Treasurer Josh Frydenberg’s spruiking of the economy based on the mid-year economic and fiscal outlook, released this week, is mix of truth, trickery and outright falsehoods. Alan Austin reports.

The Treasurer assures us that “the Government is living within its means, paying down Labor’s debt”. Neither is true.

Debt and deficit

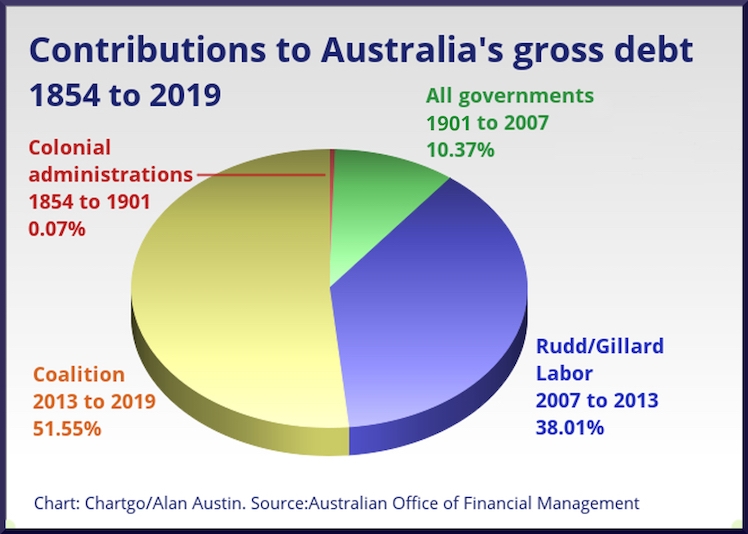

Treasury revealed on Friday that Australia’s gross debt is up to $560.8 billion, after four increases in four weeks. This is no longer Labor’s debt. All treasurers since 1854 have left significant debt for their successors, even Paul Keating and Peter Costello who both reduced it substantially.

For every $100 of debt now carried, seven cents is attributable to colonial administrations, $10.37 was added between Federation and 2007, and $38.01 was accumulated by the last Labor Government through the global financial crisis (GFC). But $51.55, more than half, has been stacked on by the Coalition since 2013.

There has been no significant repayment. Gross debt is up $26.4 billion since Josh Frydenberg’s budget speech in April announcing his hoped surplus. Net debt was $394.8 billion at the end of October, down slightly on September but up $18.1 billion since the budget speech. That’s according to the Finance Department’s monthly update which shows the budget deficit to October at -$14.7 billion. So when Frydenberg claims “The budget is in balance for the first time in 11 years”, this is not true yet.

There has been no significant repayment. Gross debt is up $26.4 billion since Josh Frydenberg’s budget speech in April announcing his hoped surplus. Net debt was $394.8 billion at the end of October, down slightly on September but up $18.1 billion since the budget speech. That’s according to the Finance Department’s monthly update which shows the budget deficit to October at -$14.7 billion. So when Frydenberg claims “The budget is in balance for the first time in 11 years”, this is not true yet.

Fanciful forecasts

The Treasurer claims,

“With gross debt having peaked in 2017-18 … the nation’s interest bill on its debt burden falls from $19 billion last year to $14.5 billion in 2022-23.”

The first part is not true. At the end of 2017-18, gross debt was $531.9 billion. It is now $560.8 billion. The second part is fortune telling, as is this:

“This year growth is forecast to be 2.25 per cent, lifting to 2.75 per cent next year. Next year the Australian economy is expected to grow faster than any nation in the G7, and faster than the OECD average of 1.6 per cent.”

These have the same believability as former Coalition Treasurer Joe Hockey’s prophesy in 2012 that “We will achieve a surplus in our first year in office and we will achieve a surplus for every year of our first term.” No credibility at all. The MYEFO actually slashed the surpluses announced in the April budget by $21 billion over the forward estimates. Already.

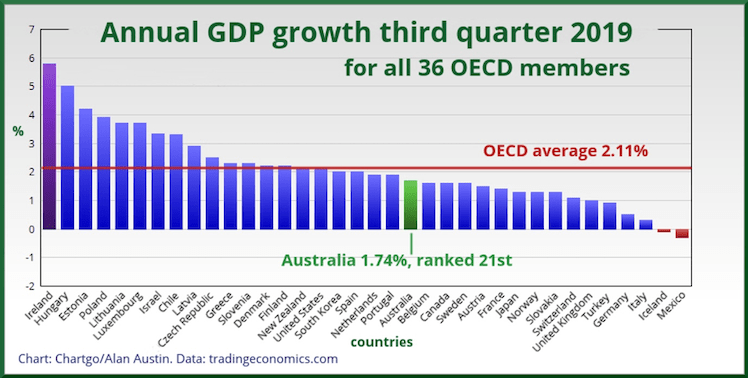

Economic growth

Frydenberg insists “Australia’s economy continues to grow” which is technically true. Growth in gross domestic product (GDP) has been positive for 28 years. But it has never been lower relative to the rest of the developed world since records have been kept. Of the 36 developed member countries in the Organisation for Economic Cooperation and Development (OECD) Australia was in the top ten on GDP growth rate through the Labor period. For some quarters in 2009 it was top of the heap. At just 1.74 per cent, it now ranks a dismal 21st in the OECD.

