere near as easy as the years 2014 to 2019 when all well-managed economies generated strong surpluses and repaid the debt stacked on in the global financial crisis.

The general picture the IMF paints is as positive for Australia as for any nation, along with Switzerland, Norway and Denmark. (Publisher’s note: Go Norway!)

Economists judegement

This month’s pre-election economic and fiscal outlook (PEFO), prepared by the politically neutral secretaries of Treasury and the Finance Department, is highly instructive, especially when contrasted with the 2022 PEFO.

Deficits for the four years 2023 to 2026 were forecast before the last election to be $224.4 billion. After Labor changed Coalition budget settings, those deficits reduced to $31.9 billion, aided also by a strong global economy and higher tax income due to high commodity prices.

The department heads in 2022 forecast gross debt to reach $1,000 billion under Coalition policies in 2023-24. After the change of government, that did not happen. Debt is now forecast to hit the trillion some time in 2025-26, which may not happen either, depending on commodity prices and global conditions.

The boffins forecast gross debt at June 2026 would be $1,169.0 billion under the Coalition. They now predict $1,022.0 billion under Labor – $147 billion lower.

The Coalition’s interest payable on the debt for the three years 2024 to 2026 was to have been $57.3 billion. Labor has cut this to $45.7 billion.

Bureau bursts Coalition bubble

Several recent announcements from the Bureau of Statistics (ABS) undermine Opposition claims that most citizens are worse off now than in 2022.

The ABS has confirmed that the majority nay be better off with these reports:

- Item #1. Employees in food and accommodation services have hit new records, confirming Australians are dining out and holidaying more frequently.

- Item #2. Jobs in other areas of discretionary spending – arts and recreation, luxury retail sales – are also surging, in numbers and as a percentage of all jobs.

- Item #3. Australian residents took 923,360 overseas trips in February, an all-time high for any February. Flights during the three months of December to February tallied a record 3,291,250, up 13.2% on the previous year.

- Item #4. Total household spending in February reached a fresh all-time high of $75.6 billion. That’s five consecutive record months.

- Item #5. Jobs outcomes for March, as reported last Thursday, continue to be close to the best-ever. The unemployment rate of 4.05% extends the streak of months below 4.25% to 40.

- Item #6. Jobless Australians have been fewer than 650,000 for 40 months, another impressive milestone. Under the previous government, this exceeded 900,000 seven times, clicking over one million in July 2020, during the pandemic.

- Item #7. The fortnightly age pension is up 12.2% since December 2022, when Labor’s first budget took effect, to $1,051.30; the adult unemployment benefit has risen 16.9% to $781.10; the living away from home youth allowance is 25.1% higher at $663.30.

- Item #8. Wage rises have been above inflation for the last 16 months.

Many groups, including inner-city renters, may find all of the above irrelevant as they continue to feel the pinch of ever-increasing rents as housing supply remains well behind demand. But that’s another story.

It’s complicated. Nevertheless, may the best economic management team win on Saturday.

Alan Austin is a freelance journalist with interests in news media, religious affairs and economic and social issues.