Donald Trump has declared a trade war, the share market is down, and US t-bond yields are rising. But how did it all start, and what’s next? Michael West and Kim Wingerei with the lowdown.

[Events moved quickly since this story was published. Trump backflipped on global tariffs, saying reciprocal tariffs would be paused for 90 days – as an insider trading scandal erupted over buyers ‘front-running’ the news. Besides global market uncertainty, heavy tariffs on Australia’s biggest customer China remain.]

They say that truth is stranger than fiction, and when it comes to what Trump and his acolytes are doing to world markets, they are not wrong! Donald tanked the economy based on a book his son-in-law found on Amazon.

Donald Trump told Jared Kushner to find him an economic advisor – someone who could make him “look tough” and talk tough on China. Jared searched Amazon, saw a book called Death by China, and thought the title was “cool.” So he cold-called the author, Peter Navarro, and gave him a job.

It turns out that Navarro has no real economic credentials, except for an obsession with tariffs and a made-up expert named “Ron Vara” whom he cited repeatedly in his books. Who’s Ron Vara? A fictional economist, Navarro invented. It’s an anagram of his name.

This is not a joke. This is literally how the Trump administration created its trade policy – one that has so far wiped out $10 trillion in wealth, crashed markets, and has put the world at the brink of recession. A fake expert. A book cover. An Amazon search!

The China (bond) Syndrome

Earlier this year, the US imposed a 20% tariff on Chinese imports. On ‘Liberation Day‘, Trump added another 34%, and overnight, he vowed to up the ante and slap China with a 104% tariff on goods imported to the US.

The stakes are rising. China has yet to respond to the latest hike, but President Xi Jinping has made it clear he’s up for a “fight to the end”. According to The Economist, that may mean a “decoupling between the world’s two largest economies.” The cost of that on both sides of the Pacific is hard to measure.

China does, however, have another option: the ‘nuclear’ option of selling US treasury bonds, which would drive yields up and prices down and send the world into recession.

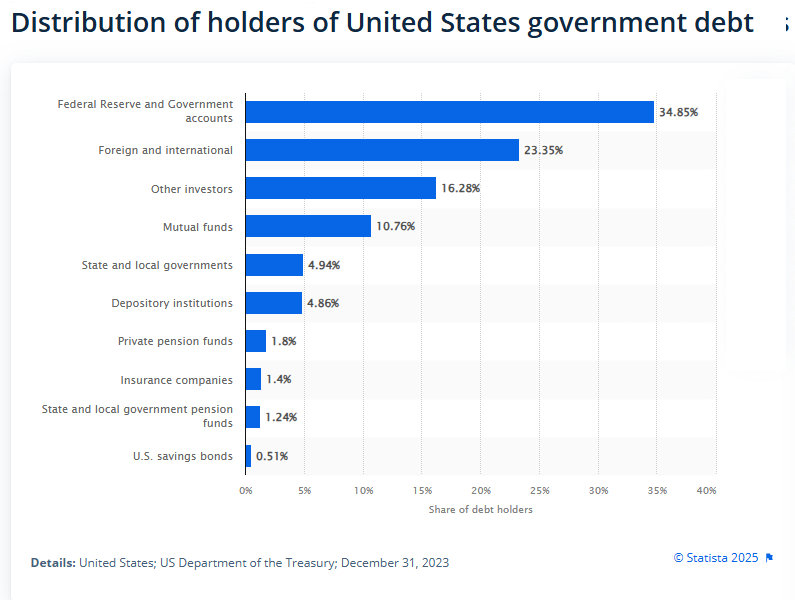

US Treasuries, or the US bond market, is the biggest market in the world, worth about $50 trillion, or around half of the world’s bond debt. Treasury bonds is how the US finances its deficit. Issuing bonds means borrowing money. But from whom? Who buys this stuff? Who owns most of the US Bonds?

Apart from the Federal Reserve and the US Government itself, the largest holders of US Treasury Bonds are Japan with US$1.1 trillion and China with US$868 billion (as of November 2024, Investopedia.).

China and Japan have had massive trade surpluses over the years, so what have they done with the money? A lot of it has been pumped into bonds, which are safe havens.