Employment

“More than 1.4 million new jobs have been created since we came to government” is the claim. Sounds good, but it isn’t really.

Yes, the jobs number is up by 1,442,000. But the workforce has expanded by 1,474,000. So the jobless quantum has also increased – up by 31,600 to 726,000.

Only 57 per cent of the new jobs were full-time, thus increasing the underemployed to 1,112,000. That’s up 221,000 under the Coalition.

Australia’s ranking on the jobless rate has tumbled disastrously. From seventh in the OECD under Labor, it has slipped badly through the global recovery period since. It ranked 18th when Frydenberg became Treasurer last year but has now tanked further to 20th, the lowest ever.

Family incomes

“Household disposable incomes have had the fastest increase in a decade off the back of the tax cuts.”

WTF? Why these fibs? Real net household disposable income is found at ABS file 5206.0 Table 1, column BI. For the September quarter, the increase was just 0.50 per cent above the June quarter and 3.28 per cent above September last year. Neither is anywhere near the ten year highs, which are 4.64 per cent and 6.65 per cent respectively, recorded in 2010 during the stimulus regime in response to the GFC.

Do they think nobody will check?

Reserve Bank condemns Coalition mismanagement … not in so many words

Economic headwinds

“Australia faces economic headwinds, including global trade tensions …”

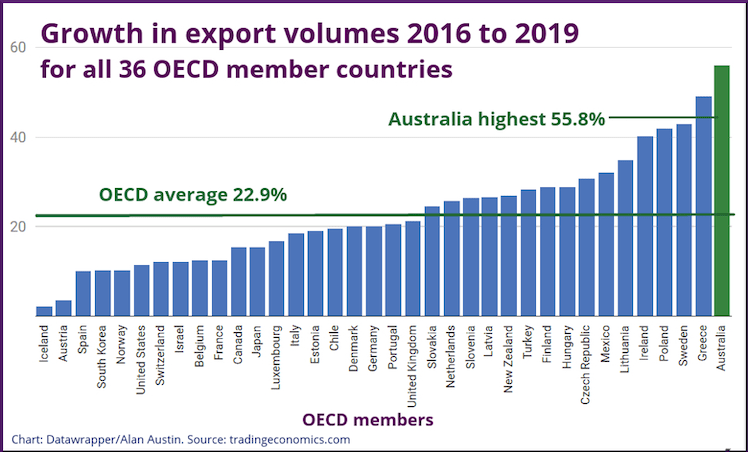

There are no external headwinds. This is one of the central falsehoods of the Government’s narrative. The whole world has been in an extraordinary upswing in investment, trade, jobs, profits and government revenue for three years. Thirty countries now have unemployment rates at all-time lows. The OECD’s average jobless rate is 5.81 per cent, the lowest ever.

Australia’s big corporations are enjoying the boom even if the majority of Australians, including its hapless retailers, are not. Commodity prices are surging, export volumes and values have hit new all-time records in 13 of the last 21 months. Australia has had the strongest recent exports growth of all OECD members.

The monthly trade balance hit a new record surplus of $4.5 billion last January and has been above that level every month since, peaking at $7.9 billion in June. The trade tensions between China and the US have been great for Australia, as has the disaster at the Brumadinho iron ore mine in Brazil. The economy now has a current account surplus for the first time in 44 years. Stock exchange prices and volumes are setting new records.

In fact, just since Frydenberg’s budget speech, global conditions have improved even further. A strong majority of the 70 or so economies which have reported their September quarter GDP growth show it at a higher rate than in June.

Australia’s troubles

Australia’s household sector slump and budget fails are entirely of its own making. Far too little of the vast wealth generated by the minerals, energy, manufacturing and agricultural sectors are getting to Treasury or to the people of Australia.

Coalition changes to wages, welfare, taxation, spending and investment policies have seen to that.

——————-

Public support is vital so this website can continue to fund investigations and publish stories which speak truth to power. Please subscribe for the free newsletter, share stories on social media and, if you can afford it, tip in $5 a month.

Alan Austin is a freelance journalist with interests in news media, religious affairs and economic and social issues.