Mathias Cormann has been exposed for gilding the lily by a report from his own government department, or maybe he just got the facts wildly wrong. The report proved Australia’s Finance Minister wrong on Australia’s gross debt, net worth, taxation levels, infrastructure, government spending and the surplus. Alan Austin reports.

The report? The department? The document was the monthly update on Australia’s budget outcomes. It was released by Cormann’s own Finance Department last Friday.

Cormann’s embarrassment arises principally from his speech to the Sydney Institute in August where he bragged shamelessly about the Coalition’s economic record, and savaged the “socialist” Labor Party. This was reported approvingly by the Australian Financial Review. Its political editor held a megaphone for Cormann’s attacks against Labor when he should have used a microscope to examine the fiscal falsehoods. We will come back to this.

The monthly Finance reports are issued ten times a year, skipping June and July. But the August figures were not released until mid October. So we have waited some months for this first window into the current financial year.

Net debt smashes $400 billion

The main news from Friday’s report is that net debt was $399.1 billion at the end of August. That is a blow-out of $25.5 billion since June. In just two months.

We know gross debt increased by $10.7 billion from $542.0 billion to $552.7 billion over that period.

And we know that gross debt has increased by another $12.4 billion between the end of August and last Friday, when it hit $565.1 billion.

Simple algebra suggests net debt is now, in mid October, close to $408.0 billion.

Readers who remember the Labor years will recall Coalition condemnation of Labor’s debt levels and Tony Abbott’s promise to achieve “a reduction of $30 billion in net debt”. At the end of Labor’s tenure, net debt was just $161.3 billion.

Net debt has doubled under the Coalition govt, Josh Frydenberg. This is what your Abbott/Turnbull/Morrison government has achieved, even though, in 2013, Tony Abbott promised he’d ‘… identified $50 billion of savings, for … a reduction of $30 billion in net debt.’

— ?Urban Wronski (@UrbanWronski) November 29, 2018

You would think that smashing the $400 billion barrier might be worth a media mention, if not a headline. But no. Not a whisper in any of the pro-Coalition mainstream newspapers or electronic news outlets.

Gross debt expanding

Cormann said in his August speech:

“The Government is also reducing total borrowings – gross debt – as a share of the economy over time. Gross debt peaked in 2017-18 at less than 30 per cent of GDP. By 2029-30, it is projected to fall below the 30-year average to 12.8 per cent of GDP.”

This has not happened. At the end of 2017-18 gross debt was $531.9 billion. Last Friday, it was $$565.1 billion. That’s higher both in dollars and as a percentage of gross domestic product (GDP). https://www.michaelwest.com.au/australia-a-classic-study-in-how-not-to-build-a-productive-economy/

Net worth trashed

Cormann also said:

“Net financial worth is also projected to improve over time, consistent with our fiscal strategy.”

When he said that, the latest available net financial worth figure was negative $591.4 billion. That was the level in May this year. Friday’s update records this at negative $707.7 billion at the end of August — a staggering reversal of $116.3 billion. In just three months. They have no credible fiscal strategy.

Government expenditure up

Cormann again:

“The Government has kept a tight rein on spending and is no longer borrowing to pay for everyday expenses.”

Not true. Just in the first two months of this financial year, expenditure is up 6.4% on the same two months a year earlier. That exceeds population growth, inflation and GDP growth combined.

Budget deficit deepening

“We inherited a rapidly deteriorating budget position from our predecessors. Today, after more than a decade in deficit, we are finally in a position to return the Budget to surplus.”

Both are false. In 2013, Australia’s budget deficit was a puny 1.2% of GDP and reducing steadily. Friday’s report confirms the deficit at 30 June was $690 million. But by the end of August it had expanded to $9.7 billion, fourteen times deeper.

The RBA is cutting rates because the government has completely abandoned responsibility for economic growth | Greg Jericho https://t.co/EZAdIFaOLZ — Greg Jericho (@GrogsGamut) October 2, 2019

Increased taxes

“We believe in the positive power of lower taxes, smaller government, a pro-business agenda …”

The Coalition does not believe in lower taxes. It believes in claiming that they are delivering lower taxes while actually raising taxes on the majority of Australians.

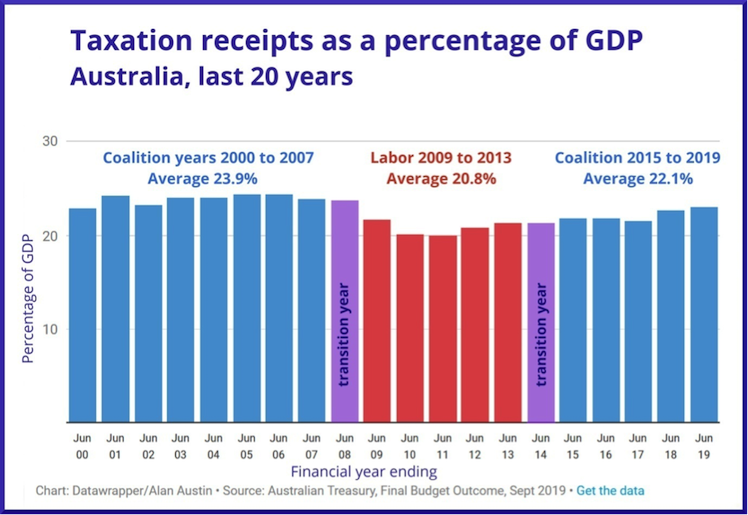

Last month’s final budget outcome (FBO) showed tax receipts as a percentage of GDP for the last financial year rose to 23.0%, the highest since the last budget framed by Peter Costello in 2007.

Comparing average tax collections relative to GDP over time, they were much lower under Labor.

Friday’s Finance update shows no relief for taxpayers. It confirms $36.2 billion has been collected already from PAYE taxpayers in the year to August. That is 5.8% higher than for the same period last year, despite wage growth running at only 2.3% per year and the workforce expanding at just 2.4%.

The PAYE collections for the year to date to August are 75.7% of all taxes collected. That is the highest rate in any year to August since the commencement of the current tax system with the GST in 2000.

It is a malicious falsehood to assert that taxes are lower under the Coalition. They are not.

Infrastructure

Cormann said in August:

“We are now working with the States in order to ensure that the infrastructure funding is taken up as swiftly as possible and is translated into new roads and new rail lines …”

No, they are not. If Cormann and his crew were moving swiftly, the balance at the end of August of all land, buildings, plant, equipment and infrastructure would have advanced from the total of $121.1 billion at the end of June.

Friday’s report shows the balance at the end of August at just $122.1 billion. That is a minuscule increase of 0.85%.

Overall economic management

Cormann opined in August:

“Labor lost an election that many believed and asserted was a foregone conclusion. Why? Because in the end Labor’s political gamble that enough Australians had forgotten the historical failure of socialism failed.”

Friday’s Finance report knocks that on the head also. We can see how the current financial year is progressing relative to all previous years. On every significant variable, Australia’s economy was much healthier under Labor than it is now, with the exceptions of corporate profits and executive salaries.

The real issue

The aforementioned article in the Australian Financial Review neatly encapsulates the fundamental problem in Australia. The mainstream media employs so-called economics writers to support the Government in fudging the record.

Fortunately, Australia’s public service, including those who assembled Friday’s Finance update, enable those who wish to know the truth to discern it.

———————-

Corporate profits and government spending boom while wages and economy languish

Public support is vital so this website can continue to fund investigations and publish stories which speak truth to power. Please subscribe for the free newsletter, share stories on social media and, if you can afford it, tip in $5 a month.

Alan Austin is a freelance journalist with interests in news media, religious affairs and economic and social issues.