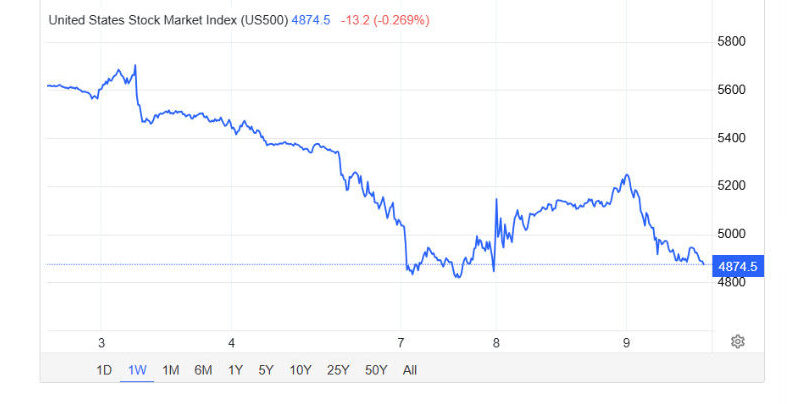

But it is no longer safe. This is the bit to understand. Bond prices are the inverse of yields, so when you sell a lot of bonds, you drive the price down. If the price goes down, the yield, or the interest rate, goes up. That’s what’s been happening this week.

And who knows if the Chinese are selling in quantity already? US 10-year bond yields are up by 10% since Liberation Day. It’s a heck of a lever to pull.

Tariffic consequences

Tariffs are just a tax, so Donald is slamming massive taxes on imports.

That means prices for imports are going up, possibly at the same time there is upward pressure on interest rates because of people fleeing for the hills in the bond market. The knuckleheads in the US have hit their own voters the hardest.

But why would China want to flog its bonds, you ask? If they sell a whole lot, the price goes down for the rest they own, and they are simply hurting demand for their own goods in their biggest market, America. But Donald’s tariffs are doing that for them anyway. The just announced 104% simply doubles the price of everything from China.

Everything means all kinds of consumer goods, pharmaceutical ingredients, and electronics, including smartphones (9% of total). Hundreds of thousands of products with well-established supply chains are not easily replaced.

It is difficult to comprehend the scale of what is going on here, the sheer abomination which is US leadership in the world. Australia’s biggest export, iron ore, is tumbling, which means less money coming into our economy, which means less revenue for the Budget, which means fewer services for Australians.

Tariffs also mean less trade, which means lower economic activity worldwide. That is what is happening now, Trump’s aim is to boost US manufacturing to replace imports, but he is driving the world into recession.

Second, market turmoil means severe dislocation, like what happened during the GFC, so that will trigger further fallout.

Along with the potential bond mayhem, there is a lot of stuff going on in the stock market, too: margin calls, short selling, funds in trouble, and forced sellers. What happens when share prices go down? The companies’ cost of capital rises.

US500 Index past week. Source: tradingeconomics.com

There is strong precedent for a tariff-driven disaster. When the US sharemarket crashed in 1929, the ‘Smoot-Hawley Act‘ hiked tariffs around the world, and trade dropped 20%. A year or two later, we had the Great Depression, then hyperinflation in Germany, more debt defaults, the rise of Hitler, and World War II.

We are not saying this will happen again. As Mark Twain once said, “History never repeats itself, but it does often rhyme.” What we are saying is that it is impossible to predict what’s next, but in all likelihood it will get worse with one of the first effects being severe disruptions to world supply chains.

What about Australia?

Trump’s dopes claim they are trying to tackle trade deficits of the US, but they actually run a trade surplus with Australia, so the extra 10% imposed on Australian goods into the US makes no sense. Why don’t they buy Australian beef, they cry?

Because we are one of the biggest exporters of the stuff in the world. Do you want us to buy your iron ore and coal too?

How did Australia get locked into this giant stuff up, foreign policy completely rooted, allied to a bunch of dangerous morons engaged in genocide and destruction of the world economy. Time to get out of AUKUS, the greatest foreign policy hospital pass in history.